Form 8872 Rev November Internal Revenue Service 2002

What is the Form 8872 Rev November Internal Revenue Service

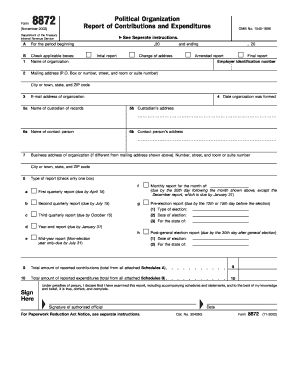

Form 8872, also known as the Political Organization Report of Contributions and Expenditures, is a document required by the Internal Revenue Service (IRS) for certain political organizations. This form is crucial for organizations that receive contributions and make expenditures in connection with federal elections. The form ensures transparency by requiring detailed reporting of financial activities, allowing the IRS and the public to monitor the financial dealings of these political entities.

How to use the Form 8872 Rev November Internal Revenue Service

To use Form 8872 effectively, organizations must first determine if they meet the criteria for filing. Eligible organizations include those that have received contributions or made expenditures exceeding a specified threshold. Once eligibility is confirmed, organizations should gather all required financial data, including details of contributions received and expenditures made. The completed form must then be submitted to the IRS by the designated deadlines to ensure compliance with federal regulations.

Steps to complete the Form 8872 Rev November Internal Revenue Service

Completing Form 8872 involves several key steps:

- Gather necessary information, including the organization's name, address, and Employer Identification Number (EIN).

- Compile a detailed list of contributions received, including the names of contributors and the amounts contributed.

- Document expenditures made by the organization, specifying the purpose and amount for each expense.

- Fill out the form accurately, ensuring all sections are completed, including any required schedules.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form electronically or by mail to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

Filing deadlines for Form 8872 are critical for compliance. Organizations must submit this form periodically, typically on a quarterly basis, depending on their financial activities. The specific due dates can vary based on the organization’s fiscal year and the timing of contributions and expenditures. It is essential to stay informed about these deadlines to avoid penalties and ensure timely reporting.

Penalties for Non-Compliance

Failure to file Form 8872 or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, incomplete information, or failure to comply with reporting requirements. Organizations should be aware of these potential penalties and take proactive steps to ensure compliance, as maintaining accurate records and timely filing can help avoid unnecessary financial repercussions.

Who Issues the Form

The Internal Revenue Service (IRS) is the official body that issues Form 8872. As a part of its regulatory responsibilities, the IRS provides guidelines and instructions for completing and submitting this form. Organizations must adhere to these regulations to maintain their tax-exempt status and ensure proper reporting of their financial activities.

Quick guide on how to complete form 8872 rev november internal revenue service

Effortlessly Prepare Form 8872 Rev November Internal Revenue Service on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 8872 Rev November Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Alter and eSign Form 8872 Rev November Internal Revenue Service with Ease

- Obtain Form 8872 Rev November Internal Revenue Service and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your delivery method for the form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new printed document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8872 Rev November Internal Revenue Service to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8872 rev november internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8872 rev november internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8872 Rev November from the Internal Revenue Service?

Form 8872 Rev November is a document required by the Internal Revenue Service for political organizations to report contributions and expenditures. Understanding this form is essential for compliance with federal regulations. Using airSlate SignNow helps streamline the process of completing and submitting Form 8872 Rev November, ensuring accuracy and efficiency.

-

How does airSlate SignNow assist with preparing Form 8872 Rev November?

airSlate SignNow offers a user-friendly interface that simplifies the completion of Form 8872 Rev November. With templates and guided workflows, users can fill out the form quickly and accurately. Additionally, eSigning features allow for seamless approvals, making the entire process hassle-free.

-

What are the pricing options for using airSlate SignNow to manage Form 8872 Rev November?

airSlate SignNow provides various pricing plans suitable for different business sizes and needs. Users can choose from monthly or annual subscriptions, which include features tailored for managing documents like Form 8872 Rev November. A free trial is also available for potential customers to evaluate the service before committing.

-

Can airSlate SignNow integrate with other software for handling Form 8872 Rev November?

Yes, airSlate SignNow offers integrations with widely used software including CRMs and document management systems. This allows users to seamlessly import data and manage Form 8872 Rev November alongside other business functions. Such integrations enhance the overall efficiency of filing and tracking compliance documentation.

-

What are the key benefits of using airSlate SignNow for Form 8872 Rev November?

Using airSlate SignNow for Form 8872 Rev November offers several benefits, such as increased efficiency, improved accuracy, and a secure eSigning process. It reduces the risk of errors while ensuring that your submissions meet IRS deadlines. The solution is also mobile-friendly, permitting users to work on-the-go without compromising compliance.

-

Is airSlate SignNow secure for submitting Form 8872 Rev November?

Absolutely! airSlate SignNow is designed with robust security measures to protect sensitive information submitted via Form 8872 Rev November. The platform employs encryption and complies with industry standards, ensuring your data remains confidential and secure throughout the submission process.

-

How does airSlate SignNow enhance collaboration for Form 8872 Rev November?

airSlate SignNow allows multiple stakeholders to collaborate seamlessly on Form 8872 Rev November. Users can share documents, collect inputs, and track changes in real-time within the platform. This collaborative approach streamlines the reviewing and eSigning phases, leading to faster completion of necessary filings.

Get more for Form 8872 Rev November Internal Revenue Service

Find out other Form 8872 Rev November Internal Revenue Service

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now