1545 0029 Enter State Code for State in Which Deposits Were Made Only If Different from State in Address to the Right See Page 2 Form

Understanding the Form

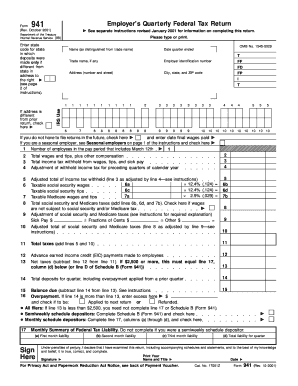

The form is a specific IRS document that requires users to enter the state code for the state in which deposits were made, but only if this state differs from the one listed in the address section. This form is essential for ensuring accurate tax reporting and compliance with federal regulations. It is particularly relevant for individuals and businesses that have financial activities in multiple states, as it helps clarify where income is generated and taxed.

How to Complete the Form

To accurately fill out the form, start by reviewing your address details. If the state where deposits were made is different from the state in your address, locate the appropriate state code. This code is typically a two-letter abbreviation recognized by the IRS. Ensure that you double-check this information against the IRS guidelines to avoid errors that could lead to compliance issues.

State-Specific Rules for the Form

Each state may have unique regulations regarding tax deposits and reporting. It is crucial to be aware of these state-specific rules when completing the form. For instance, some states may have additional requirements or forms that need to be submitted alongside the . Understanding these nuances can help ensure that you remain compliant with both federal and state tax laws.

Examples of Using the Form

Consider a scenario where a business based in California makes deposits in Nevada. In this case, the business would need to enter the state code for Nevada on the form, as it differs from the state in the address. This example illustrates the importance of accurately reporting the state of deposit to maintain compliance and avoid potential penalties.

IRS Guidelines for the Form

The IRS provides specific guidelines for completing the form. These guidelines outline the necessary steps for accurately reporting state codes and emphasize the importance of using the correct codes to prevent processing delays. It is advisable to consult the latest IRS publications or the official IRS website for the most current and detailed instructions regarding this form.

Penalties for Non-Compliance with the Form

Failing to accurately complete the form can lead to penalties imposed by the IRS. These penalties may include fines or additional scrutiny during audits. It is essential to ensure that all information is correct and submitted on time to avoid these potential issues. Regularly reviewing your tax obligations and consulting with a tax professional can help mitigate these risks.

Quick guide on how to complete 1545 0029 enter state code for state in which deposits were made only if different from state in address to the right see page

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2

Create this form in 5 minutes!

How to create an eSignature for the 1545 0029 enter state code for state in which deposits were made only if different from state in address to the right see page

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of entering the state code as per the instruction '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions'?

The state code is necessary for accurate reporting and compliance. If deposits were made in a different state than your registered address, this entry ensures that the necessary tax obligations are met. It's essential for maintaining transparency and correctness in your documentation.

-

How can airSlate SignNow streamline my workflow concerning the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions'?

airSlate SignNow allows for seamless eSigning and document management that simplifies the process of entering pertinent information, such as the state code. Our intuitive platform minimizes errors, ensuring that your compliance with the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions' is hassle-free.

-

Is there a specific pricing model for using airSlate SignNow while adhering to the '1545 0029' instruction?

Yes, airSlate SignNow offers tiered pricing options that cater to different needs and use cases, including compliance with regulations like the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions.' You can choose a plan that aligns with your volume of transactions and document management requirements.

-

What features does airSlate SignNow provide to help with tax compliance related to the '1545 0029' instruction?

Our platform includes features like customizable templates and automated workflows which can be tailored to accommodate the specifics outlined in the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions.' This ensures that you can efficiently manage your documentation throughout the tax process.

-

Can I integrate airSlate SignNow with other tools to assist in complying with the '1545 0029' guidance?

Absolutely! airSlate SignNow offers integrations with various business tools, facilitating a smooth workflow for businesses needing to follow the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions.' This connectivity enhances overall efficiency and accuracy.

-

What benefits does airSlate SignNow offer for businesses dealing with the '1545 0029' compliance?

By utilizing airSlate SignNow, businesses can ensure they comply with the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions' with ease. Our platform not only streamlines document management but also enhances security and reduces turnaround time for approvals.

-

How secure is airSlate SignNow in handling documents required for the '1545 0029' filing?

Security is paramount at airSlate SignNow. We implement robust encryption and security protocols to protect your documents requiring compliance with the '1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2 Of Instructions.' Your sensitive information will always be safeguarded while using our platform.

Get more for 1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2

Find out other 1545 0029 Enter State Code For State In Which Deposits Were Made Only If Different From State In Address To The Right see Page 2

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template