Form W 4 Fill in Version Employee's Withholding Allowance Certificate

What is the Form W-4 Fill in Version Employee's Withholding Allowance Certificate

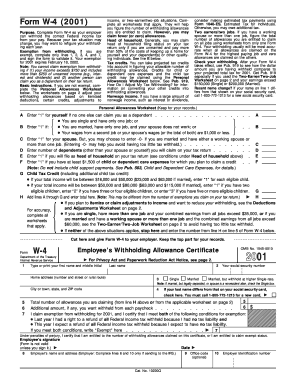

The Form W-4, officially known as the Employee's Withholding Allowance Certificate, is a crucial document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is withheld, helping employees avoid underpayment or overpayment of taxes throughout the year. The fill-in version allows for easy digital completion and submission, streamlining the process for both employees and employers.

Steps to Complete the Form W-4 Fill in Version Employee's Withholding Allowance Certificate

Completing the Form W-4 involves several key steps:

- Begin by entering your personal information, including your name, address, Social Security number, and filing status.

- Indicate the number of allowances you are claiming. This can affect the amount of tax withheld.

- Consider any additional amounts you want withheld from each paycheck, if applicable.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to your employer to ensure the correct withholding amount is applied to your paychecks.

How to Obtain the Form W-4 Fill in Version Employee's Withholding Allowance Certificate

The Form W-4 can be easily obtained from the Internal Revenue Service (IRS) website or directly from your employer. Many employers provide the form as part of their onboarding process for new hires. Additionally, the IRS offers a fillable PDF version on their website, which can be downloaded and completed digitally for convenience.

Key Elements of the Form W-4 Fill in Version Employee's Withholding Allowance Certificate

Several key elements are included in the Form W-4:

- Personal Information: This includes your name, address, and Social Security number.

- Filing Status: You must select your filing status, such as single, married, or head of household.

- Allowances: The number of allowances you claim will impact your withholding amount.

- Additional Withholding: You can specify any extra amount you wish to have withheld from your paycheck.

Legal Use of the Form W-4 Fill in Version Employee's Withholding Allowance Certificate

The Form W-4 is legally required for employees to accurately report their withholding preferences to their employers. Employers must use the information provided on the W-4 to calculate the appropriate federal income tax withholding. It is important to complete this form accurately and update it as necessary, especially after significant life changes such as marriage or the birth of a child.

IRS Guidelines

The IRS provides specific guidelines for completing the Form W-4. These guidelines include instructions on how to determine the number of allowances to claim based on your personal circumstances, as well as how to adjust your withholding if you expect to owe more tax or receive a refund at the end of the year. It is advisable to consult these guidelines to ensure compliance and accuracy in your tax withholding.

Quick guide on how to complete form w 4 fill in version employees withholding allowance certificate

Effortlessly Prepare [SKS] on Any Device

Digital document management is increasingly favored by both businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Alter and Electrically Sign [SKS] with Ease

- Obtain [SKS] and then select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and electronically sign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4 fill in version employees withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4 Fill in Version Employee's Withholding Allowance Certificate?

The Form W 4 Fill in Version Employee's Withholding Allowance Certificate is a document that employees use to inform their employers of their tax withholding preferences. It enables employees to specify the amount of federal income tax to be withheld from their paychecks, based on personal circumstances and allowances.

-

How can I fill out the Form W 4 Fill in Version Employee's Withholding Allowance Certificate using airSlate SignNow?

You can easily fill out the Form W 4 Fill in Version Employee's Withholding Allowance Certificate by accessing our intuitive platform. Simply upload the form, enter your information, and our user-friendly interface will guide you through the entire process, allowing for efficient completion and eSigning.

-

Is the Form W 4 Fill in Version Employee's Withholding Allowance Certificate available in different formats?

Yes, the Form W 4 Fill in Version Employee's Withholding Allowance Certificate can be downloaded and filled out in various formats, including PDF. airSlate SignNow ensures that you can save and send your form in the format that works best for your workflow.

-

What are the benefits of using airSlate SignNow for the Form W 4 Fill in Version Employee's Withholding Allowance Certificate?

Using airSlate SignNow for the Form W 4 Fill in Version Employee's Withholding Allowance Certificate offers several advantages, including easy document management, secure eSigning, and streamlined workflows. Our platform enhances efficiency, helps reduce errors, and ensures compliance with tax regulations.

-

Are there any costs associated with using airSlate SignNow for the Form W 4 Fill in Version Employee's Withholding Allowance Certificate?

airSlate SignNow offers flexible pricing plans that cater to different business needs. By signing up for a plan, you can gain access to unlimited eSigning and document management features, allowing you to efficiently use the Form W 4 Fill in Version Employee's Withholding Allowance Certificate without breaking your budget.

-

Can the Form W 4 Fill in Version Employee's Withholding Allowance Certificate be integrated with other applications?

Absolutely! airSlate SignNow supports several integrations with other applications, allowing you to streamline your document processes. This means you can easily connect the Form W 4 Fill in Version Employee's Withholding Allowance Certificate with your HR software or payroll systems for enhanced productivity.

-

How secure is the information when using airSlate SignNow for the Form W 4 Fill in Version Employee's Withholding Allowance Certificate?

Security is a top priority for airSlate SignNow. When you use the Form W 4 Fill in Version Employee's Withholding Allowance Certificate on our platform, all your data is encrypted, and we comply with industry standards to ensure that your personal and financial information remains safe and secure.

Get more for Form W 4 Fill in Version Employee's Withholding Allowance Certificate

- Complete the sentences with the correct form of the words in brackets

- Application for rental housing form

- Nigeria max international sign up form download

- Ieee copyright and consent form submission site

- Oak lawn garage sale permit form

- Yamaha cygnus 125 werkstatthandbuch pdf form

- Americorps timesheet fillable form

- Information form noc for dangerous goods caaf 015 atnr 1 0 124 29 236

Find out other Form W 4 Fill in Version Employee's Withholding Allowance Certificate

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple