Form 8835 Fill in Version Renewable Electricity Production Credit

What is the Form 8835 Fill in Version Renewable Electricity Production Credit

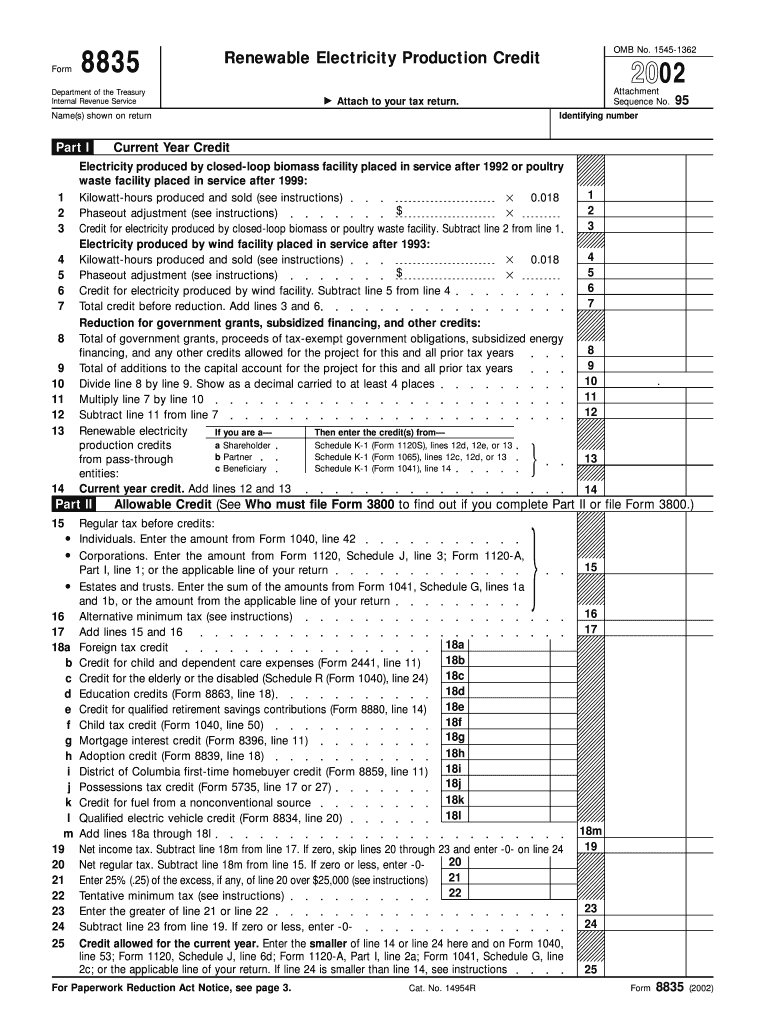

The Form 8835 is a tax form used to claim the Renewable Electricity Production Credit. This credit is designed to incentivize the production of renewable energy, such as wind, solar, and geothermal energy. By filing this form, eligible taxpayers can receive a credit against their federal income tax, which can significantly reduce their tax liability. The form is specifically tailored for businesses and individuals who generate electricity from qualified renewable sources. Understanding the purpose and benefits of this form is crucial for those looking to capitalize on renewable energy investments.

How to use the Form 8835 Fill in Version Renewable Electricity Production Credit

Using the Form 8835 requires careful attention to detail to ensure accurate completion. Taxpayers must first determine their eligibility based on the type of renewable energy produced and the amount of electricity generated. Once eligibility is confirmed, the form should be filled out with the necessary information, including details about the energy production facility, the amount of electricity generated, and any applicable credits. It is essential to keep accurate records of energy production, as these will be needed to support the claims made on the form.

Steps to complete the Form 8835 Fill in Version Renewable Electricity Production Credit

Completing the Form 8835 involves several key steps:

- Gather necessary documentation, including proof of energy production and facility details.

- Fill out the identification section with your name, address, and taxpayer identification number.

- Provide information about the renewable energy facility, including its location and type of energy produced.

- Calculate the amount of credit being claimed based on the electricity generated.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Renewable Electricity Production Credit, certain criteria must be met. The facility must produce electricity from qualified renewable sources, such as wind, solar, or geothermal energy. Additionally, the facility must be operational and generating electricity during the tax year for which the credit is claimed. Taxpayers must also ensure that they have not previously claimed the credit for the same energy production. Understanding these eligibility criteria is vital for successfully claiming the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8835 align with the general tax return deadlines. Typically, the form must be submitted by the due date of the tax return for the year in which the electricity was produced. Taxpayers should be aware of any extensions that may apply and ensure that all documentation is submitted on time to avoid penalties. Keeping track of these important dates helps in maintaining compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 8835 can be submitted through various methods, depending on the taxpayer's preference and the requirements set by the IRS. Taxpayers can file the form electronically through authorized e-filing services or submit a paper version by mail. In-person submission is generally not an option for this form. It is important to choose a submission method that ensures timely processing and receipt confirmation.

Quick guide on how to complete form 8835 fill in version renewable electricity production credit

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8835 Fill in Version Renewable Electricity Production Credit

Create this form in 5 minutes!

How to create an eSignature for the form 8835 fill in version renewable electricity production credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8835 Fill in Version Renewable Electricity Production Credit?

The Form 8835 Fill in Version Renewable Electricity Production Credit is a tax form that allows businesses to claim a credit for producing renewable electricity. This form is specifically designed to support businesses involved in renewable energy production, ensuring they receive the financial benefits they deserve.

-

How can airSlate SignNow help me fill out the Form 8835?

airSlate SignNow offers an intuitive platform that simplifies the process of filling out the Form 8835. With our user-friendly interface, you can easily input the necessary information, ensuring accuracy and compliance while saving time in the process.

-

Are there any costs associated with using airSlate SignNow for the Form 8835?

airSlate SignNow provides a cost-effective solution for businesses looking to complete the Form 8835 Fill in Version Renewable Electricity Production Credit. Our pricing plans are designed to accommodate various business sizes, with options that fit different budgets.

-

What features does airSlate SignNow offer for the Form 8835?

airSlate SignNow includes features like eSignature capabilities, document sharing, and automatic reminders to streamline the completion of the Form 8835 Fill in Version Renewable Electricity Production Credit. These features ensure that your documents are processed quickly and efficiently.

-

How do I integrate airSlate SignNow with existing software for the Form 8835?

Integrating airSlate SignNow with your existing accounting or tax software is seamless. We offer various integrations that allow you to sync your data effortlessly, making it easy to manage your Form 8835 Fill in Version Renewable Electricity Production Credit alongside your other financial documents.

-

What are the benefits of using airSlate SignNow for the Form 8835?

Using airSlate SignNow for the Form 8835 Fill in Version Renewable Electricity Production Credit enhances efficiency and accuracy in your document management process. Our platform not only simplifies filling out forms but also provides secure storage and easy access to your documents.

-

Can I collaborate with my team using airSlate SignNow for the Form 8835?

Yes! airSlate SignNow enables team collaboration when completing the Form 8835 Fill in Version Renewable Electricity Production Credit. You can easily share documents and invite team members to review and sign, ensuring everyone is on the same page.

Get more for Form 8835 Fill in Version Renewable Electricity Production Credit

Find out other Form 8835 Fill in Version Renewable Electricity Production Credit

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now