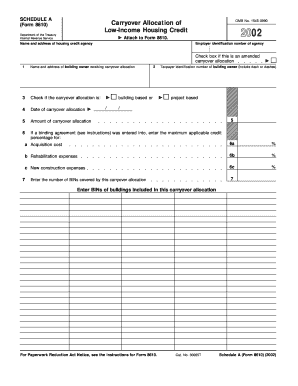

SCHEDULE a Form 8610 Department of the Treasury Internal Revenue Service Carryover Allocation of Low Income Housing Credit Attac

Understanding the SCHEDULE A Form 8610

The SCHEDULE A Form 8610 is a document used by taxpayers to report the carryover allocation of Low Income Housing Credits to the Internal Revenue Service (IRS). This form is essential for individuals or entities that have received Low Income Housing Credits in previous years and need to allocate these credits for the current tax year. It ensures compliance with IRS regulations and helps in accurately reporting tax liabilities related to low-income housing investments.

Steps to Complete the SCHEDULE A Form 8610

Completing the SCHEDULE A Form 8610 involves several steps:

- Gather all necessary documentation related to your Low Income Housing Credits.

- Fill out the identifying information at the top of the form, including your name, address, and taxpayer identification number.

- Detail the amount of Low Income Housing Credits you are carrying over from previous years.

- Complete the allocation section, specifying how the credits are to be distributed among eligible properties.

- Review the form for accuracy and completeness before submission.

Obtaining the SCHEDULE A Form 8610

The SCHEDULE A Form 8610 can be obtained directly from the IRS website or through tax preparation software. It is advisable to ensure that you are using the most current version of the form to comply with any updates or changes in tax regulations. Additionally, tax professionals can provide assistance in obtaining and filling out the form correctly.

Key Elements of the SCHEDULE A Form 8610

Several key elements are crucial for accurately completing the SCHEDULE A Form 8610:

- Taxpayer Information: Accurate identification details of the taxpayer.

- Credit Amount: The total amount of Low Income Housing Credits being carried over.

- Property Allocation: Specific details on how the credits are allocated to different properties.

- Signature: The taxpayer's signature is required to validate the form.

Legal Use of the SCHEDULE A Form 8610

The SCHEDULE A Form 8610 must be used in compliance with IRS guidelines to ensure that taxpayers accurately report their Low Income Housing Credits. Incorrect use of this form can lead to penalties or audits. It is important for taxpayers to understand the legal implications of the information reported and to maintain accurate records supporting their claims.

Filing Deadlines for the SCHEDULE A Form 8610

Filing deadlines for the SCHEDULE A Form 8610 typically align with the annual tax return deadlines. Taxpayers should be aware of these dates to avoid late penalties. Generally, the deadline for filing individual tax returns is April 15, unless extended. It is important to check for any specific extensions or changes in deadlines that may apply to your situation.

Quick guide on how to complete schedule a form 8610 department of the treasury internal revenue service carryover allocation of low income housing credit

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks on any device of your choosing. Modify and eSign [SKS] while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 8610 department of the treasury internal revenue service carryover allocation of low income housing credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of SCHEDULE A Form 8610?

SCHEDULE A Form 8610 is used to report the carryover allocation of low-income housing credits. This form must be attached to Form 8610 when filing with the Department of the Treasury Internal Revenue Service. It ensures that taxpayers accurately account for their credits and comply with IRS regulations.

-

How can airSlate SignNow assist with SCHEDULE A Form 8610?

airSlate SignNow provides a streamlined solution for eSigning and managing documents like SCHEDULE A Form 8610. With its user-friendly interface, you can easily fill out, sign, and send this form securely. This tool simplifies compliance with the Department of the Treasury Internal Revenue Service requirements.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can select from monthly or annual subscriptions, each designed to provide access to essential features for eSigning documents, including SCHEDULE A Form 8610. Explore different tiers to find the right fit for your budget.

-

Does airSlate SignNow offer integration with other applications for SCHEDULE A Form 8610?

Yes, airSlate SignNow integrates seamlessly with numerous applications to facilitate effective document management. You can connect it with your favorite tools, ensuring that you can easily manage your SCHEDULE A Form 8610 alongside other data. This integration enhances workflow efficiency across platforms.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides several benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. It enables businesses to manage forms like SCHEDULE A Form 8610 effortlessly, ensuring compliance with IRS standards. The cost-effective pricing also helps businesses save resources.

-

How secure is the transmission of SCHEDULE A Form 8610 through airSlate SignNow?

airSlate SignNow employs advanced security protocols to ensure the safe transmission of documents, including SCHEDULE A Form 8610. With encryption and secure servers, you can trust that sensitive information is protected. This commitment to security aligns with the compliance measures set by the Department of the Treasury Internal Revenue Service.

-

Can I track the status of my SCHEDULE A Form 8610 once sent through airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your documents, including SCHEDULE A Form 8610. You will receive notifications when the document is opened, signed, and completed, ensuring you stay informed throughout the process.

Get more for SCHEDULE A Form 8610 Department Of The Treasury Internal Revenue Service Carryover Allocation Of Low Income Housing Credit Attac

- Michigan notary application pdf form

- Swot templates editable form

- Ua local 803 pay scale form

- Efekta insurance claim form

- Training proposal template word form

- Two year permit application abusable volatile chemical avc dshs texas form

- Tax file number application or enquiry for individuals living outside australia form

- Copyright glencoe mcgraw hill answer key form

Find out other SCHEDULE A Form 8610 Department Of The Treasury Internal Revenue Service Carryover Allocation Of Low Income Housing Credit Attac

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements