Form 730 Rev October , Fill in Version Tax on Wagering

What is the Form 730 Rev October, Fill in Version Tax On Wagering

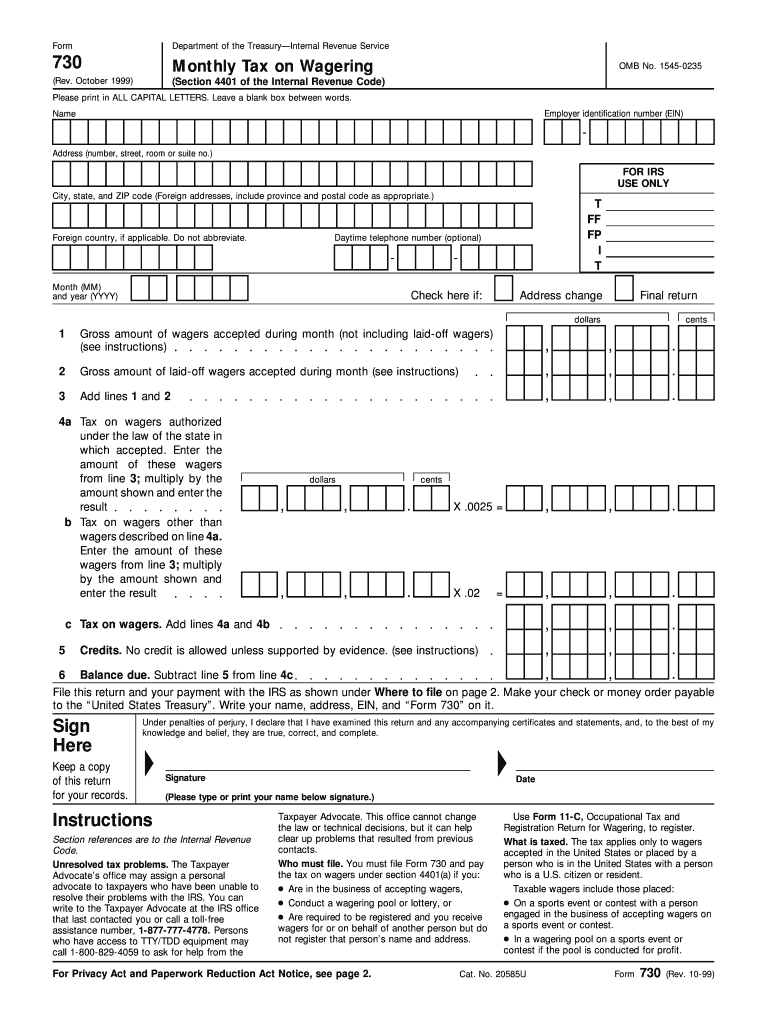

The Form 730 Rev October is a tax form used by individuals and businesses to report and pay taxes related to wagering activities. This form is specifically designed for those who engage in activities such as gambling, betting, or other wagering transactions. It outlines the taxpayer's obligations under U.S. tax law regarding the taxation of winnings and losses from these activities. Understanding this form is crucial for compliance with federal tax regulations.

How to use the Form 730 Rev October, Fill in Version Tax On Wagering

To effectively use the Form 730 Rev October, individuals must first ensure they have the correct version of the form. Once obtained, taxpayers should fill in their personal information, including name, address, and Social Security number. The form requires details about total wagering activities, including both winnings and losses. After completing the form, it must be submitted to the appropriate tax authority, along with any required payments. Keeping a copy for personal records is also recommended.

Steps to complete the Form 730 Rev October, Fill in Version Tax On Wagering

Completing the Form 730 Rev October involves several key steps:

- Obtain the latest version of the form from the IRS website or authorized sources.

- Fill in your personal information accurately.

- Report total wagering gains and losses in the designated sections.

- Calculate the tax owed based on the net winnings.

- Sign and date the form to certify its accuracy.

- Submit the form by the specified deadline, ensuring you include any payment if applicable.

Legal use of the Form 730 Rev October, Fill in Version Tax On Wagering

The legal use of the Form 730 Rev October is primarily for reporting and paying taxes on wagering activities as mandated by the Internal Revenue Service (IRS). Taxpayers must use this form to comply with federal tax laws, ensuring that all gambling winnings are reported accurately. Failure to use the form correctly can result in penalties or legal consequences, making it essential for individuals engaged in wagering to understand their responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 730 Rev October are typically aligned with the annual tax return deadlines. Taxpayers should be aware that the form is generally due on April fifteenth of the following year after the tax year ends. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes in deadlines or specific requirements that may arise.

Required Documents

When completing the Form 730 Rev October, certain documents may be required to support the information provided. Taxpayers should gather records of all wagering activities, including receipts, statements from casinos, and any other documentation that verifies winnings and losses. These documents are essential for accurate reporting and may be requested by the IRS during audits or reviews.

Quick guide on how to complete form 730 rev october fill in version tax on wagering

Complete Form 730 Rev October , Fill in Version Tax On Wagering effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow offers you all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Handle Form 730 Rev October , Fill in Version Tax On Wagering on any platform with airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

The easiest way to edit and electronically sign Form 730 Rev October , Fill in Version Tax On Wagering without hassle

- Find Form 730 Rev October , Fill in Version Tax On Wagering and click on Get Form to initiate.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent portions of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that function.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tiresome form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 730 Rev October , Fill in Version Tax On Wagering and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 730 rev october fill in version tax on wagering

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 730 Rev October, Fill in Version Tax On Wagering?

The Form 730 Rev October, Fill in Version Tax On Wagering is a tax form required for reporting and paying the tax on wagering activities. This form is crucial for businesses involved in gambling operations, as it helps ensure compliance with federal tax regulations. Using airSlate SignNow, you can easily fill in and eSign this form directly, streamlining your tax reporting process.

-

How can I fill out the Form 730 Rev October, Fill in Version Tax On Wagering using airSlate SignNow?

With airSlate SignNow, filling out the Form 730 Rev October, Fill in Version Tax On Wagering is straightforward. You can access the form online, enter the required information, and review it for accuracy before eSigning. Our user-friendly interface simplifies the data entry process, making it quick and hassle-free.

-

What are the benefits of using airSlate SignNow for Form 730 Rev October, Fill in Version Tax On Wagering?

Using airSlate SignNow for the Form 730 Rev October, Fill in Version Tax On Wagering offers several benefits. It saves time by allowing for electronic signatures and automatic document storage. Plus, you can track the status of your forms, ensuring you never miss a deadline and remain compliant with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the Form 730 Rev October, Fill in Version Tax On Wagering?

airSlate SignNow provides a cost-effective solution for managing documents, including the Form 730 Rev October, Fill in Version Tax On Wagering. Pricing options are available to suit different business needs, ensuring that you only pay for what you require. You can explore our competitive plans that allow you to maximize your investment in document management.

-

Can I integrate airSlate SignNow with other software for filing the Form 730 Rev October, Fill in Version Tax On Wagering?

Yes, airSlate SignNow offers a seamless integration with various platforms and software tools, enhancing your workflow when filling out the Form 730 Rev October, Fill in Version Tax On Wagering. By integrating with your existing systems, you can retrieve and send documents effortlessly. This connectivity improves efficiency and helps maintain your organization's overall productivity.

-

What security measures does airSlate SignNow offer for the Form 730 Rev October, Fill in Version Tax On Wagering?

airSlate SignNow prioritizes your document security, ensuring that the Form 730 Rev October, Fill in Version Tax On Wagering is protected with advanced encryption and secure access controls. We comply with industry standards for data protection to safeguard sensitive information. This commitment to security allows you to fill out and eSign your forms with confidence.

-

How can airSlate SignNow help reduce errors in the Form 730 Rev October, Fill in Version Tax On Wagering?

airSlate SignNow includes built-in validation tools to help reduce errors when completing the Form 730 Rev October, Fill in Version Tax On Wagering. These tools automatically check for missing information and formatting issues before submission, ensuring that your form is accurate and complete. This feature signNowly minimizes the likelihood of costly mistakes and enhances compliance.

Get more for Form 730 Rev October , Fill in Version Tax On Wagering

- Form chp 13 1

- County of erie standard insurance certificate form

- Convertible note term sheet form

- Sxcbdo form

- Backflow prevention device test report guelph form

- 994l rules and regulations 324 letter size form

- Box 6300 winnipeg mb r3c 4a4 phone 204 9857000 toll 1 8006652410 hearing impaired line 204 9858832 drivers licence form

- Concussion form palo alto unified school district pausd

Find out other Form 730 Rev October , Fill in Version Tax On Wagering

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy