Form 3800, Fill in Version General Business Credit

What is the Form 3800, Fill in Version General Business Credit

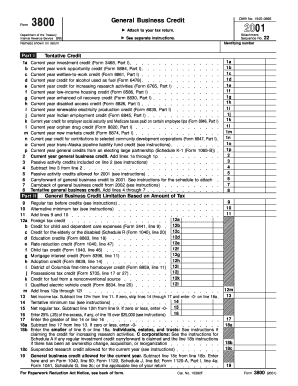

The Form 3800, Fill in Version General Business Credit, is a tax form used by businesses in the United States to claim various business credits. These credits can reduce the amount of tax owed, providing financial relief and incentives for businesses to invest in growth and development. The form consolidates multiple credits, including those for research activities, energy efficiency, and other qualifying expenditures. Understanding this form is essential for businesses looking to maximize their tax benefits.

How to use the Form 3800, Fill in Version General Business Credit

Using Form 3800 involves several steps to ensure accurate completion and submission. First, businesses must gather necessary documentation related to the credits they are claiming. Next, they should carefully fill out the form, providing detailed information on each credit being claimed. After completing the form, it is vital to review it for accuracy before submission. This form can be filed electronically or mailed, depending on the preferences of the business and IRS guidelines.

Steps to complete the Form 3800, Fill in Version General Business Credit

Completing Form 3800 requires a systematic approach:

- Gather all relevant documentation and records related to the business credits.

- Access the latest version of Form 3800 from the IRS website or a trusted source.

- Fill in the business information, including the name, address, and Employer Identification Number (EIN).

- Identify and complete the sections corresponding to each credit being claimed.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for the credits claimed on Form 3800, businesses must meet specific eligibility criteria. Generally, these criteria include being a domestic business entity, having qualified expenses related to the credits, and complying with IRS regulations. Each credit may have unique requirements, so it is crucial for businesses to review the guidelines for each specific credit they intend to claim. Consulting with a tax professional can also help clarify eligibility and ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 3800 align with the overall tax filing deadlines for businesses. Typically, businesses must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For corporations, this means the deadline is usually April 15. However, if a business requires an extension, they may have additional time to file. It is essential to stay informed about any changes to deadlines to avoid penalties.

Required Documents

Businesses must prepare several documents to support their claims on Form 3800. Commonly required documents include:

- Records of qualified expenses related to the credits.

- Previous tax returns that may impact eligibility.

- Documentation proving the business's status as a domestic entity.

- Any additional forms that correspond to specific credits being claimed.

Having these documents ready will streamline the process of completing and filing the form.

Quick guide on how to complete form 3800 fill in version general business credit

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] easily

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and eSign [SKS] to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3800, Fill in Version General Business Credit

Create this form in 5 minutes!

How to create an eSignature for the form 3800 fill in version general business credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3800, Fill in Version General Business Credit?

The Form 3800, Fill in Version General Business Credit is a tax form used to claim various business credits at the federal level. This form consolidates multiple credits into a single document, streamlining the process for businesses to leverage the available tax benefits. With airSlate SignNow, you can easily fill out and eSign this form online for quick submissions.

-

How can airSlate SignNow help with Form 3800, Fill in Version General Business Credit?

airSlate SignNow enables users to efficiently fill in the Form 3800, Fill in Version General Business Credit with our intuitive interface. Our platform simplifies document editing and adding necessary signatures, ensuring that your submission is flawless. You can also store and manage your completed forms securely within our solution.

-

What are the pricing options for using airSlate SignNow when filling out Form 3800, Fill in Version General Business Credit?

airSlate SignNow offers various pricing tiers to cater to different business needs, from basic plans to premium options. Each plan allows businesses to access tools essential for filling out forms like Form 3800, Fill in Version General Business Credit while ensuring you stay within your budget. You can find detailed pricing information on our website.

-

What features does airSlate SignNow offer for filling out the Form 3800, Fill in Version General Business Credit?

Our platform includes features such as customizable templates, eSignature options, and document tracking, all designed to enhance your experience with the Form 3800, Fill in Version General Business Credit. Moreover, users can benefit from collaborative tools that allow multiple team members to work on the form simultaneously.

-

Are there any benefits to using airSlate SignNow for Form 3800, Fill in Version General Business Credit?

Yes, using airSlate SignNow for the Form 3800, Fill in Version General Business Credit offers several benefits, including time savings, improved accuracy, and enhanced security. Our digital solution minimizes paperwork, allowing you to focus on your business while ensuring that your tax forms are submitted correctly and on time.

-

Can I integrate airSlate SignNow with other applications for the Form 3800, Fill in Version General Business Credit?

Absolutely! airSlate SignNow integrates seamlessly with various applications and tools, facilitating a smoother workflow for the Form 3800, Fill in Version General Business Credit. Whether you need to connect with CRM systems or document repositories, our integrations allow you to manage your documents across platforms efficiently.

-

Is airSlate SignNow secure for filling out sensitive documents like Form 3800, Fill in Version General Business Credit?

Yes, airSlate SignNow prioritizes the security of your documents, including the Form 3800, Fill in Version General Business Credit. We implement robust encryption and compliance measures to ensure that all your data remains safe and confidential throughout the entire signing and filling process.

Get more for Form 3800, Fill in Version General Business Credit

- Cancer donation form 284632321

- Dtmb 1104 claim form

- General liability property damage claim form city of chicago cityofchicago

- Press release example non profit organization form

- 4211 ghmc act 1955 form

- Form 1a filing status and exemption connecticut workers compensation commission agency forms

- Self inspection checklist healy vr 201202 evr phase ii and 2 valleyair form

- Usda rd form 1980 41

Find out other Form 3800, Fill in Version General Business Credit

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure