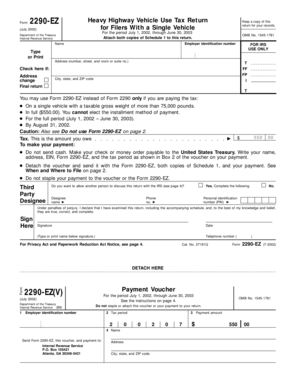

Heavy Highway Vehicle Use Tax Return for Filers with a Single Vehicle Form

What is the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle

The Heavy Highway Vehicle Use Tax Return for Filers With A Single Vehicle is a tax form used by individuals and businesses operating a single heavy highway vehicle. This form is required to report and pay the federal highway use tax imposed on vehicles that weigh over 55,000 pounds. The tax supports the construction and maintenance of highways in the United States. It is essential for ensuring compliance with federal regulations and avoiding penalties.

Steps to complete the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle

Completing the Heavy Highway Vehicle Use Tax Return involves several key steps:

- Gather necessary information about the vehicle, including its weight and registration details.

- Determine the applicable tax rate based on the vehicle's weight and the number of miles driven on public highways.

- Fill out the form accurately, ensuring all required sections are completed.

- Calculate the total tax owed and include any applicable credits or deductions.

- Review the completed form for accuracy before submission.

Required Documents

To complete the Heavy Highway Vehicle Use Tax Return, you will need the following documents:

- Vehicle registration information, including the Vehicle Identification Number (VIN).

- Records of mileage driven on public highways.

- Payment information for the tax owed, if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the Heavy Highway Vehicle Use Tax Return are typically set by the IRS. Generally, the return must be filed annually, with the due date falling on the last day of the month following the end of the tax period. It is crucial to stay informed about any changes to deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Heavy Highway Vehicle Use Tax Return can be submitted through various methods:

- Online submission via the IRS e-file system, which offers a convenient way to file electronically.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Penalties for Non-Compliance

Failure to file the Heavy Highway Vehicle Use Tax Return by the deadline can result in significant penalties. These may include fines based on the amount of tax owed and additional interest charges on late payments. It is essential to comply with all filing requirements to avoid these financial repercussions.

Quick guide on how to complete heavy highway vehicle use tax return for filers with a single vehicle

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without complications. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and eSign [SKS] with ease

- Obtain [SKS] and then select Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Double-check all details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, and the need to print new copies due to errors. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle

Create this form in 5 minutes!

How to create an eSignature for the heavy highway vehicle use tax return for filers with a single vehicle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle?

The Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle is a tax form that owners of heavy vehicles must file if their vehicle's gross weight exceeds 55,000 pounds. This form allows for the calculation and payment of taxes related to the usage of heavy highway vehicles. By knowing your obligations, you can ensure compliance and avoid penalties.

-

How can airSlate SignNow help with filing the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle?

airSlate SignNow streamlines the process of filing the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle by allowing you to eSign necessary documents efficiently. Our user-friendly platform simplifies paperwork, ensuring that you can complete your tax returns quickly and accurately. Additionally, it provides a secure environment for your sensitive documents.

-

What are the key features of airSlate SignNow for tax document handling?

Key features of airSlate SignNow include customizable templates, real-time tracking of document status, and automatic reminders for filing deadlines. These features play a crucial role in managing the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle and ensure you stay on top of your tax obligations. Enhanced security measures guarantee that your data remains safe.

-

Is there a cost associated with using airSlate SignNow for my Heavy Highway Vehicle Use Tax Return?

Yes, airSlate SignNow operates on a subscription-based pricing model. Our plans are designed to be cost-effective for businesses of all sizes, especially those handling the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle. You can choose from various plans based on your needs, ensuring you only pay for what you use.

-

Can I integrate airSlate SignNow with other tax software for the Heavy Highway Vehicle Use Tax Return?

Absolutely! airSlate SignNow offers integrations with popular tax software platforms, making it easier to manage your Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle. This integration allows for seamless data transfer, reducing errors and saving you time during tax season.

-

What are the benefits of eSigning documents for the Heavy Highway Vehicle Use Tax Return?

ESigning documents signNowly speeds up the process of submitting your Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle. It eliminates the need for printing, signing, and scanning, saving you time and resources. Plus, eSigned documents are legally valid and secure, ensuring compliance with tax regulations.

-

How secure is my data when using airSlate SignNow for tax documents?

Data security is a top priority for airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your information related to the Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle. Our compliance with industry standards ensures that your sensitive documents are safe from unauthorized access.

Get more for Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle

- On the day on which i sign this attestation choose all that bapplyb a bwithdrawalb for expenditures on medical or disability form

- Tcdrs withdrawal application 2017 2019 form

- Tda hardship withdrawal application form

- Chase pay card plus form

- Form cc 1680 inst commissioner of accounts

- Np annual report form

- Ks form

- Business registration license application santa fe santafebiz form

Find out other Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free