What is a G4p Form Used for 2018

What is the g 4p Form Used For

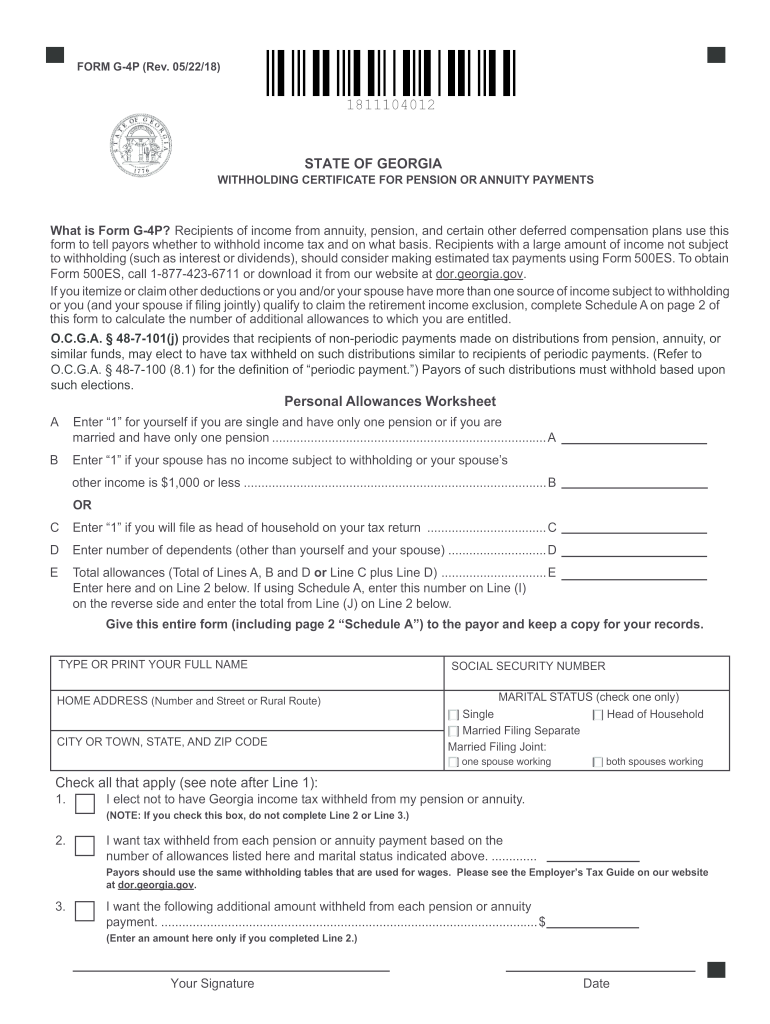

The g 4p form, also known as the Georgia withholding certificate, is primarily used by employees in the state of Georgia to determine the correct amount of state income tax to withhold from their paychecks. This form is essential for individuals who want to ensure that their tax withholdings align with their financial situation, including any exemptions or additional withholdings they may wish to claim. By accurately completing the g 4p form, employees can avoid under-withholding, which could lead to a tax bill at the end of the year, or over-withholding, which results in less take-home pay.

Steps to Complete the g 4p Form

Completing the g 4p form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Specify the number of allowances you are claiming. This number affects how much tax is withheld from your paycheck.

- If applicable, you can also request additional withholding by specifying an extra amount to be deducted from each paycheck.

- Review your completed form for accuracy before signing and dating it.

Once completed, submit the form to your employer, who will use it to adjust your state tax withholdings accordingly.

Legal Use of the g 4p Form

The g 4p form is legally recognized by the state of Georgia as a valid document for tax withholding purposes. It complies with state regulations regarding income tax withholding and is designed to help employees manage their tax liabilities effectively. By submitting this form, employees affirm their understanding of the information provided and its implications for their state tax withholdings. It is important to keep a copy of the completed form for personal records, as it may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

While the g 4p form itself does not have a specific filing deadline, it is crucial for employees to submit it to their employer as soon as they start a new job or experience a change in their tax situation. Employers typically require this form to ensure accurate withholding from the first paycheck. Additionally, employees should be aware of the annual tax filing deadline, which is usually April fifteenth, to ensure that they have sufficient withholdings throughout the year.

Form Submission Methods

The g 4p form can be submitted in several ways, depending on the employer's policies:

- In-person: Many employers prefer employees to submit the form in person during the onboarding process.

- By mail: Employees may also send the completed form via postal mail if their employer allows it.

- Online: Some employers may provide an online portal where employees can complete and submit the g 4p form electronically.

It is advisable to confirm the preferred submission method with your employer to ensure timely processing.

Key Elements of the g 4p Form

The g 4p form contains several key elements that are essential for accurate tax withholding:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects withholding amounts.

- Additional Withholding: Option to specify any extra amount to withhold.

Understanding these elements helps employees make informed decisions about their tax withholdings.

Quick guide on how to complete g 4p 2018 2019 form

Your assistance manual on how to prepare your What Is A G4p Form Used For

If you’re wondering how to finalize and submit your What Is A G4p Form Used For, here are some brief instructions on how to streamline tax processing.

To get started, simply create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that lets you edit, draft, and finish your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify information as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your What Is A G4p Form Used For in just a few minutes:

- Create your account and begin working on PDFs quickly.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your What Is A G4p Form Used For in our editor.

- Populate the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically submit your taxes with airSlate SignNow. Be aware that submitting in paper form can lead to return errors and slow down reimbursements. Additionally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct g 4p 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the g 4p 2018 2019 form

How to make an eSignature for your G 4p 2018 2019 Form online

How to create an electronic signature for your G 4p 2018 2019 Form in Chrome

How to create an eSignature for putting it on the G 4p 2018 2019 Form in Gmail

How to create an electronic signature for the G 4p 2018 2019 Form straight from your smartphone

How to create an eSignature for the G 4p 2018 2019 Form on iOS

How to generate an electronic signature for the G 4p 2018 2019 Form on Android OS

People also ask

-

What is g 4p and how does it relate to airSlate SignNow?

G 4p refers to the general concept of online document signing and management, which is a crucial feature of airSlate SignNow. Our platform allows businesses to efficiently send, sign, and manage documents digitally, streamlining workflows and reducing paperwork. By implementing g 4p strategies, companies can enhance their operational efficiency.

-

What pricing plans does airSlate SignNow offer for g 4p solutions?

AirSlate SignNow offers various pricing plans tailored to meet different business needs for g 4p solutions. Whether you are a small startup or a large enterprise, our pricing is competitive and designed to provide value at every level. Additionally, we often provide flexible options and discounts for annual subscriptions.

-

What are the key features of airSlate SignNow related to g 4p?

Key features of airSlate SignNow concerning g 4p include mobile-friendly document signing, customizable templates, and real-time tracking of document statuses. These features enhance user experience and ensure that all signing processes are quick and secure. By utilizing these features, users can seamlessly integrate g 4p methodologies into their operations.

-

How can businesses benefit from using airSlate SignNow for g 4p?

Businesses can signNowly benefit from airSlate SignNow's g 4p capabilities by reducing turnaround times for document approvals and increasing overall productivity. The platform simplifies the entire signing process, allowing teams to focus on more strategic tasks. Furthermore, it promotes higher compliance and security with legally binding electronic signatures.

-

Does airSlate SignNow integrate with other software for g 4p?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, which is essential for maximizing your g 4p capabilities. Our platform supports integrations with popular tools like Salesforce, Google Workspace, and Microsoft Office. This allows for a more cohesive workflow across different applications, enhancing operational efficiency.

-

Is airSlate SignNow suitable for all business sizes regarding g 4p?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes when it comes to g 4p functionalities. From individual freelancers needing simple signing solutions to large corporations requiring complex document workflows, our platform scales accordingly to meet diverse needs. This versatility makes it a perfect choice for any business looking to improve its document management.

-

What kind of customer support does airSlate SignNow provide for g 4p users?

AirSlate SignNow offers robust customer support for all g 4p users, ensuring you have assistance whenever you need it. Our support channels include live chat, email, and an extensive knowledge base filled with articles and tutorials. We strive to resolve user inquiries promptly to help you fully utilize our g 4p solutions.

Get more for What Is A G4p Form Used For

Find out other What Is A G4p Form Used For

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free