Ein Ss4 Fillable Form

What is the EIN SS-4 Fillable Form

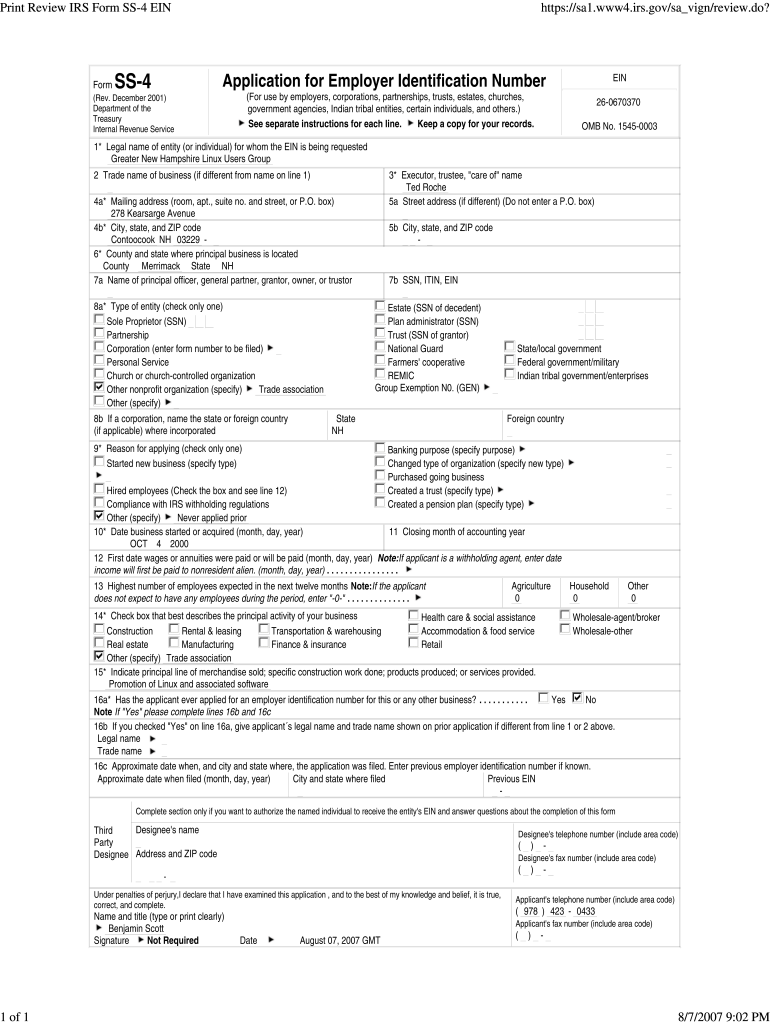

The EIN SS-4 fillable form is an official document used by businesses and organizations to apply for an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This number is essential for various tax-related purposes, including reporting income and payroll taxes. The SS-4 form can be completed electronically, making it easier for applicants to fill out and submit their information. It is designed to gather important details about the entity applying for the EIN, such as the legal name, address, and type of business structure.

Steps to Complete the EIN SS-4 Fillable Form

Completing the EIN SS-4 fillable form involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary information: Collect details about your business, including its legal name, address, and structure.

- Access the fillable form: Download the EIN SS-4 fillable form from the IRS website or use a trusted electronic signature platform like signNow.

- Fill out the form: Enter the required information in the designated fields. Ensure all data is accurate and complete.

- Review the form: Double-check all entries for errors or missing information before submission.

- Submit the form: Follow the instructions for submitting the form online, by mail, or in person, depending on your preference.

Legal Use of the EIN SS-4 Fillable Form

The EIN SS-4 fillable form is legally recognized as the official application for obtaining an Employer Identification Number. Completing and submitting this form correctly is crucial for businesses to comply with federal tax regulations. The information provided on the form must be accurate, as it will be used by the IRS to identify the business for tax purposes. Failure to complete the form correctly may result in delays or complications in obtaining the EIN, which could affect the business's ability to operate legally.

IRS Guidelines for the EIN SS-4 Fillable Form

The IRS provides specific guidelines for completing the EIN SS-4 fillable form to ensure that applicants provide all necessary information. These guidelines include:

- Providing accurate legal names and addresses to avoid processing delays.

- Indicating the correct type of entity, such as a corporation, partnership, or sole proprietorship.

- Filing the form in a timely manner to align with any business registration or tax obligations.

Who Issues the EIN SS-4 Fillable Form

The EIN SS-4 fillable form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS processes the applications submitted on the SS-4 form and assigns an Employer Identification Number to eligible businesses. This number is essential for tax reporting and compliance, making the SS-4 form a critical document for any business entity operating in the U.S.

Required Documents for the EIN SS-4 Fillable Form

When completing the EIN SS-4 fillable form, certain documents may be required to support the application. These documents can include:

- Proof of business formation, such as articles of incorporation or partnership agreements.

- Identification for the responsible party, which may include a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Business licenses or permits, if applicable, depending on the nature of the business.

Quick guide on how to complete ein ss4 fillable form

Effortlessly Prepare Ein Ss4 Fillable Form on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Ein Ss4 Fillable Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Ein Ss4 Fillable Form effortlessly

- Find Ein Ss4 Fillable Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark up signNow parts of your documents or redact sensitive data using tools that airSlate SignNow specifically provides for this function.

- Create your signature with the Sign feature, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ein Ss4 Fillable Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

Create this form in 5 minutes!

How to create an eSignature for the ein ss4 fillable form

How to generate an eSignature for your Ein Ss4 Fillable Form in the online mode

How to make an electronic signature for the Ein Ss4 Fillable Form in Chrome

How to make an eSignature for putting it on the Ein Ss4 Fillable Form in Gmail

How to create an eSignature for the Ein Ss4 Fillable Form right from your smartphone

How to generate an electronic signature for the Ein Ss4 Fillable Form on iOS devices

How to generate an electronic signature for the Ein Ss4 Fillable Form on Android OS

People also ask

-

What is an Ein Ss4 Fillable Form and how can it be used?

The Ein Ss4 Fillable Form is a document used to apply for an Employer Identification Number (EIN) from the IRS. This form can be filled out electronically, making it easier for businesses to submit their applications accurately and quickly. Utilizing an Ein Ss4 Fillable Form through airSlate SignNow helps streamline the process, allowing you to eSign and send documents seamlessly.

-

How does airSlate SignNow simplify the process of filling out an Ein Ss4 Fillable Form?

airSlate SignNow offers an intuitive platform that allows users to fill out the Ein Ss4 Fillable Form with ease. With features like drag-and-drop fields and pre-filled templates, you can save time and reduce errors. The ability to electronically sign and send the form directly through the platform enhances efficiency and ensures your application is submitted promptly.

-

Are there any costs associated with using the Ein Ss4 Fillable Form on airSlate SignNow?

Yes, while the Ein Ss4 Fillable Form itself is free to obtain from the IRS, using airSlate SignNow comes with a subscription fee that provides access to various features. Our pricing plans are designed to be cost-effective, ensuring that businesses can manage document signing and eSigning without breaking the bank. Explore our pricing tiers to find the best option for your needs.

-

What are the benefits of using an Ein Ss4 Fillable Form with airSlate SignNow?

Using an Ein Ss4 Fillable Form with airSlate SignNow offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. Our platform allows you to complete the form electronically, sign it digitally, and send it with just a few clicks. This simplifies the application process and helps you focus on growing your business instead of dealing with paperwork.

-

Can I integrate airSlate SignNow with other applications when using the Ein Ss4 Fillable Form?

Absolutely! airSlate SignNow supports integrations with various applications, enhancing your workflow when using the Ein Ss4 Fillable Form. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management and ensure all your business processes are interconnected.

-

Is the Ein Ss4 Fillable Form secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. When you fill out the Ein Ss4 Fillable Form on our platform, your data is protected with advanced encryption and secure storage. We comply with industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

-

How can I track the status of my Ein Ss4 Fillable Form once sent via airSlate SignNow?

Once you've sent the Ein Ss4 Fillable Form through airSlate SignNow, you can easily track its status. Our platform provides real-time updates and notifications, allowing you to see when the document has been viewed, signed, and completed. This feature gives you peace of mind and helps you manage your documents efficiently.

Get more for Ein Ss4 Fillable Form

- Control number il 004 d form

- State of illinois hereinafter referred to as the trustor whether one or more and form

- State of illinois hereinafter referred to as the trustor and the trustee designated form

- Below and shall be governed and administered in accordance with the following form

- Control number in 006 d form

- Forming an llc in indiana findlaw state laws

- State of indiana hereinafter referred to as the trustor and the trustee form

- Boule registration transfer form sigma gamma rho sorority inc

Find out other Ein Ss4 Fillable Form

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple