Form 1040 ES NR Fill in Version U S Estimated Tax for Nonresident Alien Individuals

What is the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

The Form 1040 ES NR is specifically designed for nonresident alien individuals who need to pay estimated taxes in the United States. This form allows individuals who do not meet the criteria for filing a standard Form 1040 to report their income and calculate their estimated tax obligations. Nonresident aliens typically include foreign students, scholars, and other individuals who are temporarily residing in the U.S. for work or study purposes. The form is essential for ensuring compliance with U.S. tax laws and avoiding penalties for underpayment.

Steps to complete the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

Completing the Form 1040 ES NR involves several key steps:

- Gather necessary financial documents, including income statements and any relevant tax documents.

- Determine your estimated income for the year, including wages, dividends, and any other sources of income.

- Calculate your estimated tax liability using the tax rates applicable to nonresident aliens.

- Complete the form by entering your personal information, estimated income, and tax calculations in the appropriate sections.

- Review the form for accuracy and completeness before submission.

How to use the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

The Form 1040 ES NR is used to report estimated tax payments for the current tax year. Nonresident aliens should use this form if they expect to owe tax of one thousand dollars or more when they file their tax return. The form allows individuals to calculate and remit their estimated tax payments quarterly, ensuring they stay compliant with U.S. tax regulations. It is important to keep track of payment deadlines to avoid interest and penalties.

Filing Deadlines / Important Dates

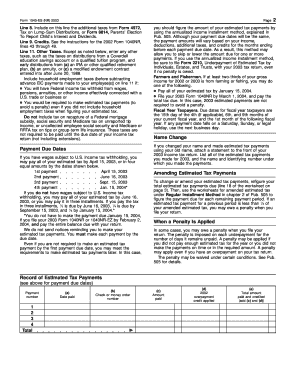

Filing deadlines for the Form 1040 ES NR are crucial for nonresident aliens to avoid penalties. Typically, estimated tax payments are due on the 15th day of April, June, September, and January of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping a calendar of these dates helps ensure timely submissions and compliance with tax obligations.

Legal use of the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

The legal use of the Form 1040 ES NR is essential for nonresident aliens who earn income in the U.S. and have tax obligations. By using this form, individuals can accurately report their estimated tax payments, which is a requirement under U.S. tax law. Failing to file or pay estimated taxes can lead to penalties, interest, and potential legal issues. Therefore, understanding the legal implications of this form is vital for compliance.

Key elements of the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

Key elements of the Form 1040 ES NR include:

- Personal information section, where you provide your name, address, and taxpayer identification number.

- Estimated income section, where you report expected earnings for the year.

- Tax calculation section, which helps determine your estimated tax liability based on your income.

- Payment vouchers, which are used to submit quarterly estimated tax payments.

Quick guide on how to complete form 1040 es nr fill in version u s estimated tax for nonresident alien individuals

Complete [SKS] easily on any device

Online document management has become popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es nr fill in version u s estimated tax for nonresident alien individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals?

The Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals is used by nonresident aliens to estimate their tax liability for the year. This form ensures that you are making timely estimated tax payments to avoid penalties. airSlate SignNow makes it easy to fill out and eSign this form digitally.

-

How does airSlate SignNow facilitate the completion of Form 1040 ES NR?

airSlate SignNow offers an intuitive platform that allows users to fill out the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals seamlessly. With built-in templates and easy navigation, users can complete their tax forms quickly, saving valuable time and minimizing mistakes.

-

Are there any costs associated with using airSlate SignNow for Form 1040 ES NR?

Yes, airSlate SignNow provides different pricing plans that cater to various needs, including options for individual users and businesses. Each plan offers access to essential features for completing the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals, along with additional perks like document security and support.

-

Can I save my progress while filling out the Form 1040 ES NR on airSlate SignNow?

Absolutely! airSlate SignNow allows users to save their progress when completing the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals. This means you can return to your form anytime, ensuring you have enough time to gather all necessary information before submitting your taxes.

-

Does airSlate SignNow offer features for collaboration on Form 1040 ES NR?

Yes, airSlate SignNow supports collaborative features that allow multiple users to work on the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals. This is ideal for situations where you need input from tax professionals or family members to ensure accuracy and compliance.

-

What integrations does airSlate SignNow have for easier tax filing?

airSlate SignNow integrates with various accounting and financial software, making it easier to manage your financial records alongside filling out Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals. These integrations streamline your workflow and ensure accurate data transfer between platforms.

-

How secure is my information when using airSlate SignNow for Form 1040 ES NR?

Security is a top priority at airSlate SignNow. When filling out the Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals, your information is protected with advanced encryption and security protocols, ensuring that your sensitive tax information remains confidential and safe.

Get more for Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

Find out other Form 1040 ES NR Fill in Version U S Estimated Tax For Nonresident Alien Individuals

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online