Membership Application Internal Revenue Service Irs Form

What is the Membership Application Internal Revenue Service Irs

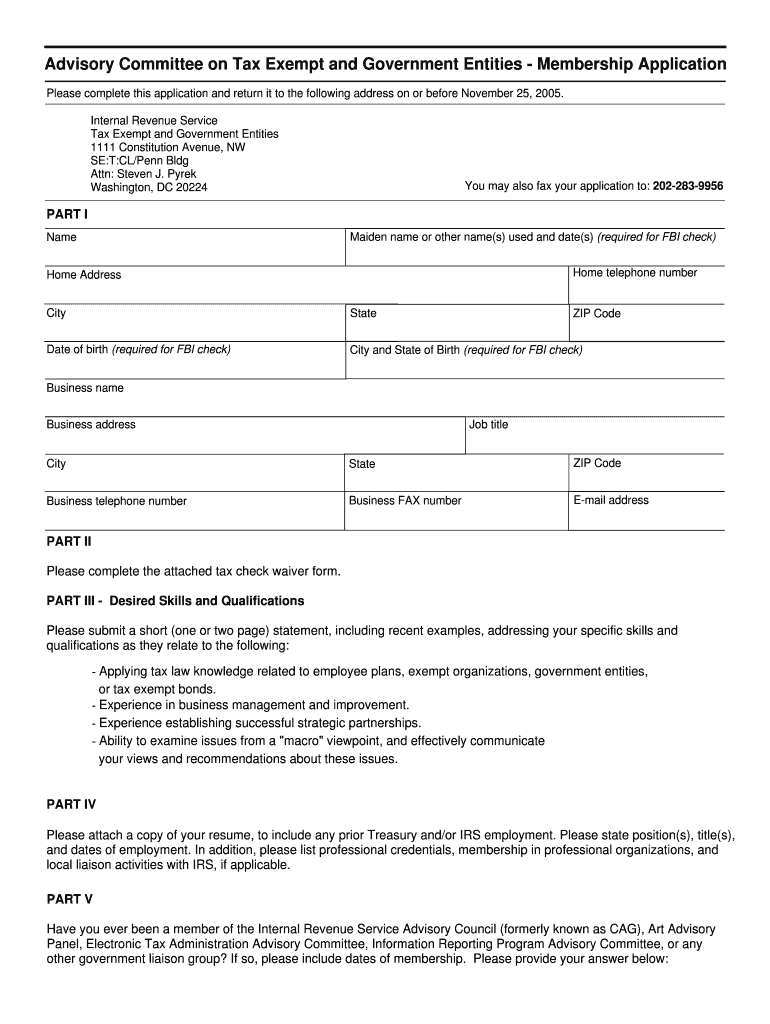

The Membership Application for the Internal Revenue Service (IRS) is a crucial document used by individuals and organizations to apply for membership in various IRS programs. This application facilitates access to specific IRS services and benefits, such as tax-exempt status or participation in certain tax-related initiatives. Understanding the purpose and implications of this application is essential for anyone looking to engage with the IRS effectively.

How to use the Membership Application Internal Revenue Service Irs

Utilizing the Membership Application involves several straightforward steps. First, ensure that you meet the eligibility criteria set by the IRS for the specific program you are applying to. Next, gather all necessary documentation, which may include identification, financial records, and any relevant tax information. Once you have completed the application form, you can submit it either online, by mail, or in person, depending on the IRS guidelines for the specific program.

Steps to complete the Membership Application Internal Revenue Service Irs

Completing the Membership Application requires careful attention to detail. Follow these steps to ensure a successful submission:

- Review the eligibility criteria for the program you are applying to.

- Collect all required documents, such as identification and financial statements.

- Fill out the application form accurately, ensuring all fields are completed.

- Double-check your application for any errors or omissions.

- Submit the application through the appropriate channel, whether online, by mail, or in person.

Required Documents

When applying for membership with the IRS, several documents may be required to support your application. Commonly needed documents include:

- Proof of identity, such as a government-issued ID.

- Financial records, including tax returns or income statements.

- Any additional documentation specific to the program, such as organizational bylaws for non-profits.

Eligibility Criteria

Eligibility for the Membership Application varies based on the specific IRS program. Generally, individuals and organizations must demonstrate compliance with IRS regulations and provide adequate documentation to support their application. For instance, non-profit organizations may need to show their mission aligns with tax-exempt purposes, while individuals may need to provide proof of income or residency.

Form Submission Methods

The Membership Application can be submitted through various methods, ensuring flexibility for applicants. Options include:

- Online submission via the IRS website, which is often the fastest method.

- Mailing the completed application to the designated IRS address.

- In-person submission at local IRS offices, which may provide immediate assistance.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Membership Application. These guidelines include instructions on the required format, necessary documentation, and timelines for processing applications. Familiarizing yourself with these guidelines can help streamline the application process and reduce the likelihood of delays or rejections.

Quick guide on how to complete membership application internal revenue service irs

Complete [SKS] seamlessly on any device

Digital document handling has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documentation, allowing you to procure the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused task today.

The simplest method to modify and electronically sign [SKS] effortlessly

- Find [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Membership Application Internal Revenue Service Irs

Create this form in 5 minutes!

How to create an eSignature for the membership application internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Membership Application Internal Revenue Service Irs used for?

The Membership Application Internal Revenue Service Irs is essential for individuals or entities looking to apply for membership with the IRS. By filling out this application, users can ensure compliance with IRS regulations and simplify their tax processes.

-

How does airSlate SignNow facilitate the IRS Membership Application process?

airSlate SignNow streamlines the IRS Membership Application process by providing a user-friendly platform for eSigning documents. Users can easily fill out and submit their applications while ensuring all necessary signatures are collected securely and efficiently.

-

What pricing plans does airSlate SignNow offer for businesses needing IRS forms?

airSlate SignNow offers several pricing plans tailored to fit diverse business needs, including those requiring the Membership Application Internal Revenue Service Irs. These plans provide cost-effective solutions for document signing and processing, empowering businesses of all sizes.

-

Are there any integration options available when using airSlate SignNow for IRS applications?

Yes, airSlate SignNow offers various integration options that allow users to connect seamlessly with other applications. These integrations enhance the submission process for the Membership Application Internal Revenue Service Irs, facilitating a more comprehensive workflow.

-

What are the benefits of using airSlate SignNow for IRS Membership Applications?

Using airSlate SignNow for IRS Membership Applications provides signNow benefits, including time savings and increased document security. The platform's ease of use also allows users to manage their applications without hassle, ensuring they meet IRS requirements promptly.

-

Is there customer support available for those filling out the IRS Membership Application?

Absolutely! airSlate SignNow offers dedicated customer support for users navigating the IRS Membership Application process. Our knowledgeable team is available to assist with any questions or issues, ensuring a smooth experience.

-

Can I save my progress when completing the Membership Application Internal Revenue Service Irs?

Yes, airSlate SignNow allows you to save your progress while completing the Membership Application Internal Revenue Service Irs. This feature ensures you can return to your application at any time without losing information filled out previously.

Get more for Membership Application Internal Revenue Service Irs

Find out other Membership Application Internal Revenue Service Irs

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later