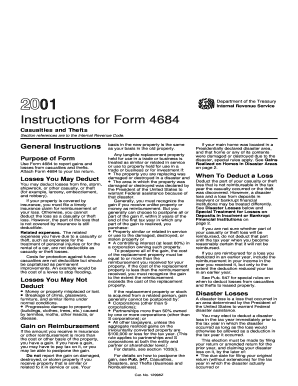

Instructions for Form 4684 Casualties and Thefts

Understanding Form 4684: Casualties and Thefts

Form 4684 is used to report casualties and thefts for tax purposes. This form allows taxpayers to claim a deduction for losses due to theft, fire, storm, or other casualties. It is essential for individuals and businesses to accurately report these losses to adjust their taxable income appropriately. The form requires detailed information about the loss, including the type of casualty, the date it occurred, and the fair market value of the property before and after the event.

Steps to Complete Form 4684

Completing Form 4684 involves several steps. First, gather all necessary documentation related to the casualty or theft, such as police reports, insurance claims, and photographs of the damaged property. Next, fill out the form by providing personal information, details of the loss, and calculations of the deductible amount. Ensure that you follow the instructions carefully to avoid errors. Finally, review the completed form for accuracy before submitting it with your tax return.

Required Documents for Form 4684

To complete Form 4684, certain documents are necessary. These include:

- Proof of ownership, such as receipts or titles.

- Documentation of the loss, including police reports for theft or insurance claims.

- Photographs of the damaged property.

- Records of the fair market value before and after the event.

Having these documents ready will streamline the process and help substantiate your claims.

IRS Guidelines for Form 4684

The IRS provides specific guidelines for filling out Form 4684. It is important to refer to the latest IRS publications for updates on eligibility criteria, deduction limits, and reporting requirements. The IRS outlines how to calculate losses and what types of losses qualify for deductions. Familiarizing yourself with these guidelines can help ensure compliance and maximize potential deductions.

Filing Deadlines for Form 4684

Form 4684 must be filed along with your annual tax return. Typically, the deadline for filing individual tax returns is April fifteenth of each year. However, if you are unable to file by this date, you may request an extension. It is crucial to be aware of these deadlines to avoid penalties and ensure that your deductions are processed in a timely manner.

Examples of Casualties and Thefts Reported on Form 4684

Common examples of losses reported on Form 4684 include:

- Damage to property due to natural disasters such as floods or hurricanes.

- Theft of personal belongings, such as electronics or jewelry.

- Destruction of property from fire or vandalism.

Understanding these examples can help taxpayers recognize qualifying events that may warrant a deduction.

Quick guide on how to complete instructions for form 4684 casualties and thefts

Complete Instructions For Form 4684 Casualties And Thefts effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Instructions For Form 4684 Casualties And Thefts on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Instructions For Form 4684 Casualties And Thefts with ease

- Find Instructions For Form 4684 Casualties And Thefts and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Instructions For Form 4684 Casualties And Thefts and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 4684 casualties and thefts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 4684 Casualties And Thefts?

The Instructions For Form 4684 Casualties And Thefts provide taxpayers with guidelines on how to report losses from casualties and thefts on their tax returns. They detail the necessary information needed, including how to calculate your losses and any potential deductions. Understanding these instructions is vital for accurate tax reporting.

-

How can airSlate SignNow help in managing documents related to Form 4684?

airSlate SignNow simplifies the process of managing documents related to Form 4684 by allowing users to securely send and eSign documents online. This ensures that all necessary paperwork is organized and easily accessible. Using airSlate SignNow can streamline the documentation process required for the Instructions For Form 4684 Casualties And Thefts.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and comprehensive document tracking. These features enhance your ability to manage important tax documents like the Instructions For Form 4684 Casualties And Thefts effortlessly. Additionally, integrations allow for seamless workflows with your existing financial software.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers different pricing plans to cater to various business needs. Each plan provides a range of features, ensuring you have the necessary tools to handle tax documents including the Instructions For Form 4684 Casualties And Thefts. You can choose the plan that best suits your volume of document handling.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! airSlate SignNow supports integrations with various applications including cloud storage solutions and accounting software. This capability allows you to easily access and manage documents related to the Instructions For Form 4684 Casualties And Thefts alongside your other essential business tools.

-

What are the benefits of using airSlate SignNow for filing taxes?

Using airSlate SignNow for filing taxes offers several benefits such as time savings, enhanced accuracy, and improved security. By simplifying the signing and submission process for documents like the Instructions For Form 4684 Casualties And Thefts, businesses can focus more on their operations rather than paperwork. Digital solutions also reduce the risk of loss or error associated with physical documents.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security with features such as data encryption, secure storage, and compliance with industry standards. This makes it a reliable solution for handling sensitive tax documents, including the Instructions For Form 4684 Casualties And Thefts. Users can confidently eSign and store vital information knowing that their data is protected.

Get more for Instructions For Form 4684 Casualties And Thefts

Find out other Instructions For Form 4684 Casualties And Thefts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors