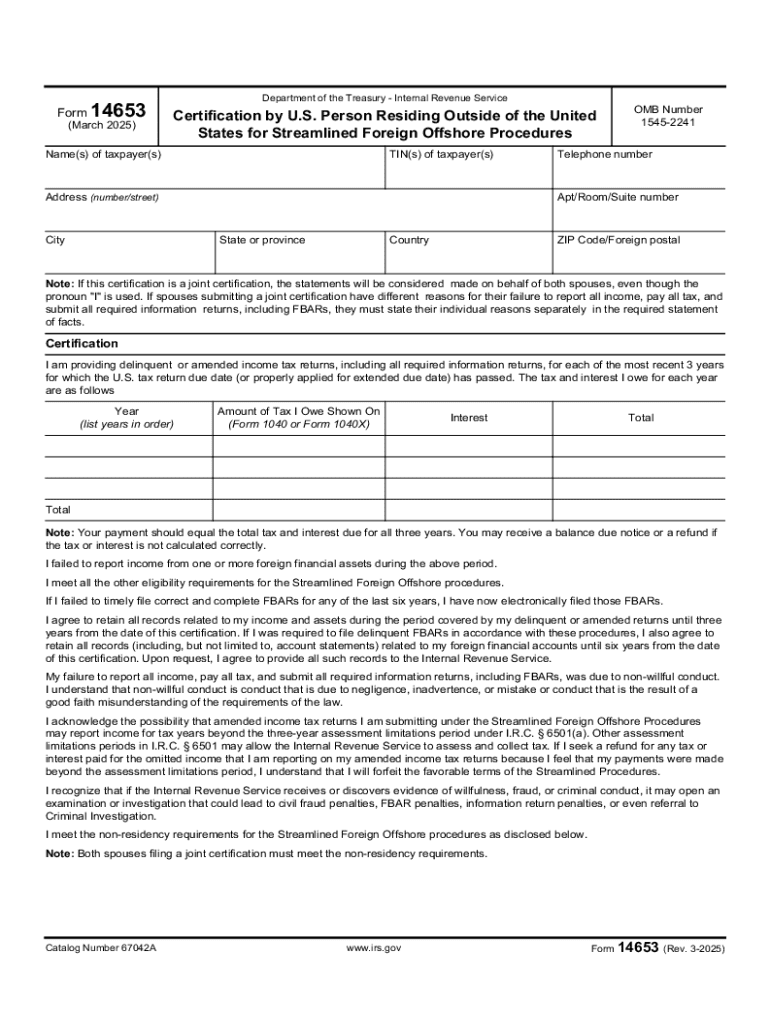

Form 14653 March Department of the Treasury 2025-2026

What is Form 14653?

Form 14653, issued by the Department of the Treasury, is primarily used for the purpose of reporting certain tax-related information. This form is particularly relevant for individuals who have specific tax obligations or are seeking to rectify their tax status with the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for compliance and ensuring accurate reporting of financial information.

Steps to Complete Form 14653

Completing Form 14653 involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including your Social Security number and any relevant tax documents. Next, carefully fill out each section of the form, ensuring that all information is correct and complete. Pay close attention to any specific instructions provided with the form, as these will guide you through the required details. Finally, review the form for any errors before submission to avoid delays or complications.

How to Obtain Form 14653

Form 14653 can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to comply with the latest regulations. Additionally, many tax software programs may provide access to this form, allowing for easier completion and submission.

Legal Use of Form 14653

The legal use of Form 14653 is essential for individuals who need to report specific tax information to the IRS. It serves as an official document that can impact your tax status and compliance with federal tax laws. Utilizing this form correctly can help avoid potential penalties and ensure that all tax obligations are met in accordance with U.S. law.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with Form 14653. Typically, forms must be submitted by specific dates to avoid penalties. Keeping track of these deadlines can help ensure timely compliance and prevent any issues with the IRS. Always check the IRS website for the most current deadlines related to this form.

Required Documents for Form 14653

When preparing to submit Form 14653, certain documents are required to support the information provided. This may include tax returns, proof of income, and any other relevant financial documents. Ensuring that all necessary documentation is included with your submission can help facilitate a smoother processing experience with the IRS.

Form Submission Methods

Form 14653 can be submitted through various methods, including online submission via the IRS e-file system, mailing a paper copy to the appropriate IRS address, or in-person submission at designated IRS offices. Each method has its own advantages, and choosing the right one can depend on your preferences and needs.

Handy tips for filling out Form 14653 March Department Of The Treasury online

Quick steps to complete and e-sign Form 14653 March Department Of The Treasury online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a HIPAA and GDPR compliant service for maximum efficiency. Use signNow to electronically sign and send out Form 14653 March Department Of The Treasury for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 14653 march department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the form 14653 march department of the treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14653 and how can airSlate SignNow help?

Form 14653 is a document used for specific tax purposes. With airSlate SignNow, you can easily fill out, sign, and send form 14653 electronically, streamlining your workflow and ensuring compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for form 14653?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your budget while ensuring you have the necessary features to manage form 14653 efficiently.

-

What features does airSlate SignNow offer for managing form 14653?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for form 14653. These tools help you manage your documents effectively and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for form 14653?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 14653 alongside your existing tools. This integration enhances productivity and ensures a smooth workflow across platforms.

-

What are the benefits of using airSlate SignNow for form 14653?

Using airSlate SignNow for form 14653 offers numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform simplifies the signing process, making it easier for you to focus on your core business activities.

-

How secure is airSlate SignNow when handling form 14653?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling form 14653, you can trust that your information is safe and secure throughout the signing process.

-

Can I track the status of my form 14653 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your form 14653 in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form 14653 March Department Of The Treasury

- Individual to individual with retained life estate form

- South carolina deed formsquit claim warranty and

- Control number sc 021 77 form

- Husband and wife to three individuals as joint form

- Control number sc 023 77 form

- Control number sc 023 78 form

- User agreement for paypal services send money pay online form

- Control number sc 024 78 form

Find out other Form 14653 March Department Of The Treasury

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release