Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

What is the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

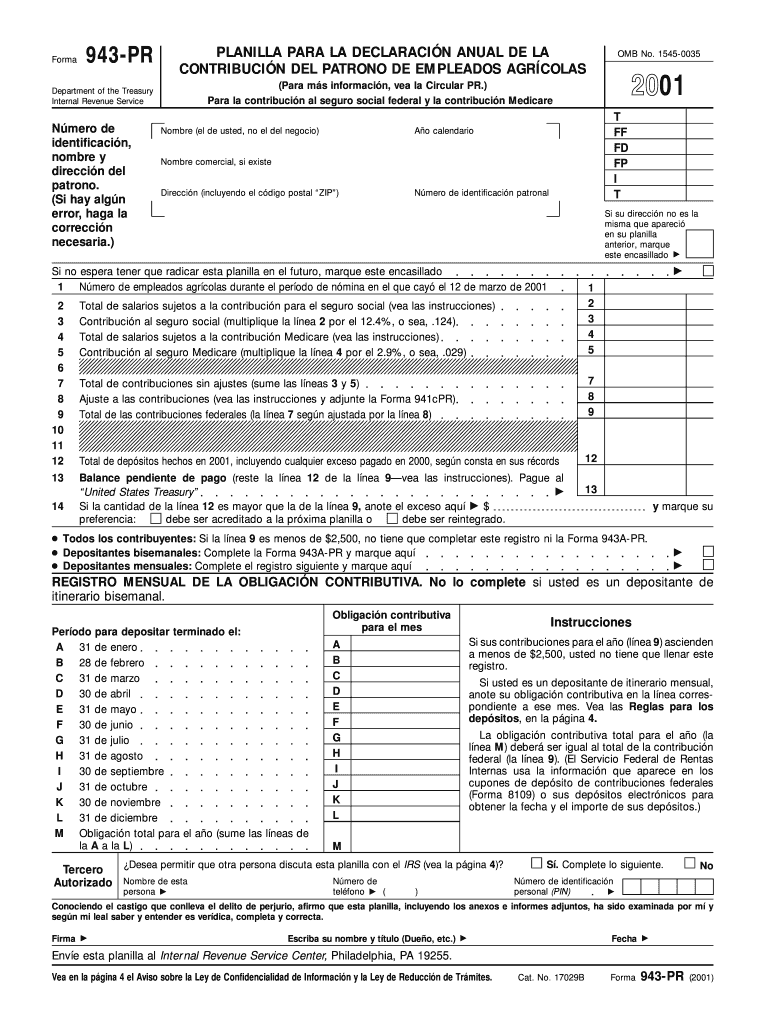

The Form 943 PR, also known as Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas, is a tax form used by employers in Puerto Rico to report annual contributions for agricultural employees. This form is essential for employers who have agricultural workers and need to comply with local tax regulations. It consolidates information regarding wages paid, taxes withheld, and contributions owed, ensuring that employers meet their financial obligations to both employees and the government.

How to use the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

Using the Form 943 PR involves several key steps. First, employers must gather all necessary payroll records for the year, including wages, hours worked, and any deductions. Next, they should carefully fill out the form, ensuring accuracy in reporting all figures. Once completed, the form must be submitted to the appropriate tax authority, either electronically or via mail, depending on the submission methods available. Employers should keep a copy of the submitted form for their records and ensure they adhere to any specific filing deadlines.

Steps to complete the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

Completing the Form 943 PR requires attention to detail. Follow these steps:

- Gather all relevant payroll documentation for the tax year.

- Fill in the employer identification information at the top of the form.

- Report total wages paid to agricultural employees in the designated section.

- Calculate the total contributions owed based on the wages reported.

- Double-check all entries for accuracy to prevent errors.

- Submit the completed form by the specified deadline.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines associated with the Form 943 PR. Typically, the form must be filed annually, with specific deadlines set by the Puerto Rico Department of Treasury. Employers should mark these dates on their calendars to ensure timely submission and avoid potential penalties. Staying informed about any changes to deadlines is also important, as these can vary from year to year.

Required Documents

Before filling out the Form 943 PR, employers should prepare several documents to ensure a smooth filing process. Required documents include:

- Payroll records detailing wages and hours worked by agricultural employees.

- Documentation of any tax withholdings made throughout the year.

- Employer identification information, such as the Employer Identification Number (EIN).

- Any previous tax forms submitted for reference.

Penalties for Non-Compliance

Failure to file the Form 943 PR accurately and on time can lead to significant penalties. Employers may face fines or interest on unpaid contributions, as well as potential legal repercussions. It is essential for employers to understand the importance of compliance with tax regulations to avoid these consequences. Regularly reviewing filing requirements and deadlines can help mitigate the risk of non-compliance.

Quick guide on how to complete form 943 pr fill in version planilla para la declaracion anual de la contribucion del patrono de empleados agricolas 1664094

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and safely save it online. airSlate SignNow equips you with all the tools needed to generate, amend, and eSign your files swiftly without holdups. Manage [SKS] on any system using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest way to alter and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that require printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

Create this form in 5 minutes!

How to create an eSignature for the form 943 pr fill in version planilla para la declaracion anual de la contribucion del patrono de empleados agricolas 1664094

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas?

The Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas is a tax document used in Puerto Rico for reporting annual employer contributions for agricultural employee taxes. This form simplifies the submission process and ensures compliance with local regulations.

-

How does airSlate SignNow support the submission of the Form 943 PR?

AirSlate SignNow provides an efficient platform for completing and electronically signing the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas. Users can easily fill out the form and manage signatures seamlessly, making tax filing faster and more secure.

-

What features does airSlate SignNow offer for filling out tax forms?

AirSlate SignNow offers features such as customizable templates, electronic signatures, and document sharing tailored for tax documents like the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas. These tools enhance the workflow and help users stay organized.

-

Is there a cost associated with using airSlate SignNow for the Form 943 PR?

Yes, airSlate SignNow operates on a subscription-based model, providing various pricing plans to accommodate different business needs. Users can access a cost-effective solution for filling out forms, including the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas.

-

Can I integrate airSlate SignNow with other software?

Absolutely! AirSlate SignNow allows seamless integration with various software platforms, which helps streamline processes for managing documents and form submissions like the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas. Integrations enhance productivity and ensure compatibility with existing systems.

-

What are the benefits of using airSlate SignNow for tax form submissions?

Using airSlate SignNow for tax form submissions, including the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas, offers numerous benefits such as easy access, improved accuracy, and not needing physical paperwork. These advantages lead to a more efficient and stress-free tax filing experience.

-

How secure is airSlate SignNow for handling sensitive tax information?

AirSlate SignNow employs advanced security measures, including encryption and compliance with data protection regulations, to ensure the safety of sensitive tax information. When using the Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas, users can rest assured that their data is well-protected.

Get more for Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

Find out other Form 943 PR Fill in Version Planilla Para La Declaracion Anual De La Contribucion Del Patrono De Empleados Agricolas

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement