TAXPAYER INFORMATION UPDATE FORM

What is the TAXPAYER INFORMATION UPDATE FORM

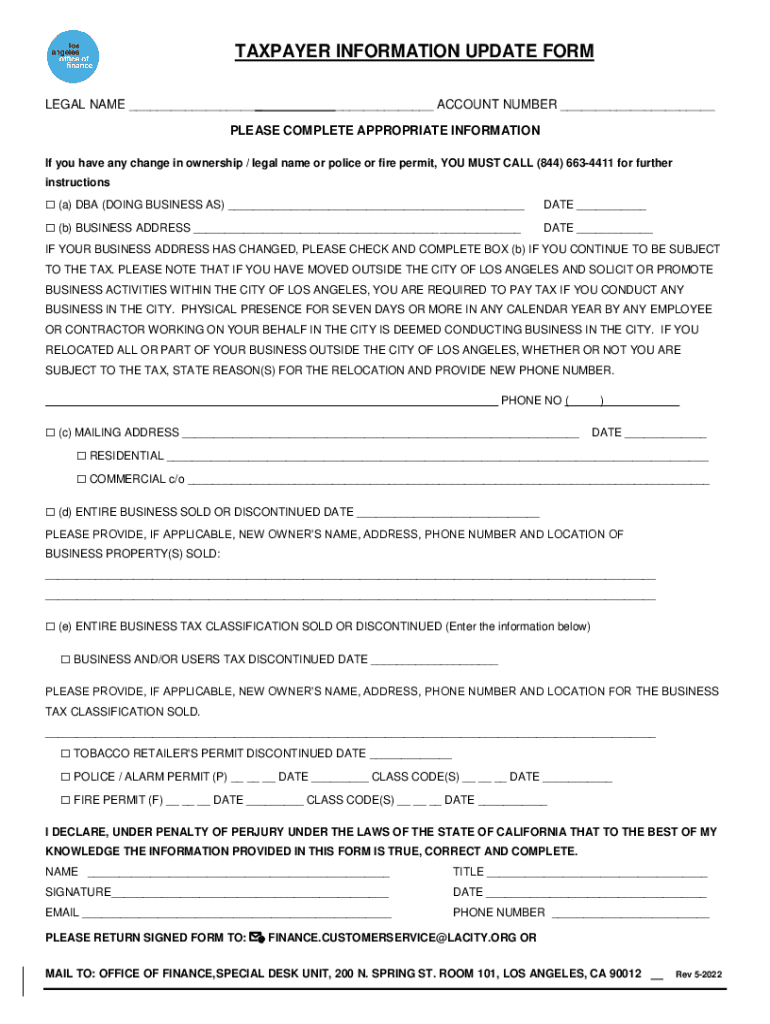

The TAXPAYER INFORMATION UPDATE FORM is a crucial document used by individuals and businesses to communicate changes in taxpayer information to the Internal Revenue Service (IRS). This form is essential for ensuring that the IRS has the most accurate and current information regarding a taxpayer's identity, address, and other relevant details. Keeping this information up to date helps prevent issues with tax filings and ensures that taxpayers receive important communications from the IRS in a timely manner.

How to use the TAXPAYER INFORMATION UPDATE FORM

Using the TAXPAYER INFORMATION UPDATE FORM involves several straightforward steps. First, obtain the form from the IRS website or through authorized tax professionals. Next, fill out the required fields, ensuring that all information is accurate and complete. After completing the form, review it carefully to avoid any errors. Finally, submit the form according to IRS guidelines, which may include mailing it to a specific address or submitting it electronically, depending on the instructions provided.

Key elements of the TAXPAYER INFORMATION UPDATE FORM

The TAXPAYER INFORMATION UPDATE FORM includes several key elements that must be filled out correctly. These typically include:

- Taxpayer's name

- Taxpayer identification number (such as Social Security Number or Employer Identification Number)

- Current address

- New address (if applicable)

- Signature of the taxpayer or authorized representative

- Date of submission

Each of these elements is vital for the IRS to process the update efficiently and accurately.

Steps to complete the TAXPAYER INFORMATION UPDATE FORM

Completing the TAXPAYER INFORMATION UPDATE FORM involves the following steps:

- Download the form from the IRS website or obtain it from a tax professional.

- Fill in your personal information, including your name, taxpayer identification number, and current address.

- If your address has changed, provide the new address in the designated section.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form to validate your submission.

- Submit the form as directed by the IRS, either electronically or by mail.

Form Submission Methods

The TAXPAYER INFORMATION UPDATE FORM can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines set by the IRS. Common submission methods include:

- Online submission through the IRS e-file system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, where available.

Choosing the appropriate submission method can help ensure timely processing of the form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the TAXPAYER INFORMATION UPDATE FORM. It is important to follow these guidelines to avoid delays or rejections. Key points include:

- Ensure that all information is accurate and up to date.

- Submit the form promptly after any changes occur.

- Keep a copy of the submitted form for your records.

- Check the IRS website for any updates or changes to submission procedures.

Adhering to these guidelines helps maintain compliance with IRS regulations.

Quick guide on how to complete taxpayer information update form 645094344

Set Up TAXPAYER INFORMATION UPDATE FORM Seamlessly on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage TAXPAYER INFORMATION UPDATE FORM across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to Modify and Electronically Sign TAXPAYER INFORMATION UPDATE FORM with Ease

- Obtain TAXPAYER INFORMATION UPDATE FORM and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your selection. Modify and electronically sign TAXPAYER INFORMATION UPDATE FORM and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer information update form 645094344

Create this form in 5 minutes!

How to create an eSignature for the taxpayer information update form 645094344

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAXPAYER INFORMATION UPDATE FORM?

The TAXPAYER INFORMATION UPDATE FORM is a crucial document that allows individuals to update their tax-related information efficiently. By using our platform, businesses can easily create, send, and eSign this form, ensuring that all necessary updates are made quickly and accurately.

-

How does the TAXPAYER INFORMATION UPDATE FORM simplify the tax update process?

The TAXPAYER INFORMATION UPDATE FORM simplifies tax updates by providing a streamlined digital process. Users can fill out, eSign, and submit the form online, which eliminates the need for physical paperwork and speeds up processing times for tax updates.

-

Is the TAXPAYER INFORMATION UPDATE FORM compliant with tax regulations?

Yes, the TAXPAYER INFORMATION UPDATE FORM created through airSlate SignNow is designed to comply with all relevant tax regulations. This ensures that the submitted information adheres to legal standards, protecting both the taxpayer and the business.

-

What are the pricing options for using the TAXPAYER INFORMATION UPDATE FORM on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs when using the TAXPAYER INFORMATION UPDATE FORM. You can choose from individual plans, team packages, or enterprise solutions, all designed to be cost-effective while providing essential features to enhance your workflow.

-

Can I integrate the TAXPAYER INFORMATION UPDATE FORM with other software solutions?

Absolutely! The TAXPAYER INFORMATION UPDATE FORM can be seamlessly integrated with several leading software solutions such as CRM, ERP, and cloud storage platforms. This integration allows for improved data management and better workflow efficiency across your business operations.

-

What features does airSlate SignNow offer for the TAXPAYER INFORMATION UPDATE FORM?

airSlate SignNow provides a variety of features for the TAXPAYER INFORMATION UPDATE FORM, including customizable templates, real-time tracking, and secure storage of documents. These features enhance the efficiency and security of handling sensitive tax information.

-

How does using the TAXPAYER INFORMATION UPDATE FORM benefit businesses?

Using the TAXPAYER INFORMATION UPDATE FORM can signNowly benefit businesses by reducing the time and complexity associated with tax updates. The electronic signing process is not only faster but also ensures higher accuracy, which minimizes the chances of errors in critical documentation.

Get more for TAXPAYER INFORMATION UPDATE FORM

- Retail mail order form thermo gel australia

- Queensland garaging address statement queensland garaging address statement form

- Instructions for preparation of financial statements for bank form

- Stronglink warranty application form stronglink warranty application form

- How to fill in a form f50 discontinuance mjt law youtube

- Hpcsa form 27

- Sweepstakes donor club application form

- Sgpi licensingdepartment of public safety form

Find out other TAXPAYER INFORMATION UPDATE FORM

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate