Conventional Underwriting Submission Form First State 2019-2026

What is the Conventional Underwriting Submission Form First State

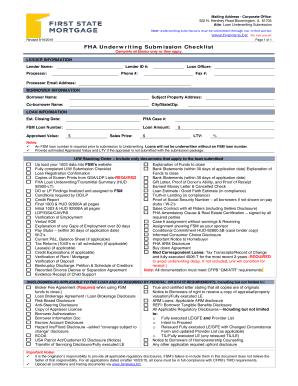

The Conventional Underwriting Submission Form First State is a critical document used in the mortgage underwriting process. This form collects essential information about the borrower and the property to assess the risk associated with the loan. It is specifically designed to facilitate the evaluation of conventional mortgage applications, ensuring that lenders have the necessary data to make informed decisions. The form typically includes sections for personal information, financial details, and property specifics, making it a comprehensive tool for both borrowers and lenders.

How to use the Conventional Underwriting Submission Form First State

Using the Conventional Underwriting Submission Form First State involves several straightforward steps. First, gather all required personal and financial information, including income statements, credit history, and property details. Next, carefully fill out each section of the form, ensuring accuracy to avoid delays in processing. Once completed, submit the form to your lender along with any supporting documents. It is crucial to review the form for completeness and correctness before submission, as errors can lead to complications in the underwriting process.

Key elements of the Conventional Underwriting Submission Form First State

Key elements of the Conventional Underwriting Submission Form First State include borrower identification, income verification, credit information, and property details. The borrower identification section captures personal data such as name, address, and Social Security number. Income verification requires documentation of employment and earnings, while the credit information section assesses the borrower’s creditworthiness. Property details encompass the address, type of property, and its estimated value, all of which are vital for the lender's risk assessment.

Steps to complete the Conventional Underwriting Submission Form First State

Completing the Conventional Underwriting Submission Form First State involves a series of methodical steps:

- Gather necessary documents, including proof of income, tax returns, and credit reports.

- Fill in personal information accurately, ensuring all names and addresses are correct.

- Provide detailed financial information, including assets and liabilities.

- Detail the property information, including its location and type.

- Review the entire form for accuracy and completeness before submission.

Required Documents

When submitting the Conventional Underwriting Submission Form First State, several documents are typically required to support the application. These documents may include:

- Recent pay stubs or proof of income.

- Tax returns for the last two years.

- Bank statements showing assets.

- Credit reports to assess creditworthiness.

- Property appraisal or purchase agreement.

Eligibility Criteria

Eligibility criteria for using the Conventional Underwriting Submission Form First State generally include factors such as credit score, income level, and debt-to-income ratio. Borrowers typically need a minimum credit score to qualify for conventional loans, along with sufficient income to support loan repayment. Additionally, the property must meet certain standards set by the lender, ensuring it is suitable for financing. Understanding these criteria can help borrowers prepare effectively for the underwriting process.

Quick guide on how to complete conventional underwriting submission form first state

Prepare Conventional Underwriting Submission Form First State effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Conventional Underwriting Submission Form First State on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Conventional Underwriting Submission Form First State with ease

- Find Conventional Underwriting Submission Form First State and then click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important portions of the documents or conceal sensitive details with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all information and then click on the Done button to finalize your edits.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Conventional Underwriting Submission Form First State and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct conventional underwriting submission form first state

Create this form in 5 minutes!

How to create an eSignature for the conventional underwriting submission form first state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Conventional Underwriting Submission Form First State?

The Conventional Underwriting Submission Form First State is a digital document designed to streamline the mortgage underwriting process. It allows lenders to gather essential borrower information efficiently, ensuring that all necessary data is submitted for underwriting review. By utilizing this form, financial institutions can reduce processing time and enhance accuracy in their submissions.

-

How can I access the Conventional Underwriting Submission Form First State?

You can easily access the Conventional Underwriting Submission Form First State through airSlate SignNow's platform. Simply log in to your account, navigate to the template library, and search for the form. Once found, you can customize and send it directly to your clients for electronic signing.

-

What are the costs associated with using the Conventional Underwriting Submission Form First State on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that allow you to use the Conventional Underwriting Submission Form First State affordably. Depending on your needs, you can choose from various subscription tiers that provide different features and usage levels. This ensures you only pay for what you need without any hidden costs.

-

What features does the Conventional Underwriting Submission Form First State offer?

The Conventional Underwriting Submission Form First State includes features such as customizable templates, electronic signatures, and automated workflows. These tools help reduce errors and accelerate the submission process. Additionally, the platform enables users to track document status and manage submissions securely.

-

What are the benefits of using the Conventional Underwriting Submission Form First State?

Using the Conventional Underwriting Submission Form First State enhances efficiency in the underwriting process by reducing paperwork and minimizing processing delays. With digital signatures integrated, this form provides a fast and secure way to obtain approvals. Ultimately, it improves customer satisfaction by speeding up mortgage transactions.

-

Can the Conventional Underwriting Submission Form First State integrate with other tools?

Yes, the Conventional Underwriting Submission Form First State on airSlate SignNow can easily integrate with various CRM and financial management tools. This integration streamlines the workflow by automatically importing borrower data and updating your database. It enables a more cohesive experience for your underwriting tasks.

-

How secure is the data submitted using the Conventional Underwriting Submission Form First State?

Data submitted via the Conventional Underwriting Submission Form First State is highly secure. airSlate SignNow employs advanced encryption and secure data transmission protocols to protect sensitive borrower information. You can confidently manage all your submissions without worrying about data bsignNowes.

Get more for Conventional Underwriting Submission Form First State

- F14104 fit to facc member flyer p1 accorg form

- Verizon wireless com form

- Wisconsin uniform building permit application

- Casm critical appraisal of systematic review or meta wvsha form

- Tc661 74903383 form

- Social security claim form ssa 1724 f4

- Supporting statement for form ssa 1372 bk and

- Laboratory service agreement template form

Find out other Conventional Underwriting Submission Form First State

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free