Form 1120 FSC Schedule P, Fill in Version

What is the Form 1120 FSC Schedule P, Fill in Version

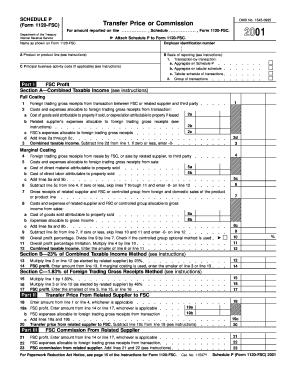

The Form 1120 FSC Schedule P is a supplemental form used by U.S. corporations that have elected to be treated as foreign sales corporations (FSCs). This form is essential for reporting income, deductions, and other tax-related information specific to the FSC's operations. It allows businesses to take advantage of tax benefits associated with foreign sales, helping them to reduce their overall tax liability. The fill-in version of this form provides an electronic format that simplifies the process of completing and submitting the necessary information to the IRS.

How to use the Form 1120 FSC Schedule P, Fill in Version

Using the Form 1120 FSC Schedule P in its fill-in version is straightforward. First, download the form from the IRS website or a trusted source. Once you have the form, open it in a compatible PDF reader that allows for fillable fields. Carefully enter the required information, ensuring accuracy in all entries. After filling out the form, review it for any errors or omissions. Finally, follow the submission guidelines provided by the IRS, which may include electronic filing options or mailing the completed form.

Steps to complete the Form 1120 FSC Schedule P, Fill in Version

Completing the Form 1120 FSC Schedule P involves several key steps:

- Gather all necessary financial documents, including income statements and expense reports related to foreign sales.

- Open the fill-in version of the form and begin with the identification section, providing your corporation's name, address, and taxpayer identification number.

- Fill in the sections detailing income earned from foreign sales, including any deductions applicable to those earnings.

- Review each section for accuracy, ensuring that all calculations are correct and that you have included all required information.

- Save your completed form and prepare it for submission according to IRS guidelines.

Key elements of the Form 1120 FSC Schedule P, Fill in Version

The Form 1120 FSC Schedule P includes several key elements that are crucial for accurate reporting:

- Identification Information: This section requires basic details about the corporation, including its name and tax identification number.

- Income Reporting: Corporations must report all income derived from foreign sales, which is essential for determining tax liabilities.

- Deductions: The form allows for the reporting of specific deductions related to the foreign sales activities of the corporation.

- Signature Section: A designated area for authorized individuals to sign and date the form, certifying its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 FSC Schedule P are critical for compliance. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15 of the following year. It is advisable to check for any updates or changes to deadlines annually, as the IRS may adjust them based on specific circumstances or legislative changes.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1120 FSC Schedule P. These guidelines include instructions on how to report income, claim deductions, and ensure compliance with tax laws. It is essential for corporations to familiarize themselves with these guidelines to avoid errors that could lead to penalties or audits. The IRS also offers resources and publications that provide additional clarity on the requirements for foreign sales corporations.

Quick guide on how to complete form 1120 fsc schedule p fill in version

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your files or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 FSC Schedule P, Fill in Version

Create this form in 5 minutes!

How to create an eSignature for the form 1120 fsc schedule p fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1120 FSC Schedule P, Fill in Version?

The Form 1120 FSC Schedule P, Fill in Version, is a tax form used by certain foreign sales corporations to report their income and expenses. This fillable version simplifies the process of providing accurate information to the IRS, making tax preparation more efficient for businesses. Utilizing this form correctly can lead to potential tax benefits for eligible corporations.

-

How can airSlate SignNow help me complete the Form 1120 FSC Schedule P, Fill in Version?

airSlate SignNow provides an intuitive platform that allows you to fill in the Form 1120 FSC Schedule P, Fill in Version digitally. With our user-friendly interface, you can easily enter the necessary data, ensure accuracy, and eSign the document in one seamless process. This eliminates the hassle of paperwork and streamlines your tax filing experience.

-

Is there a cost associated with using airSlate SignNow for the Form 1120 FSC Schedule P, Fill in Version?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different business needs. Our cost-effective solutions provide access to a range of features, including the ability to fill out the Form 1120 FSC Schedule P, Fill in Version. You can explore our pricing page to find the plan that best suits your requirements.

-

What features are included when using airSlate SignNow for this form?

When using airSlate SignNow for the Form 1120 FSC Schedule P, Fill in Version, you gain access to powerful features like eSignature, document templates, and cloud storage. These tools facilitate a more organized approach to managing your tax documents, helping businesses maintain compliance while saving time. Our platform also supports collaboration, allowing team members to review and sign the document together.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow offers integrations with various accounting software to enhance your workflow when filling out the Form 1120 FSC Schedule P, Fill in Version. This seamless integration allows you to import necessary data directly into the form, minimizing manual input errors and expediting the completion of your tax documentation.

-

What are the benefits of using the Fill in Version of Form 1120 FSC Schedule P?

Using the Fill in Version of Form 1120 FSC Schedule P allows for straightforward data entry, reducing the potential for errors compared to handwritten forms. Moreover, it saves time during tax preparation and provides a professional appearance when submitting to the IRS. Leveraging airSlate SignNow further enhances this experience with eSigning and secure document storage.

-

Is eSigning the Form 1120 FSC Schedule P secure with airSlate SignNow?

Yes, eSigning the Form 1120 FSC Schedule P with airSlate SignNow is secure and complies with legal standards. We utilize advanced encryption methods and authentication protocols to ensure that your documents remain confidential and tamper-proof. You can confidently eSign your tax forms knowing that they are protected.

Get more for Form 1120 FSC Schedule P, Fill in Version

Find out other Form 1120 FSC Schedule P, Fill in Version

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple