Form 8610 Annual Low Income Housing Credit Agencies Report under Section 42l3 of the Internal Revenue Code OMB No

Understanding Form 8610

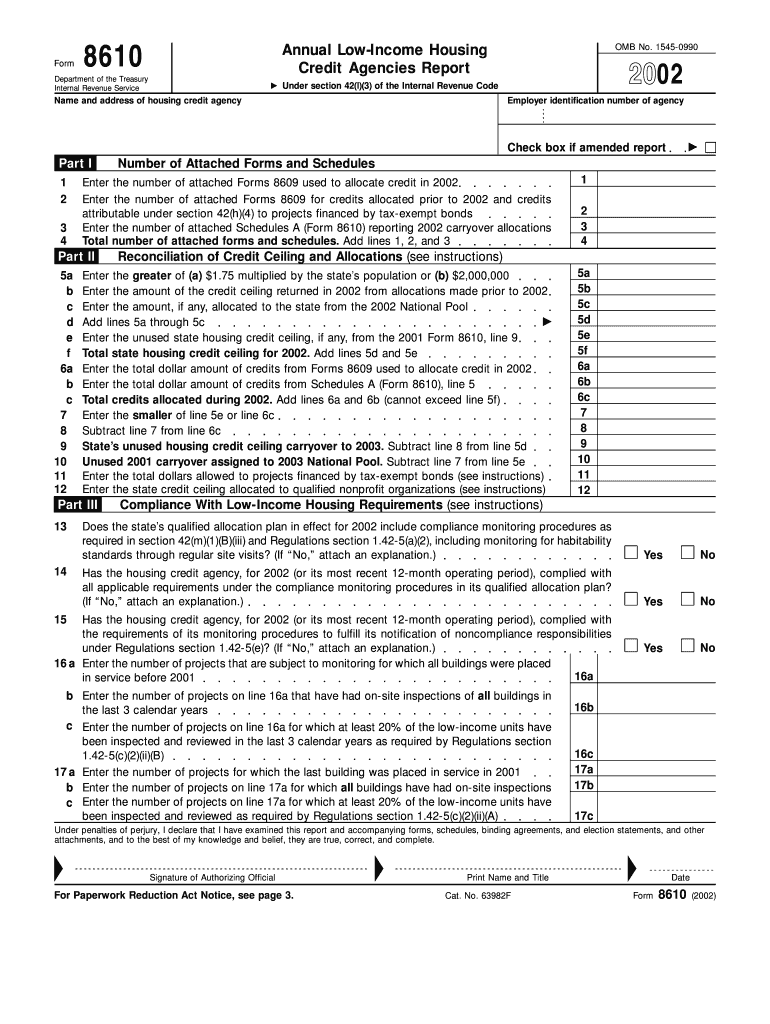

The Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42(l)(3) of the Internal Revenue Code is a crucial document for agencies administering low-income housing credits. This form provides the Internal Revenue Service (IRS) with essential information about the allocation and usage of low-income housing credits, ensuring compliance with federal regulations. It is primarily used by state and local housing agencies to report their activities related to the Low-Income Housing Tax Credit (LIHTC) program.

Steps to Complete Form 8610

Completing Form 8610 requires careful attention to detail. Here are the key steps involved:

- Gather necessary documentation, including previous year reports and financial statements related to the low-income housing projects.

- Fill out the agency's identifying information, including name, address, and contact details.

- Report the total number of low-income housing units placed in service during the reporting year.

- Provide detailed information on the allocation of credits, including the amount allocated to each project.

- Review the completed form for accuracy and compliance with IRS guidelines.

Obtaining Form 8610

Form 8610 can be obtained directly from the IRS website or through authorized tax preparation software. It is essential to ensure that you are using the most current version of the form to comply with any updates or changes in regulations. Agencies may also request paper copies from the IRS if needed.

Legal Use of Form 8610

The legal use of Form 8610 is mandated by the Internal Revenue Code, specifically under Section 42(l)(3). Agencies must file this form annually to maintain their eligibility for low-income housing credits. Failure to submit this report can result in penalties and loss of credit allocation, affecting the agency's ability to support affordable housing initiatives.

Filing Deadlines for Form 8610

Form 8610 must be filed annually, typically by the end of the calendar year following the reporting period. Agencies should be aware of specific deadlines set by the IRS to avoid late filing penalties. Keeping track of these dates is crucial for maintaining compliance and ensuring continued access to housing credits.

Key Elements of Form 8610

Form 8610 consists of several key elements that agencies must complete:

- Identification of the agency and the reporting period.

- Details of low-income housing projects, including addresses and credit allocations.

- Summary of units placed in service and their compliance status.

- Signature of the authorized representative, certifying the accuracy of the information provided.

Quick guide on how to complete form 8610 annual low income housing credit agencies report under section 42l3 of the internal revenue code omb no

Complete [SKS] with ease on any gadget

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No

Create this form in 5 minutes!

How to create an eSignature for the form 8610 annual low income housing credit agencies report under section 42l3 of the internal revenue code omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No.?

The Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. is a report required by the IRS to track the allocation of low-income housing tax credits. This report assists agencies in documenting compliance with regulations and serves to inform the IRS about program effectiveness.

-

How can airSlate SignNow help me in filling out the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No.?

airSlate SignNow provides an intuitive platform that simplifies the process of filling and eSigning the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. With templates and user-friendly tools, you can complete this essential documentation efficiently.

-

What features does airSlate SignNow offer for eSigning documents related to the Form 8610 Annual Low Income Housing Credit Agencies Report?

airSlate SignNow offers a variety of features including customizable templates, bulk sending, and audit trails that are particularly useful for handling the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. Our platform ensures secure and compliant document management.

-

Is airSlate SignNow cost-effective for managing the Form 8610 Annual Low Income Housing Credit Agencies Report?

Yes, airSlate SignNow offers affordable plans tailored for organizations of all sizes aiming to manage documents like the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. This provides you with a cost-effective way to ensure compliance without compromising quality.

-

Can I integrate airSlate SignNow with other tools for managing the Form 8610 Annual Low Income Housing Credit Agencies Report?

Absolutely! airSlate SignNow integrates seamlessly with a variety of other applications, enhancing your workflow for the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. Connect with platforms like Google Drive and Salesforce to streamline your processes.

-

What benefits does airSlate SignNow provide for submitting the Form 8610 Annual Low Income Housing Credit Agencies Report?

Using airSlate SignNow to submit the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. ensures faster processing times and improved accuracy. This minimizes the risk of errors and helps maintain compliance with IRS requirements.

-

How secure is airSlate SignNow when handling sensitive information for the Form 8610 Annual Low Income Housing Credit Agencies Report?

airSlate SignNow prioritizes security with features such as encryption and secure cloud storage. This ensures that all data related to the Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No. is protected and compliant with industry standards.

Get more for Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No

Find out other Form 8610 Annual Low Income Housing Credit Agencies Report Under Section 42l3 Of The Internal Revenue Code OMB No

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document