943x 2012

What is the 943x

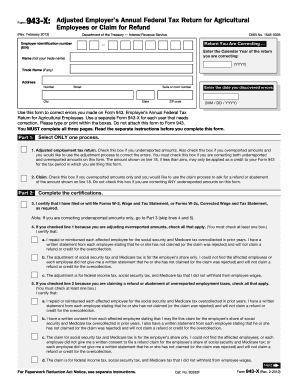

The 943x form is a crucial document used primarily for reporting adjustments related to the employment tax credits and liabilities of agricultural employers. This form allows businesses to correct previously submitted 943 forms, ensuring that any discrepancies in reported wages, taxes withheld, or credits claimed can be addressed accurately. Understanding the purpose of the 943x is essential for maintaining compliance with IRS regulations and ensuring that your tax records are accurate.

How to use the 943x

Using the 943x form involves a systematic approach to ensure that all necessary adjustments are made correctly. First, gather all relevant documentation, including the original 943 forms and any supporting payroll records. Next, carefully fill out the 943x form by providing the required information, including the employer's details, the period for which adjustments are being made, and the specific changes to wages or taxes. Once completed, review the form for accuracy before submitting it to the IRS.

Steps to complete the 943x

Completing the 943x form requires attention to detail. Follow these steps for successful submission:

- Obtain the latest version of the 943x form from the IRS website.

- Fill in your employer information, including your Employer Identification Number (EIN).

- Indicate the tax year and the specific adjustments being made.

- Provide accurate figures for wages, taxes withheld, and any credits being corrected.

- Sign and date the form to validate your submission.

Legal use of the 943x

The legal use of the 943x form is governed by IRS regulations, which stipulate that employers must file this form to correct errors on previously submitted 943 forms. To ensure that the adjustments are considered valid, it is essential to comply with all IRS guidelines and deadlines. The 943x form must be submitted in a timely manner to avoid penalties and ensure that your tax records reflect accurate information.

Filing Deadlines / Important Dates

Filing deadlines for the 943x form align with the standard deadlines for employment tax forms. Typically, the form should be filed as soon as discrepancies are identified, but it is essential to adhere to the IRS deadlines for the tax year in question. Keeping track of these dates helps prevent penalties and ensures compliance with federal tax regulations.

Required Documents

To complete the 943x form, you will need several supporting documents, including:

- The original 943 forms that need correction.

- Payroll records that support the adjustments being made.

- Any correspondence from the IRS regarding previous filings.

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in your submissions.

Quick guide on how to complete 943x

Prepare 943x effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle 943x on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign 943x with ease

- Locate 943x and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or missing documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign 943x and ensure outstanding communication at each stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 943x

Create this form in 5 minutes!

How to create an eSignature for the 943x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 943x and how does it benefit my business?

943x is a powerful feature within airSlate SignNow that streamlines document signing processes. By leveraging 943x, businesses can enhance productivity and reduce turnaround times. This tool allows users to send, sign, and manage documents efficiently, ensuring a smoother workflow.

-

How much does 943x cost for my business?

The pricing for 943x under airSlate SignNow is designed to be cost-effective and varies depending on the plan you choose. You can select from several subscription options that fit your business needs and budget. Each plan offers a range of features aimed at maximizing efficiency and collaboration.

-

What features are included in 943x?

943x includes a variety of essential features like customizable templates, real-time tracking, and extensive security options. You can easily manage multiple documents and get insights into the status of your agreements. With 943x, collaboration becomes seamless, enabling teams to work together effectively.

-

Can I integrate 943x with other software?

Yes, 943x integrates with numerous popular applications, enhancing its utility. You can connect it with CRM systems, cloud storage services, and other essential business tools. This integration capability allows for a unified workflow, making it easier to manage your documents and signatures across platforms.

-

Is 943x secure for my documents?

Absolutely, 943x prioritizes the security of your documents. It employs advanced encryption methods to protect sensitive information during transmission and storage. Additionally, airSlate SignNow complies with industry standards to ensure that your data remains safe and private.

-

How can 943x improve my document turnaround times?

Implementing 943x can signNowly decrease document turnaround times by automating the signing process. Features like reminders and notifications ensure that signers are prompted to act promptly. This efficiency leads to faster approvals and enhances overall productivity for your business.

-

Is it easy to use the 943x feature?

Yes, 943x is designed with user-friendliness in mind. The intuitive interface allows even non-technical users to navigate the platform easily. With straightforward tools for sending and signing documents, your team can quickly adapt and maximize the potential of 943x.

Get more for 943x

- Gridley farm labor housing form

- Ocean direct lets form

- Registration form 6 business names act ontario limited gsl

- Dean certification records check request form revelle college revelle ucsd

- Employee commencement form hr 2

- Non residents and income tax form

- The t5 statement of investment income tax form explained

- Dds 1273 form pdf

Find out other 943x

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now