On Page 2 of Form SS 4, the Area Code for the Tele TIN Number at the IRS Service Center in Holtsville, NY is Incorrect

Understanding the Incorrect Area Code on Form SS-4

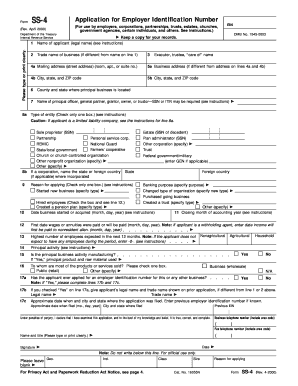

The issue regarding the incorrect area code for the Tele TIN number on page two of Form SS-4 pertains to the IRS Service Center located in Holtsville, NY. This form is essential for businesses and individuals applying for an Employer Identification Number (EIN). The Tele TIN number is a crucial part of this process, as it is used for verifying the identity of the applicant and ensuring that the application is processed correctly.

Steps to Address the Area Code Error on Form SS-4

If you encounter the incorrect area code on page two of Form SS-4, it is important to take the following steps:

- Verify the correct area code by checking the latest IRS guidelines or contacting the IRS directly.

- Update your Form SS-4 with the correct area code before submission.

- Consider using electronic filing options to reduce the risk of errors.

Legal Implications of the Incorrect Area Code

Using an incorrect area code on Form SS-4 can lead to delays in processing your application or even potential rejection. This could impact your ability to conduct business legally, as an EIN is often required for tax purposes and other regulatory compliance. It is essential to ensure that all information provided on the form is accurate and up to date.

Obtaining the Correct Information for Form SS-4

To obtain the correct area code for the Tele TIN number, applicants can refer to the IRS website or contact the IRS Service Center directly. It is advisable to check for updates regularly, as area codes and contact information may change. Keeping abreast of these changes can help ensure that your application is processed smoothly.

Examples of Correcting the Area Code on Form SS-4

When filling out Form SS-4, if you notice that the area code listed is incorrect, you can correct it by:

- Crossing out the incorrect area code and writing in the correct one clearly.

- Double-checking the updated area code against official IRS resources.

- Consulting with a tax professional if you are uncertain about the changes.

Filing Methods for Form SS-4

Form SS-4 can be submitted through various methods, including online, by mail, or in person. Each method has its own processing times and requirements. Electronic submission is often the fastest way to ensure your application is received and processed without errors, including those related to incorrect area codes.

IRS Guidelines for Completing Form SS-4

The IRS provides specific guidelines on how to complete Form SS-4 accurately. These guidelines include detailed instructions on each section of the form, including the Tele TIN number. It is crucial to follow these instructions closely to avoid mistakes that could lead to delays or complications in obtaining your EIN.

Quick guide on how to complete on page 2 of form ss 4 the area code for the tele tin number at the irs service center in holtsville ny is incorrect

Complete [SKS] seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to adjust and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Use the tools at your disposal to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] while ensuring superb communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect

Create this form in 5 minutes!

How to create an eSignature for the on page 2 of form ss 4 the area code for the tele tin number at the irs service center in holtsville ny is incorrect

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if I notice that On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect?

If you find that On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect, it's important to notify the IRS immediately to avoid any processing delays. You can contact them directly or submit a corrected form. Ensuring accurate information is crucial for smooth communication.

-

How does airSlate SignNow help in correcting form details like the TIN number?

airSlate SignNow allows you to easily edit and resend documents if any details, such as the TIN number, are incorrect. With its user-friendly interface, you can ensure that your forms are accurate before submission, which adds a layer of reliability to your documentation process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides various pricing plans to accommodate different business sizes and needs. Each plan is designed to offer exceptional value by including features that simplify the eSigning process while ensuring compliance with regulations, such as those pertaining to On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY.

-

Can airSlate SignNow integrate with other software to manage IRS forms?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM and project management tools. This integration helps streamline the workflow for handling IRS forms, including addressing issues like On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect.

-

What features does airSlate SignNow offer to enhance document security?

airSlate SignNow includes robust security features, such as end-to-end encryption and secure cloud storage, ensuring the confidentiality of your documents. This is especially important when dealing with sensitive information, like correcting entries for On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect.

-

How does airSlate SignNow support users in compliance with IRS regulations?

By using airSlate SignNow, users can ensure that their electronic signatures and documents meet IRS regulatory standards. This compliance is critical for forms like SS-4, where accuracy is essential, especially regarding entries such as On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect.

-

Is it easy to get started with airSlate SignNow for eSigning documents like Form SS 4?

Absolutely! airSlate SignNow is designed for ease of use, allowing you to get started quickly with minimal setup. You can upload documents such as Form SS 4 and electronically sign them within minutes, facilitating corrections like On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect.

Get more for On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect

- Printable court forms 400798337

- Club name sign in sheet date visited toastmasters form

- Suspicious transaction report template 267010695 form

- Mbs cmat online form

- Sonnet 65 pdf form

- Application form for allotment of guest accommodation rajya sabha

- Surgical clearance letter 37907445 form

- Addendum for coastal area property form

Find out other On Page 2 Of Form SS 4, The Area Code For The Tele TIN Number At The IRS Service Center In Holtsville, NY Is Incorrect

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF