Application E File 2003-2026

What is the eFin Application?

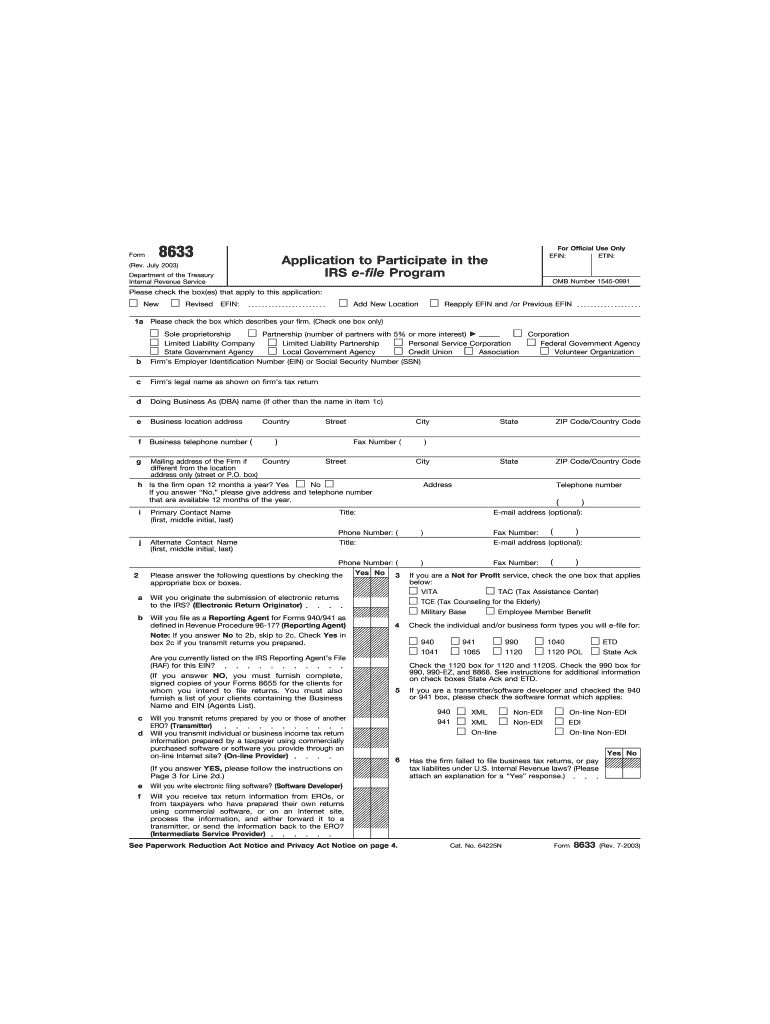

The eFin application is a crucial component for tax professionals seeking to electronically file tax returns on behalf of clients. This application allows tax preparers to obtain an Electronic Filing Identification Number (eFin) from the IRS, which is necessary for submitting tax returns electronically. The eFin serves as a unique identifier for tax professionals, ensuring that their submissions are processed efficiently and securely.

Steps to Complete the eFin Application

Completing the eFin application involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your business structure, tax identification number, and personal identification details. Next, access the IRS eFin application online portal. Fill out the application form carefully, ensuring that all required fields are completed. After submitting the application, monitor your email for any correspondence from the IRS regarding your application status. It is essential to respond promptly to any requests for additional information to avoid delays.

Required Documents for the eFin Application

When applying for an eFin, specific documents must be submitted to verify your identity and business legitimacy. These typically include:

- Your Social Security Number or Employer Identification Number (EIN).

- Proof of your business structure, such as articles of incorporation or a partnership agreement.

- Identification documents, such as a driver's license or passport.

- Any relevant certifications or licenses required by your state.

Having these documents prepared in advance can streamline the application process and help ensure compliance with IRS requirements.

IRS Guidelines for the eFin Application

The IRS has established specific guidelines that govern the eFin application process. It is important to adhere to these guidelines to ensure your application is processed without issues. Applicants must be authorized tax preparers and must complete a suitability check, which includes a background check. Additionally, the IRS requires that all applicants maintain a valid Preparer Tax Identification Number (PTIN). Familiarizing yourself with these guidelines can help prevent common pitfalls during the application process.

Application Process & Approval Time

The application process for obtaining an eFin can vary in duration based on several factors. Generally, after submitting your application, you can expect to receive a response from the IRS within four to six weeks. However, this timeline can be affected by the volume of applications being processed or if additional information is required from you. To facilitate a smoother approval process, ensure that all information is accurate and complete before submission.

Legal Use of the eFin Application

Utilizing the eFin application legally is essential for maintaining compliance with IRS regulations. Tax professionals must use their eFin solely for the purpose of electronically filing tax returns. Misuse of the eFin, such as filing fraudulent returns or sharing it with unauthorized individuals, can result in severe penalties, including revocation of the eFin and legal repercussions. Understanding the legal obligations associated with the eFin is critical for all tax preparers.

Quick guide on how to complete form 8633 application online

Discover the simplest method to complete and endorse your Application E File

Are you still spending time preparing your official documents on printed forms instead of taking care of them online? airSlate SignNow presents a superior approach to complete and endorse your Application E File and associated forms for public services. Our advanced eSignature tool provides you with everything necessary to manage documents swiftly while complying with official standards - robust PDF editing, organizing, securing, signing, and sharing features are all accessible within an intuitive interface.

Only a few steps are needed to finish filling out and signing your Application E File:

- Upload the editable template to the editor using the Get Form button.

- Verify the information you need to include in your Application E File.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Conceal sections that are no longer relevant.

- Select Sign to create a legally binding eSignature using your preferred method.

- Input the Date next to your signature and finalize your work with the Done button.

Store your completed Application E File in the Documents directory within your profile, download it, or export it to your chosen cloud storage. Our solution also offers adaptable file sharing. There's no need to print your forms when you have to submit them to the relevant public office - do it via email, fax, or by requesting a USPS "snail mail" delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill out the application for a Schengen visa?

Dear Rick,A Schengen visa application form requires the information about your passport, intended dates and duration of visit, sponsor’s or inviting person's details, previous schengen visa history etc. If you have these details with you, it is very easy to fill out the visa application.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How can I fill out the online application form of JVM Shyamli Ranchi?

Go to Jawahar Vidiya Mandir website

-

How should I fill out an online application form for the KVPY exam?

KVPY Registration 2018 is starting from 11th July 2018. Indian Institute of Science (IISC), Bangalore conducts a national level scholarship programme.How to Fill KVPY Application FormVisit the official and register as a new user by mentioning Name, date of birth, stream, nationality etc.Enter the captcha and click on submit.Enter your basic details such as Name, Date of Birth, Age, E-mail id, the Mobile number for registration, etc. Also select from the drop down menu your class, gender, category & nationality.Now click on the ‘Submit’ tab.

-

How can I fill out a Schengen visa application form online?

you can fill out online.no all embassy ask for online form filling, most of the embassy is asking for filled application, hand writteni gave a written application for swiss embassy and online application for France embassyonline application can be found in respective embassy sites.

Create this form in 5 minutes!

How to create an eSignature for the form 8633 application online

How to generate an electronic signature for the Form 8633 Application Online online

How to create an eSignature for your Form 8633 Application Online in Chrome

How to make an eSignature for signing the Form 8633 Application Online in Gmail

How to create an eSignature for the Form 8633 Application Online from your smart phone

How to create an electronic signature for the Form 8633 Application Online on iOS devices

How to make an electronic signature for the Form 8633 Application Online on Android devices

People also ask

-

What is the Application E File in airSlate SignNow?

The Application E File is a powerful feature of airSlate SignNow that allows users to electronically file and sign documents efficiently. This feature streamlines the signing process, enabling businesses to manage their documentation with ease and speed.

-

How much does the Application E File cost in airSlate SignNow?

airSlate SignNow offers competitive pricing for its Application E File feature, with various subscription plans to fit different business needs. You can choose a plan that provides access to all essential features, including eSigning and document management, at an affordable rate.

-

What are the key features of the Application E File?

The Application E File includes features such as customizable templates, bulk sending, and real-time tracking of document status. These functionalities enhance user experience and ensure that documents are signed promptly and securely.

-

How can the Application E File benefit my business?

By using the Application E File, businesses can signNowly reduce the time spent on document management and signing processes. This efficiency not only saves time but also improves workflow and productivity, allowing teams to focus on more critical tasks.

-

Can I integrate the Application E File with other software?

Yes, the Application E File in airSlate SignNow can be easily integrated with numerous third-party applications like CRM systems, cloud storage, and project management tools. This flexibility allows for seamless data transfer and enhanced operational efficiency.

-

Is the Application E File secure for sensitive documents?

Absolutely! The Application E File employs industry-leading security measures, including encryption and secure cloud storage, to protect sensitive documents. Your data is safe with airSlate SignNow, ensuring compliance with regulatory standards.

-

How do I get started with the Application E File?

Getting started with the Application E File is simple. You can sign up for a trial on the airSlate SignNow website, explore the features, and start eSigning documents within minutes. Our user-friendly interface makes it easy for anyone to begin.

Get more for Application E File

Find out other Application E File

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation