1545 1430 Department of the Treasury Internal Revenue Service IRS USE ONLY Enter State Code for State in Which Deposits Were Mad Form

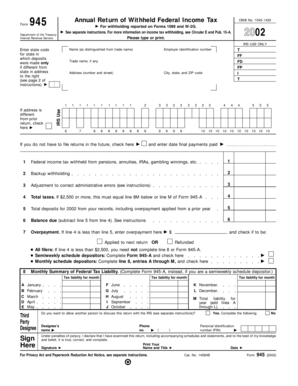

Understanding the Form

The form, issued by the Department of the Treasury Internal Revenue Service (IRS), is specifically designed for use in certain tax-related situations. This form is primarily utilized to report information regarding state codes for deposits made, particularly when the state of the deposit differs from the address provided on the form. This ensures accurate processing and compliance with state tax regulations.

How to Complete the Form

Completing the form involves several straightforward steps. First, gather all necessary information, including your business address and the state where deposits were made. If the state of the deposits is different from the state listed in your address, you will need to enter the appropriate state code in the designated area. Follow the instructions provided on page two of the form to ensure accuracy and completeness.

Key Elements of the Form

Several key elements are essential for accurately filling out the form. These include:

- State Code: This is required only if the state where deposits were made differs from the address state.

- Business Information: Ensure that your business name and address are correctly entered.

- Signature: The form must be signed to validate the information provided.

Legal Use of the Form

The form serves a legal purpose by ensuring that businesses comply with state tax requirements. Accurate reporting of state codes helps prevent potential issues with tax authorities and ensures that all deposits are properly accounted for. Misreporting can lead to penalties or delays in processing.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines associated with the form. Typically, these deadlines align with federal and state tax filing dates. Ensure that you submit the form in a timely manner to avoid any penalties. Refer to the IRS guidelines for specific dates relevant to your situation.

Examples of Using the Form

Consider a scenario where a business based in New York makes deposits in New Jersey. In this case, the business would enter the New Jersey state code on the form, even though the business address is in New York. This example illustrates the importance of accurately reporting the state of deposits to maintain compliance.

Steps to Obtain the Form

The form can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to comply with the latest regulations. Always check for any updates or changes in the form's requirements before submission.

Quick guide on how to complete 1545 1430 department of the treasury internal revenue service irs use only enter state code for state in which deposits were

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Mad

Create this form in 5 minutes!

How to create an eSignature for the 1545 1430 department of the treasury internal revenue service irs use only enter state code for state in which deposits were

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 1545 1430 form?

The 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions is used to report specific deposit information to the IRS. This form ensures accurate tracking of payments and assists in complying with tax regulations.

-

How can airSlate SignNow assist with IRS form 1545 1430?

airSlate SignNow simplifies the process of electronically signing and sending the 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions. Our platform allows for secure document management and provides a seamless way to collect necessary signatures quickly.

-

Is there a cost associated with using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans suited for different business needs. These plans ensure you have access to features that aid in managing the 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions and other official documents efficiently.

-

What features does airSlate SignNow provide for document signing?

airSlate SignNow includes several features that enhance document signing, such as customizable templates and workflow automation. This is particularly useful for users dealing with the 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions, as these features streamline the necessary electronic signature processes.

-

Can I track the status of my documents sent through airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their documents in real-time. This feature provides visibility into the signing process, which is crucial when dealing with important forms like the 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage solutions. These integrations enhance your ability to manage documents like the 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions and improve overall workflow efficiency in your organization.

-

How secure is the document signing process with airSlate SignNow?

Security is a priority at airSlate SignNow, with measures such as encryption and secure storage to protect your data. When signing sensitive documents like the 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions, you can trust that your information is kept confidential and secure.

Get more for 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Mad

Find out other 1545 1430 Department Of The Treasury Internal Revenue Service IRS USE ONLY Enter State Code For State In Which Deposits Were Mad

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors