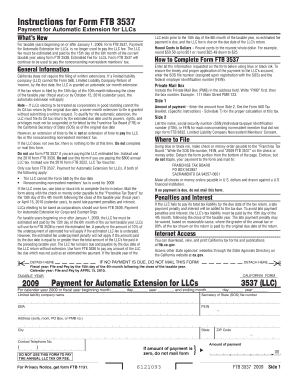

Form 3537 California Franchise Tax Board

What is the Form 3537 California Franchise Tax Board

The Form 3537 is a document issued by the California Franchise Tax Board (FTB) specifically designed for businesses that need to report and pay their estimated tax. This form is essential for corporations, limited liability companies (LLCs), and other business entities operating in California. It allows taxpayers to calculate their estimated tax liability for the year and submit payments accordingly. Understanding the purpose and requirements of Form 3537 is crucial for compliance with California tax laws.

How to use the Form 3537 California Franchise Tax Board

Using Form 3537 involves several steps. First, businesses must gather their financial information, including income estimates and deductions. Next, they need to fill out the form accurately, ensuring that all calculations are correct. Once completed, the form can be submitted along with the estimated tax payment. It is important to keep a copy of the form for your records. Businesses should also be aware of the deadlines associated with this form to avoid penalties.

Steps to complete the Form 3537 California Franchise Tax Board

Completing Form 3537 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and previous tax returns.

- Estimate your total income for the year, taking into account any expected changes.

- Calculate your estimated tax liability based on current tax rates and applicable deductions.

- Fill out the form clearly, ensuring all sections are completed accurately.

- Review the form for any errors before submission.

- Submit the form along with your estimated tax payment by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for Form 3537 are critical for compliance. Typically, estimated tax payments are due quarterly, with specific dates set by the California Franchise Tax Board. It is essential for businesses to mark these dates on their calendars to ensure timely submission. Missing a deadline can result in penalties and interest on unpaid taxes. Staying informed about these important dates helps businesses manage their tax obligations effectively.

Required Documents

To complete Form 3537, certain documents are necessary. These include:

- Previous year’s tax return for reference.

- Current year income estimates.

- Documentation of any deductions or credits you plan to claim.

- Records of any previous estimated tax payments made during the year.

Having these documents on hand will streamline the process and help ensure accuracy in your calculations.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 3537 can lead to significant penalties. Businesses that do not submit their estimated tax payments on time may incur late fees and interest charges. Additionally, underreporting income or miscalculating tax liabilities can result in further penalties. Understanding these risks emphasizes the importance of timely and accurate filing to avoid unnecessary financial repercussions.

Quick guide on how to complete form 3537 california franchise tax board

Achieve [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from your preferred device. Edit and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3537 California Franchise Tax Board

Create this form in 5 minutes!

How to create an eSignature for the form 3537 california franchise tax board

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3537 for the California Franchise Tax Board?

Form 3537 is a tax payment form used by businesses in California to make estimated payments to the California Franchise Tax Board. This form is essential for ensuring that your franchise tax obligations are met timely, helping you avoid potential penalties.

-

How can airSlate SignNow help with Form 3537 submissions?

airSlate SignNow streamlines the process of completing and submitting Form 3537 to the California Franchise Tax Board. Our platform allows users to eSign and send documents securely and efficiently, reducing the time spent on tax payment submissions.

-

Is there a cost associated with using airSlate SignNow for Form 3537?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans provide access to features that enable smooth processing of Form 3537 and other important documents according to your budget.

-

What features does airSlate SignNow offer for managing Form 3537?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning capabilities for managing Form 3537. These tools ensure that users can complete their tax-related work quickly and accurately.

-

Are there any benefits to using airSlate SignNow for Form 3537?

Using airSlate SignNow for Form 3537 simplifies the document handling process, providing a more efficient way to manage tax submissions. The platform enhances productivity and ensures compliance with the California Franchise Tax Board's requirements.

-

Can airSlate SignNow integrate with other systems for Form 3537 processing?

Yes, airSlate SignNow offers integrations with various applications and systems, enabling seamless processing of Form 3537 alongside your existing workflows. This connectivity helps you maintain a comprehensive approach to tax management.

-

How secure is using airSlate SignNow for submitting Form 3537?

airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect your documents, including Form 3537. You can confidently manage your tax submissions knowing that your data is safeguarded.

Get more for Form 3537 California Franchise Tax Board

- Po4 application form

- Cat 102 session 4 abraham worksheets kino institute kinoinstitute form

- Missouri department of revenue form mo 1040 individual income tax return long form for calendar year jan dor mo

- Ferpa form for students lenoir rhyne college

- Employee idea amp suggestion form

- L 49 liquor license form

- Pre k registration form

- Director general colleges sindh form

Find out other Form 3537 California Franchise Tax Board

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors