Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund 2023-2026

Understanding Form 943 X Rev February

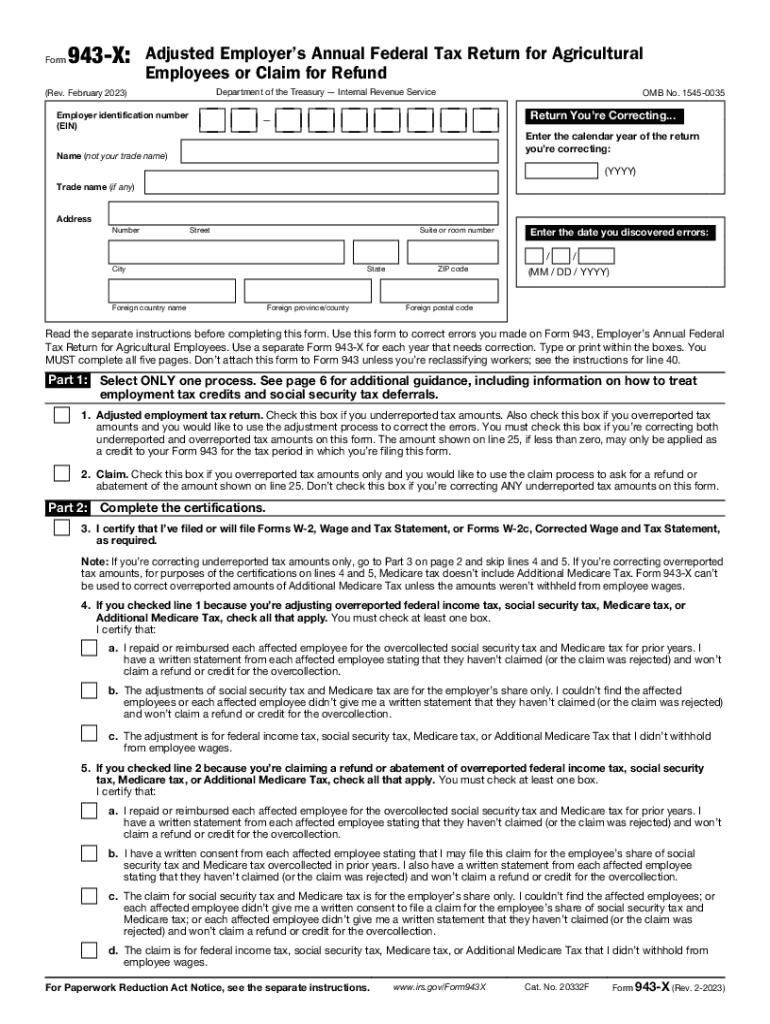

The Form 943 X Rev February is an important document used by agricultural employers in the United States. This form serves two primary purposes: it allows employers to adjust their annual federal tax return for agricultural employees and provides a mechanism to claim refunds for overpaid taxes. Understanding its significance is crucial for compliance with federal tax regulations, particularly for those in the agricultural sector.

Steps to Complete Form 943 X Rev February

Completing Form 943 X Rev February requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including previous tax returns and payroll records.

- Identify the specific adjustments needed on your original Form 943.

- Fill out the form accurately, ensuring all calculations are correct.

- Provide a clear explanation of the reasons for the adjustments in the designated section.

- Review the completed form for any errors or omissions before submission.

Legal Use of Form 943 X Rev February

The legal use of Form 943 X Rev February is essential for agricultural employers to ensure compliance with IRS regulations. This form must be filed when an employer needs to correct errors on their original Form 943, such as incorrect wages or tax amounts. Proper use of this form helps avoid potential penalties and ensures that employers are accurately reporting their tax obligations.

Obtaining Form 943 X Rev February

Form 943 X Rev February can be obtained through several channels. Employers can download the form directly from the IRS website or request a physical copy by contacting the IRS. It is important to ensure that the correct version of the form is used, as updates may occur periodically.

Filing Deadlines for Form 943 X Rev February

Timeliness is crucial when submitting Form 943 X Rev February. The form should be filed as soon as the need for adjustments is identified. Generally, the IRS allows for corrections to be made within three years of the original filing date. Staying aware of these deadlines helps avoid penalties and ensures compliance with federal tax laws.

Key Elements of Form 943 X Rev February

Several key elements are essential when filling out Form 943 X Rev February:

- Employer Information: Accurate details about the employer, including name, address, and employer identification number (EIN).

- Adjustment Details: Clear descriptions of the adjustments being made, including the specific tax periods affected.

- Signature: The form must be signed by an authorized individual to validate the submission.

Examples of Using Form 943 X Rev February

Employers may find themselves needing to use Form 943 X Rev February in various scenarios. For instance, if an employer discovers that they reported incorrect wages for an employee, they can file this form to adjust the reported amounts. Another example includes claiming a refund for overpaid taxes due to miscalculations in payroll tax withholdings. These examples illustrate the form's utility in maintaining accurate tax reporting.

Quick guide on how to complete form 943 x rev february adjusted employers annual federal tax return for agricultural employees or claim for refund

Complete Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund effortlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund without any hassle

- Obtain Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional hand-written signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Edit and eSign Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 943 x rev february adjusted employers annual federal tax return for agricultural employees or claim for refund

Create this form in 5 minutes!

How to create an eSignature for the form 943 x rev february adjusted employers annual federal tax return for agricultural employees or claim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow regarding the 943 x 12 service?

The pricing for airSlate SignNow is designed to be budget-friendly and cost-effective for businesses. For the 943 x 12 plan, you can expect flexible pricing options that cater to various organization sizes and needs. This allows you to maximize the value of document signing without breaking the bank.

-

What features are included in the 943 x 12 package?

The 943 x 12 package includes essential features such as document templates, in-person signing, and advanced security options. With airSlate SignNow, you can easily manage and track your documents, making it an efficient choice for businesses of all types. These features enhance your signing experience and streamline document workflows.

-

How does airSlate SignNow improve productivity through the 943 x 12 solution?

By using airSlate SignNow with the 943 x 12 solution, businesses can signNowly improve their productivity. The platform simplifies the document signing process, allowing teams to send, sign, and manage documents quickly and efficiently. This results in reduced turnaround times and increased collaboration among teams.

-

Are there any integrations available with the 943 x 12 option?

Yes, airSlate SignNow offers numerous integrations that enhance the functionality of the 943 x 12 option. You can easily connect with popular platforms like Google Drive, Salesforce, and Dropbox, allowing for seamless document management. These integrations help streamline your workflows and save time.

-

What industries benefit most from using airSlate SignNow's 943 x 12 plan?

The 943 x 12 plan is beneficial for various industries, including real estate, healthcare, and finance. Businesses in these sectors often require quick and efficient document signing solutions. airSlate SignNow meets these needs, allowing organizations to maintain compliance and improve operational efficiency.

-

Can I access airSlate SignNow on mobile devices with the 943 x 12 subscription?

Absolutely! The 943 x 12 subscription allows you to access airSlate SignNow on mobile devices. This means you can sign and manage documents on the go, making it a convenient option for busy professionals who need to stay connected and productive from anywhere.

-

What kind of customer support does airSlate SignNow provide for 943 x 12 users?

airSlate SignNow offers excellent customer support for users of the 943 x 12 plan. Our dedicated support team is available to assist you with any questions or issues you may encounter. With extensive resources, including tutorials and FAQs, we ensure that you make the most of your document signing experience.

Get more for Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund

Find out other Form 943 X Rev February Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word