Georgia Form St 3use 2018-2026

What is the Georgia Form ST-3use?

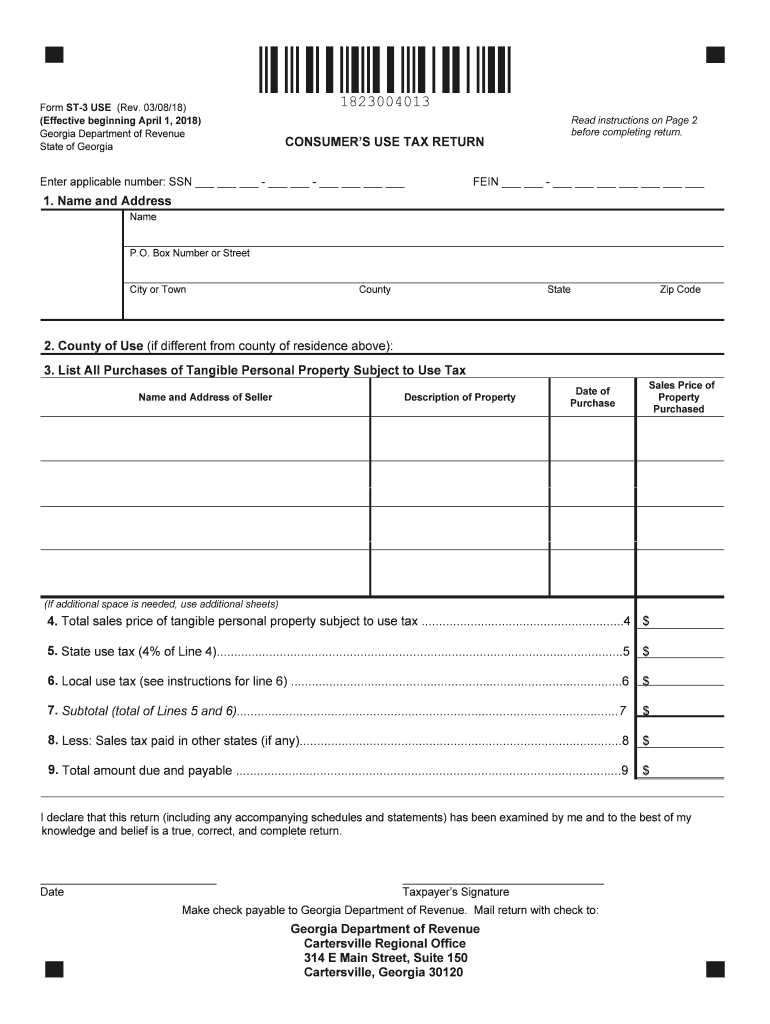

The Georgia Form ST-3use is a tax form used for reporting and paying use tax in the state of Georgia. This form is essential for individuals and businesses that purchase tangible personal property for use in Georgia but did not pay sales tax at the time of purchase. The ST-3use form ensures compliance with state tax regulations and helps maintain accurate tax records. It is particularly relevant for those who buy items from out-of-state vendors or online retailers where sales tax is not collected.

Steps to Complete the Georgia Form ST-3use

Completing the Georgia Form ST-3use involves several key steps:

- Gather necessary information, including details about the purchased items and their costs.

- Indicate the date of purchase and the name of the vendor from whom the items were acquired.

- Calculate the total use tax owed based on the purchase price of the items.

- Complete the form by filling in all required fields accurately.

- Review the form for any errors or omissions before submission.

Ensuring accuracy in these steps is crucial to avoid penalties and ensure compliance with Georgia tax laws.

How to Obtain the Georgia Form ST-3use

The Georgia Form ST-3use can be obtained through the Georgia Department of Revenue's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, some tax software may offer features to assist in completing this form electronically. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Key Elements of the Georgia Form ST-3use

Several key elements must be included when filling out the Georgia Form ST-3use:

- Purchaser Information: Name, address, and contact details of the individual or business completing the form.

- Vendor Information: Name and address of the vendor from whom the items were purchased.

- Description of Items: Clear descriptions of the tangible personal property acquired.

- Purchase Price: The total cost of items purchased, which will be used to calculate the use tax.

- Use Tax Calculation: The amount of use tax owed based on the purchase price and applicable tax rates.

Legal Use of the Georgia Form ST-3use

The legal use of the Georgia Form ST-3use is to report and remit use tax to the Georgia Department of Revenue. This form is legally required for individuals and businesses that owe use tax on purchases made without sales tax being collected. Failure to file this form or remit the appropriate tax can result in penalties and interest charges. It is important to understand the legal obligations associated with the use of this form to ensure compliance with state tax laws.

Form Submission Methods

The Georgia Form ST-3use can be submitted through various methods:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the Georgia Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Georgia Department of Revenue.

- In-Person: Taxpayers may also choose to submit the form in person at designated Georgia Department of Revenue offices.

Choosing the right submission method can help streamline the process and ensure timely compliance with tax obligations.

Quick guide on how to complete georgia form st 3use 2018 2019

Your assistance manual on how to prepare your Georgia Form St 3use

If you’re wondering how to create and submit your Georgia Form St 3use, here are some brief instructions on how to make tax reporting simpler.

To begin, you just need to register your airSlate SignNow profile to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax papers effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures and return to update information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to complete your Georgia Form St 3use in just minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to open your Georgia Form St 3use in our editor.

- Complete the necessary fillable sections with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized electronic signature (if required).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically using airSlate SignNow. Please keep in mind that submitting on paper may increase return errors and delay refunds. Before e-filing your taxes, make sure to check the IRS website for reporting requirements in your state.

Create this form in 5 minutes or less

Find and fill out the correct georgia form st 3use 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the georgia form st 3use 2018 2019

How to make an electronic signature for your Georgia Form St 3use 2018 2019 in the online mode

How to create an electronic signature for the Georgia Form St 3use 2018 2019 in Google Chrome

How to make an electronic signature for signing the Georgia Form St 3use 2018 2019 in Gmail

How to create an electronic signature for the Georgia Form St 3use 2018 2019 straight from your smartphone

How to create an electronic signature for the Georgia Form St 3use 2018 2019 on iOS devices

How to create an electronic signature for the Georgia Form St 3use 2018 2019 on Android OS

People also ask

-

What is ga st 3use and how does it benefit my business using airSlate SignNow?

Ga st 3use refers to the streamlined processes enabled by airSlate SignNow, allowing businesses to easily send and eSign documents. This helps reduce turnaround times for contracts and agreements, ultimately enhancing operational efficiency and customer satisfaction.

-

How does airSlate SignNow's pricing compare with competitors for ga st 3use?

AirSlate SignNow offers competitive pricing plans that are tailored for businesses of all sizes, ensuring that you can find a cost-effective solution for ga st 3use. With various tiers including a free trial, users can explore the features before committing to a paid plan, making it a smart choice for budget-conscious companies.

-

What features should I expect from airSlate SignNow for effective ga st 3use?

AirSlate SignNow provides a user-friendly interface, robust eSignature capabilities, customizable templates, and real-time tracking, all essential for effective ga st 3use. Additionally, features like document storage and advanced security ensure that your transactions remain secure and efficient.

-

Can I integrate other applications with airSlate SignNow for ga st 3use?

Yes, airSlate SignNow supports integration with a variety of third-party applications, enhancing the experience of ga st 3use. Integrate seamlessly with popular platforms like Google Drive, Salesforce, or Dropbox to streamline workflows and document management.

-

Is airSlate SignNow suitable for small businesses looking for ga st 3use?

Absolutely! AirSlate SignNow is designed to cater to the needs of small businesses seeking an effective solution for ga st 3use. The platform’s affordability and flexibility make it an ideal choice for organizations on a tight budget, without sacrificing features.

-

What security measures does airSlate SignNow implement for ga st 3use?

AirSlate SignNow prioritizes security with measures such as encryption, secure access controls, and compliance with industry regulations to ensure safe eSigning for ga st 3use. This allows businesses to confidently manage sensitive documents while maintaining legal compliance.

-

How can airSlate SignNow improve my document workflows for ga st 3use?

By utilizing airSlate SignNow for ga st 3use, businesses streamline their document workflows, enabling faster processing and reduced paperwork. The automated features, such as reminders and notifications, help ensure every step is tracked and completed efficiently.

Get more for Georgia Form St 3use

- Informed consent for minors examples

- Blank home visit documentation form

- Suu transcript request form

- Ex parte application to dismiss non felony traffic citations form

- Rkcl center list form

- Ab 0009 state of tennessee tn form

- Pdf myerssecrets to effective scheduling illinois state veterinary form

- Forex account management agreement template form

Find out other Georgia Form St 3use

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal