Form 8453 P Fill in Version U S Partnership Declaration and Signature for Electronic Filing

What is the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

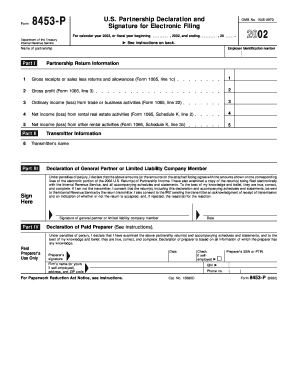

The Form 8453 P is a crucial document used by partnerships in the United States to declare their electronic filing of tax returns. This form serves as a declaration and signature for the electronic submission of partnership returns, ensuring compliance with IRS regulations. By completing this form, partnerships confirm that the information provided in their electronic return is accurate and complete. It is essential for maintaining the integrity of the electronic filing process and for fulfilling legal obligations under U.S. tax law.

How to use the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

Using the Form 8453 P involves several straightforward steps. First, ensure that all required information is accurately filled out on the electronic tax return. After preparing the return, the partnership must print and sign the Form 8453 P. This form must then be submitted alongside the electronic return. It acts as a signature page, validating the electronic submission. Ensure that all partners or authorized representatives sign the form before submission to meet IRS requirements.

Steps to complete the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

Completing the Form 8453 P involves the following steps:

- Gather all necessary information related to the partnership's tax return.

- Fill out the electronic tax return accurately, ensuring all data is complete.

- Print the Form 8453 P once the electronic return is ready.

- Have all partners or authorized representatives sign the form.

- Submit the signed form along with the electronic return to the IRS.

Key elements of the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

The Form 8453 P includes several key elements that are vital for its validity. These elements consist of:

- The partnership's name, address, and Employer Identification Number (EIN).

- The signature of the partner or authorized representative, confirming the accuracy of the return.

- The date of signature, which is essential for compliance with filing deadlines.

- A statement affirming that the partnership is authorized to file the return electronically.

Legal use of the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

The legal use of the Form 8453 P is governed by IRS regulations. It is mandatory for partnerships that choose to file their tax returns electronically. This form acts as a legal declaration that the information submitted is true and correct to the best of the signer's knowledge. Failure to properly complete and submit this form can lead to penalties or delays in processing the partnership's tax return.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines associated with the Form 8453 P. Generally, the deadline for filing partnership tax returns is the 15th day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. It is crucial to submit the Form 8453 P by this date to avoid penalties and ensure timely processing of the electronic return.

Quick guide on how to complete form 8453 p fill in version u s partnership declaration and signature for electronic filing 1662765

Finish [SKS] effortlessly on any gadget

Web-based document management has become popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

Create this form in 5 minutes!

How to create an eSignature for the form 8453 p fill in version u s partnership declaration and signature for electronic filing 1662765

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing?

The Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing is a crucial document that allows U.S. partnerships to declare and sign their electronic tax filings. This form ensures that all necessary tax information is accurately reported to the IRS. Using airSlate SignNow, businesses can easily fill in and eSign this form, streamlining the electronic filing process.

-

How does airSlate SignNow simplify the completion of Form 8453 P?

airSlate SignNow simplifies the completion of Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing by providing user-friendly templates and step-by-step guidance. The platform allows users to fill in the required fields quickly and securely. Additionally, the ability to eSign directly within the application enhances convenience and speeds up the filing process.

-

Are there any additional costs for using airSlate SignNow for Form 8453 P?

While airSlate SignNow offers competitive pricing options, costs may vary based on the subscription plan you choose. All plans provide access to essential features for completing the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing. It's recommended to check the pricing page for detailed information on features included in each plan.

-

What key features does airSlate SignNow offer for electronic signatures?

airSlate SignNow provides several key features for electronic signatures, including secure document storage, customizable workflows, and real-time tracking. You can sign the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing efficiently thanks to these features. Additionally, the platform complies with legal standards to ensure every signature is valid and secure.

-

Can I integrate airSlate SignNow with other applications for Form 8453 P?

Yes, airSlate SignNow offers integration with numerous applications, enhancing your workflow when dealing with the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing. Integrations with tools like Google Drive, Dropbox, and various CRM systems enable seamless data sharing. This allows for more efficient document management and processing.

-

What are the benefits of using airSlate SignNow for my partnership’s tax filings?

Using airSlate SignNow for your partnership’s tax filings presents signNow benefits, including time savings and improved accuracy. Completing the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing through our platform reduces potential errors and enhances compliance. Furthermore, the ease of electronic signatures speeds up the entire filing process.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to ensure that sensitive tax documents, such as the Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing, are protected. The platform utilizes encryption and secure data storage to safeguard your information from unauthorized access. You can confidently manage your documents knowing they are secure.

Get more for Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

Find out other Form 8453 P Fill in Version U S Partnership Declaration And Signature For Electronic Filing

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer