Recipients with a Large Amount of Income Not Subject 2024-2026

Understanding the Recipients With A Large Amount Of Income Not Subject

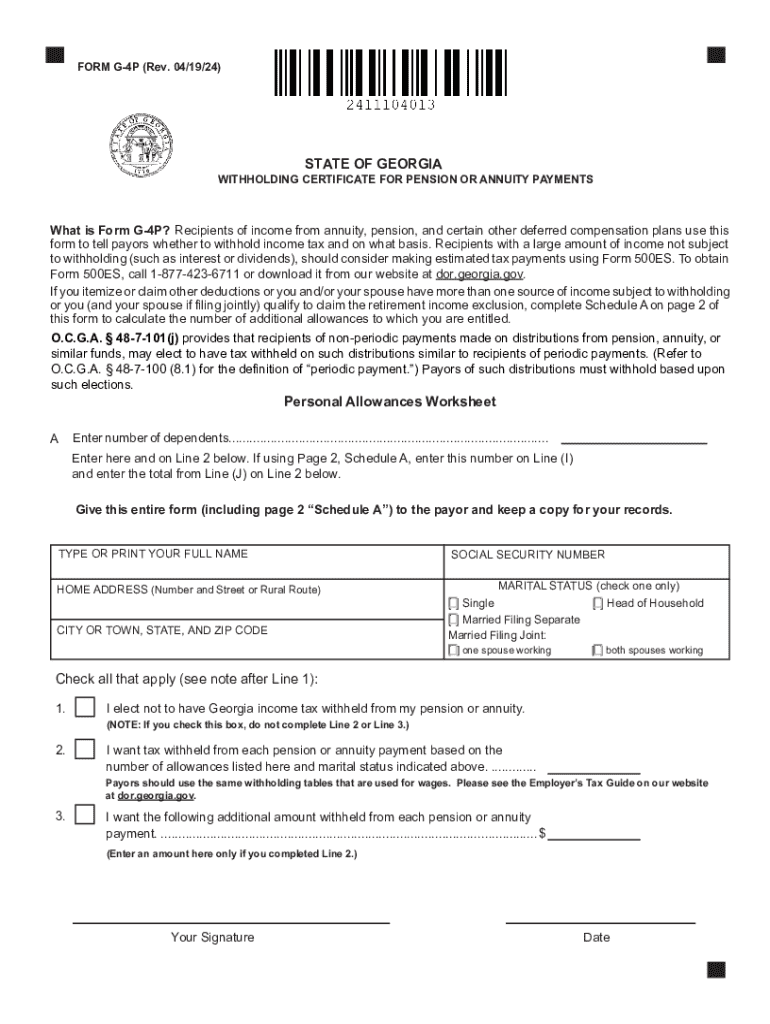

The "Recipients With A Large Amount Of Income Not Subject" refers to individuals or entities that receive significant income but are not subject to certain tax withholdings. This classification is crucial for ensuring compliance with tax regulations while allowing eligible recipients to manage their income effectively. Understanding who qualifies as a recipient in this category can help streamline financial reporting and tax preparation.

Steps to Complete the Recipients With A Large Amount Of Income Not Subject

Completing the necessary documentation for recipients with a large amount of income not subject involves several key steps:

- Gather all relevant income information, including sources and amounts.

- Determine eligibility by reviewing IRS guidelines related to income thresholds and tax obligations.

- Fill out the appropriate forms accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal Use of the Recipients With A Large Amount Of Income Not Subject

The legal use of the "Recipients With A Large Amount Of Income Not Subject" classification is governed by IRS regulations. It is essential for recipients to understand their obligations under tax law, including any reporting requirements. Misclassification or failure to adhere to legal standards can result in penalties, making it vital to consult tax professionals when necessary.

IRS Guidelines for Recipients With A Large Amount Of Income Not Subject

The IRS provides specific guidelines regarding the classification of income and the associated tax implications. Recipients must familiarize themselves with these guidelines to ensure compliance. This includes understanding the types of income that qualify, documentation requirements, and any potential exemptions that may apply.

Filing Deadlines and Important Dates

Filing deadlines for forms related to recipients with a large amount of income not subject can vary based on the type of income and the recipient's tax situation. It is important to keep track of key dates, such as:

- The date forms must be submitted to avoid penalties.

- Any extensions available for filing.

- Important dates for making estimated tax payments, if applicable.

Required Documents for Recipients With A Large Amount Of Income Not Subject

To complete the necessary forms accurately, recipients must gather specific documents, including:

- Proof of income, such as pay stubs or bank statements.

- Previous tax returns, which may be needed for reference.

- Any supporting documentation that verifies eligibility for classification.

Form Submission Methods

Recipients can submit their forms through various methods, depending on their preferences and the requirements of the form. Common submission methods include:

- Online submission through the IRS website or authorized e-filing services.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Create this form in 5 minutes or less

Find and fill out the correct recipients with a large amount of income not subject

Create this form in 5 minutes!

How to create an eSignature for the recipients with a large amount of income not subject

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a g 4p form and how can airSlate SignNow help?

The g 4p form is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of sending and eSigning g 4p forms, ensuring that your documents are handled efficiently and securely.

-

How much does it cost to use airSlate SignNow for g 4p forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing your g 4p forms and other documents.

-

What features does airSlate SignNow offer for managing g 4p forms?

airSlate SignNow provides a range of features for g 4p forms, including customizable templates, automated workflows, and secure eSigning. These features streamline the document management process, making it easier for businesses to handle their paperwork.

-

Can I integrate airSlate SignNow with other applications for g 4p forms?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage your g 4p forms alongside other tools you use. This integration capability enhances productivity and ensures a smooth workflow.

-

Is airSlate SignNow secure for handling sensitive g 4p forms?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your g 4p forms are protected with advanced encryption and secure storage. You can trust that your sensitive information is safe with us.

-

How does airSlate SignNow improve the efficiency of processing g 4p forms?

By using airSlate SignNow, businesses can signNowly reduce the time spent on processing g 4p forms. The platform automates many steps in the document workflow, allowing for quicker approvals and faster turnaround times.

-

What are the benefits of using airSlate SignNow for g 4p forms?

Using airSlate SignNow for g 4p forms offers numerous benefits, including cost savings, improved efficiency, and enhanced collaboration. These advantages help businesses streamline their operations and focus on what matters most.

Get more for Recipients With A Large Amount Of Income Not Subject

- Jury instruction impeachment inconsistent statement defendant testifies with felony conviction form

- Jury instruction impeachment inconsistent statement and felony conviction defendant testifies with felony conviction form

- Instruction expert 497334204 form

- Form 480

- Potential third party liability notification dhcs 6168 form

- Improperly or missing the member or responsible party signature will not be form

- Verious form

- Tool 12 generic falls environmental risk assessment form

Find out other Recipients With A Large Amount Of Income Not Subject

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast