Form 8872 Rev October Political Organization Report of Contributions and Expenditures 2014-2026

Understanding IRS Form 8872: Political Organization Report of Contributions and Expenditures

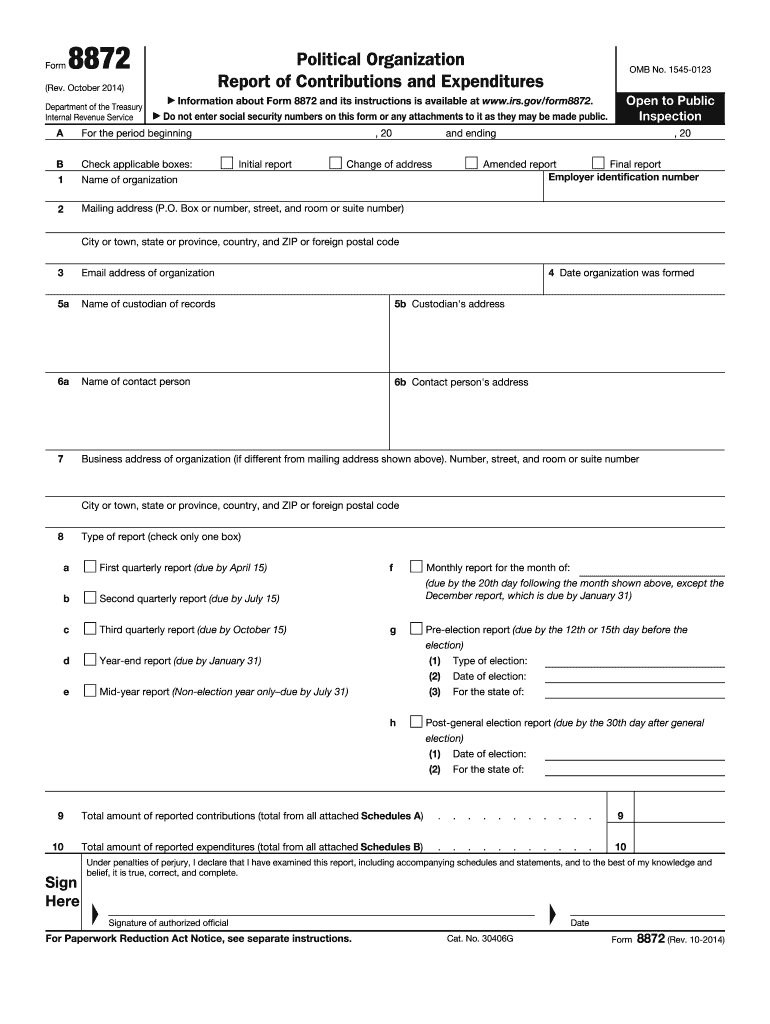

IRS Form 8872 is a crucial document for political organizations in the United States. This form, officially titled the Political Organization Report of Contributions and Expenditures, is designed to report the contributions received and expenditures made by political organizations. It is essential for ensuring transparency and compliance with federal election laws. Organizations must file this form to disclose their financial activities, which helps maintain public trust in the political process.

Steps to Complete IRS Form 8872

Completing IRS Form 8872 involves several key steps to ensure accurate reporting. First, gather all necessary financial records, including details of contributions received and expenditures made. Next, fill out the form by providing information about the organization, including its name, address, and Employer Identification Number (EIN). Report all contributions and expenditures in the designated sections, ensuring that amounts are accurate and properly categorized. Finally, review the completed form for any errors before submission.

Filing Deadlines for IRS Form 8872

Timely filing of IRS Form 8872 is critical for compliance. Political organizations must adhere to specific deadlines, which vary depending on the type of election cycle. Generally, the form should be filed within 24 hours of receiving contributions exceeding a certain threshold. Additionally, organizations must file periodic reports throughout the election cycle to maintain transparency. It is advisable to check the IRS website for the most current deadlines and requirements to avoid penalties.

Legal Use of IRS Form 8872

The legal use of IRS Form 8872 is governed by federal election laws. Political organizations are required to file this form to report their financial activities accurately. Failure to comply with these regulations can result in significant penalties, including fines and loss of tax-exempt status. Organizations must ensure that they understand the legal implications of their reporting obligations and maintain thorough records to support their filings.

Obtaining IRS Form 8872

IRS Form 8872 can be obtained directly from the IRS website. The form is available for download in PDF format, allowing organizations to print and fill it out manually. Additionally, many tax preparation software programs may include the form for electronic filing. It is important to ensure that the most current version of the form is used, as updates may occur periodically.

Key Elements of IRS Form 8872

Several key elements must be included in IRS Form 8872 to ensure compliance. These include the organization’s identification information, a detailed account of contributions received, and a comprehensive list of expenditures made. Furthermore, organizations must disclose any contributions from foreign entities, as these are prohibited under U.S. law. Accurate and complete reporting of these elements is essential for maintaining transparency and adhering to legal requirements.

Quick guide on how to complete form 8872 rev october political organization report of contributions and expenditures

Prepare Form 8872 Rev October Political Organization Report Of Contributions And Expenditures effortlessly on any device

Digital document management has gained increased traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Form 8872 Rev October Political Organization Report Of Contributions And Expenditures on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Form 8872 Rev October Political Organization Report Of Contributions And Expenditures effortlessly

- Obtain Form 8872 Rev October Political Organization Report Of Contributions And Expenditures and then click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate issues of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 8872 Rev October Political Organization Report Of Contributions And Expenditures and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8872 rev october political organization report of contributions and expenditures

Create this form in 5 minutes!

How to create an eSignature for the form 8872 rev october political organization report of contributions and expenditures

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8872?

IRS Form 8872 is used to report contributions and expenditures of political organizations. This form is crucial for compliance with federal regulations and ensures transparency in political funding. Understanding how to properly fill out and submit IRS Form 8872 is essential for any political group seeking to meet legal obligations.

-

How can airSlate SignNow help with IRS Form 8872?

airSlate SignNow provides a seamless platform to electronically sign and submit IRS Form 8872. Our solution simplifies the process for political organizations, allowing for quick and secure document management. With airSlate SignNow, you can ensure your IRS Form 8872 is filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for IRS Form 8872?

airSlate SignNow offers flexible pricing plans to meet the needs of organizations filing IRS Form 8872. Whether you are a small political group or a large campaign, our cost-effective solutions provide value without compromising features. Explore our pricing page for various options and select the one that suits you best.

-

What features does airSlate SignNow offer for filing IRS Form 8872?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking to streamline the filing of IRS Form 8872. Additionally, our platform supports secure electronic signatures, ensuring your documents are validated and legally compliant. These features save time and reduce errors in the submission process.

-

Can airSlate SignNow integrate with other tools for managing IRS Form 8872?

Yes, airSlate SignNow offers integrations with popular tools and platforms to enhance your document management for IRS Form 8872. Integrate with your CRM or project management software for seamless workflows. This capability allows for easier access to necessary information and documentation when filling out IRS Form 8872.

-

What are the benefits of using airSlate SignNow for IRS Form 8872?

Using airSlate SignNow to manage IRS Form 8872 offers many benefits, including user-friendly navigation and time-saving features. With secure electronic signatures, you reduce the hassle of physical paperwork and ensure your submissions are more efficient. Additionally, our compliance tools help you avoid common pitfalls associated with IRS Form 8872 submissions.

-

Is airSlate SignNow compliant with IRS regulations for Form 8872?

Yes, airSlate SignNow is designed to meet the compliance standards set forth by the IRS for Form 8872. Our platform ensures that all electronic signatures and submissions adhere to necessary legal requirements. With airSlate SignNow, you can confidently file IRS Form 8872 knowing that you are within federal guidelines.

Get more for Form 8872 Rev October Political Organization Report Of Contributions And Expenditures

- Media consent form 36486219

- Loan verification certificate form

- Summary card north carolina board of law examiners ncble form

- Doh 4353 form

- Cgi date name answer id 0941485 cause and effect match the cause with its effect form

- N 400 form

- Minnesota death record application certified death form

- What is quality assuranceqa process methods examples guru99 form

Find out other Form 8872 Rev October Political Organization Report Of Contributions And Expenditures

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now