Who Uses Form 450

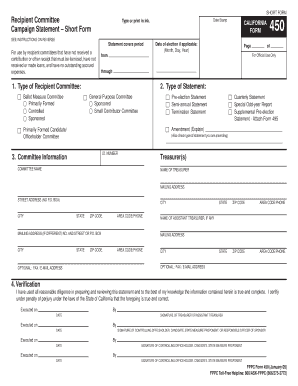

What is Form 450?

Form 450 is a specific document used for reporting certain financial information to the Internal Revenue Service (IRS). This form is primarily utilized by businesses and organizations to disclose details related to their financial activities. It plays a crucial role in ensuring compliance with federal tax regulations, allowing the IRS to monitor income and expenses accurately.

Who Uses Form 450?

Various entities utilize Form 450, including:

- Corporations that must report specific financial transactions.

- Partnerships involved in business activities requiring detailed financial disclosures.

- Non-profit organizations that need to maintain transparency in their financial dealings.

- Self-employed individuals who engage in business activities that necessitate reporting to the IRS.

Each of these users must ensure that they complete the form accurately to avoid penalties and ensure compliance with tax laws.

Steps to Complete Form 450

Completing Form 450 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form with accurate information regarding financial transactions.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline.

Following these steps carefully can help ensure that the form is filled out correctly and submitted on time.

IRS Guidelines for Form 450

The IRS provides specific guidelines for completing and submitting Form 450. These guidelines include:

- Instructions on what information must be reported.

- Details on filing deadlines to avoid late penalties.

- Clarification on who is required to file the form based on their business structure.

Staying informed about these guidelines is essential for compliance and accurate reporting.

Filing Deadlines for Form 450

Filing deadlines for Form 450 can vary based on the type of entity submitting the form. Generally, businesses must file by the end of the tax year, while certain extensions may apply. It is crucial for users to be aware of these deadlines to avoid penalties.

Legal Use of Form 450

Form 450 must be used in accordance with IRS regulations. Legal use entails accurately reporting all required information and submitting the form by the specified deadlines. Misuse or failure to file can result in significant penalties, including fines and increased scrutiny from the IRS.

Quick guide on how to complete who uses form 450

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files promptly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The optimal approach to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for such tasks.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Decide how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Who Uses Form 450

Create this form in 5 minutes!

How to create an eSignature for the who uses form 450

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 450 used for?

Form 450 is primarily used to report certain information about health insurance coverage. It is essential for both employers and employees, and understanding who uses Form 450 can help streamline compliance processes. Businesses utilizing airSlate SignNow can quickly prepare, sign, and manage this documentation.

-

Who uses Form 450?

Various entities, including employers, insurance providers, and tax professionals, use Form 450 to ensure compliance. Businesses must know who uses Form 450 to understand their responsibilities regarding health coverage reporting. airSlate SignNow simplifies the process of creating and signing these forms, benefiting all users.

-

How does airSlate SignNow help in managing Form 450?

airSlate SignNow provides an easy-to-use platform for businesses to electronically sign and send Form 450. With its robust features, companies can quickly fill out Forms, track their status, and ensure timely submission. This efficiency is especially valuable for those who use Form 450 regularly.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs. Whether you’re a small business or a larger enterprise, there is a plan that suits you, ensuring cost-effective solutions for those who use Form 450. This flexibility allows you to scale your document management effectively.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow can integrate seamlessly with various popular software applications, enhancing its functionality. Businesses who use Form 450 can connect their existing systems with airSlate SignNow to streamline workflows and improve efficiency. This means less hassle in managing documents and more time to focus on your core business.

-

What are the benefits of using airSlate SignNow for Form 450?

Using airSlate SignNow to handle Form 450 offers several benefits, including enhanced security, improved efficiency, and reduced paperwork. Businesses can track who uses Form 450 with ease and ensure compliance without the stress of manual processes. This positions your organization for growth and better service delivery.

-

Is it easy to use airSlate SignNow for beginners?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for beginners. Users who that may be unsure about who uses Form 450 will find the platform intuitive, allowing quick onboarding and ease of use. This simplicity is a signNow advantage when managing essential documentation.

Get more for Who Uses Form 450

- Temporary cadc ky form

- Ap biology notes google drive form

- Scc888n form

- Cover page for group project form

- Iowa state extension profit and loss statement form

- Tiaa f10982 form

- Food labeling fsi 514 department of agriculture and markets form

- Electrical appliance serviceperson examination 21 ewrb govt form

Find out other Who Uses Form 450

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed