Home Depot Tax Exempt ID California Form

Understanding the Home Depot Tax Exempt Id in California

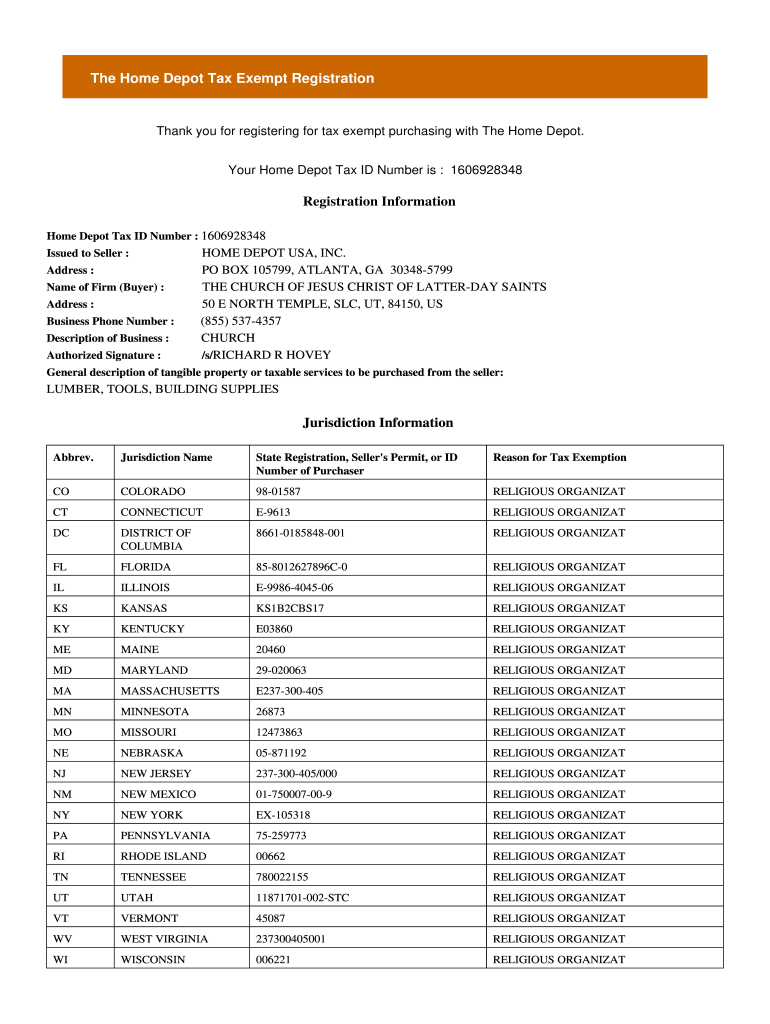

The Home Depot tax exempt ID is a unique identifier that allows eligible organizations in California to make tax-free purchases at Home Depot locations. This ID is primarily used by government entities, non-profit organizations, and certain educational institutions that qualify under state tax exemption laws. To be eligible, organizations must demonstrate their tax-exempt status and provide the necessary documentation to Home Depot.

Steps to Obtain the Home Depot Tax Exempt Id in California

To acquire a Home Depot tax exempt ID, follow these steps:

- Determine your eligibility by reviewing California's tax exemption criteria.

- Complete the Home Depot tax exemption application form, which requires details about your organization, including its legal name and tax identification number.

- Gather the necessary documentation, such as your IRS determination letter or state tax exemption certificate.

- Submit the completed application form along with the required documents to Home Depot, either online or in person.

- Wait for confirmation from Home Depot regarding your tax exempt status and ID issuance.

How to Use the Home Depot Tax Exempt Id in California

Once you have obtained your Home Depot tax exempt ID, you can use it during purchases. When shopping in-store or online, present your tax exempt ID at checkout. For online purchases, enter the ID in the designated field during the checkout process to ensure that sales tax is not applied to your order. Always keep your ID handy, as it may be required for verification during transactions.

Required Documents for Home Depot Tax Exemption Application

To successfully apply for a Home Depot tax exempt ID, you will need to provide specific documents, including:

- IRS determination letter confirming your organization's tax-exempt status.

- California state tax exemption certificate.

- Proof of your organization's legal name and address, such as a business license or registration.

Legal Use of the Home Depot Tax Exempt Id in California

The Home Depot tax exempt ID must be used in compliance with California tax laws. It is intended solely for purchases made by eligible organizations for official use. Misuse of the tax exempt ID, such as using it for personal purchases or by ineligible entities, can lead to penalties and revocation of tax-exempt status. Organizations should ensure that all employees understand the proper use of the tax exempt ID to avoid compliance issues.

Eligibility Criteria for Home Depot Tax Exemption

To qualify for a Home Depot tax exempt ID in California, organizations must meet specific eligibility criteria, including:

- Being a government entity, non-profit organization, or educational institution.

- Possessing a valid tax identification number.

- Providing documentation that verifies tax-exempt status as recognized by the IRS or California state.

Quick guide on how to complete home depot tax exempt id california

Access Home Depot Tax Exempt Id California effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Home Depot Tax Exempt Id California on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest way to edit and electronically sign Home Depot Tax Exempt Id California with ease

- Locate Home Depot Tax Exempt Id California and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Home Depot Tax Exempt Id California and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home depot tax exempt id california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Home Depot tax exempt number?

A Home Depot tax exempt number is a unique identifier issued to eligible businesses or organizations, allowing them to make tax-exempt purchases at Home Depot. This number is vital for managing expenses efficiently and ensuring compliance with tax regulations. By providing this number during transactions, you can avoid paying sales tax on purchases that qualify for exemption.

-

How can I obtain a Home Depot tax exempt number?

To obtain a Home Depot tax exempt number, you need to apply directly through Home Depot's tax exemption program. Typically, this involves providing relevant documentation that certifies your organization’s eligibility for tax exemption. Once approved, you will receive your tax exempt number, which you can use for future purchases at Home Depot.

-

Are there any fees associated with obtaining a Home Depot tax exempt number?

No, there are no fees for obtaining a Home Depot tax exempt number. The application process is free of charge. However, you may need to submit documentation and wait for approval, which is standard practice for these types of registrations.

-

Can I use my Home Depot tax exempt number for online purchases?

Yes, you can use your Home Depot tax exempt number for online purchases. When shopping on the Home Depot website, there is an option to enter your tax exempt number at checkout. This allows you to avoid sales tax on eligible items directly through the online platform.

-

What types of purchases qualify for the Home Depot tax exempt number?

Purchases that are strictly for business use or in support of certain organizations typically qualify for the Home Depot tax exempt number. This includes materials, supplies, and services that are vital for business operations or charitable activities. Always check Home Depot's tax exemption policy for specific guidelines.

-

Can I still benefit from discounts when using my Home Depot tax exempt number?

Yes, you can still take advantage of any applicable discounts or promotions when using your Home Depot tax exempt number. The number does not prevent you from accessing sales or promotional offers available to all customers. Always review current sales and clearance items for additional savings.

-

How do I ensure my Home Depot tax exempt number is used correctly?

To ensure your Home Depot tax exempt number is used correctly, always provide it during the transaction and keep records of your purchases. It's also beneficial to train your purchasing team on its usage to avoid any accidental tax charges. Regularly check that the number is active and correctly noted on receipts.

Get more for Home Depot Tax Exempt Id California

Find out other Home Depot Tax Exempt Id California

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT