Application for Property Tax Exemption Form 136 2010

What is the Application For Property Tax Exemption Form 136

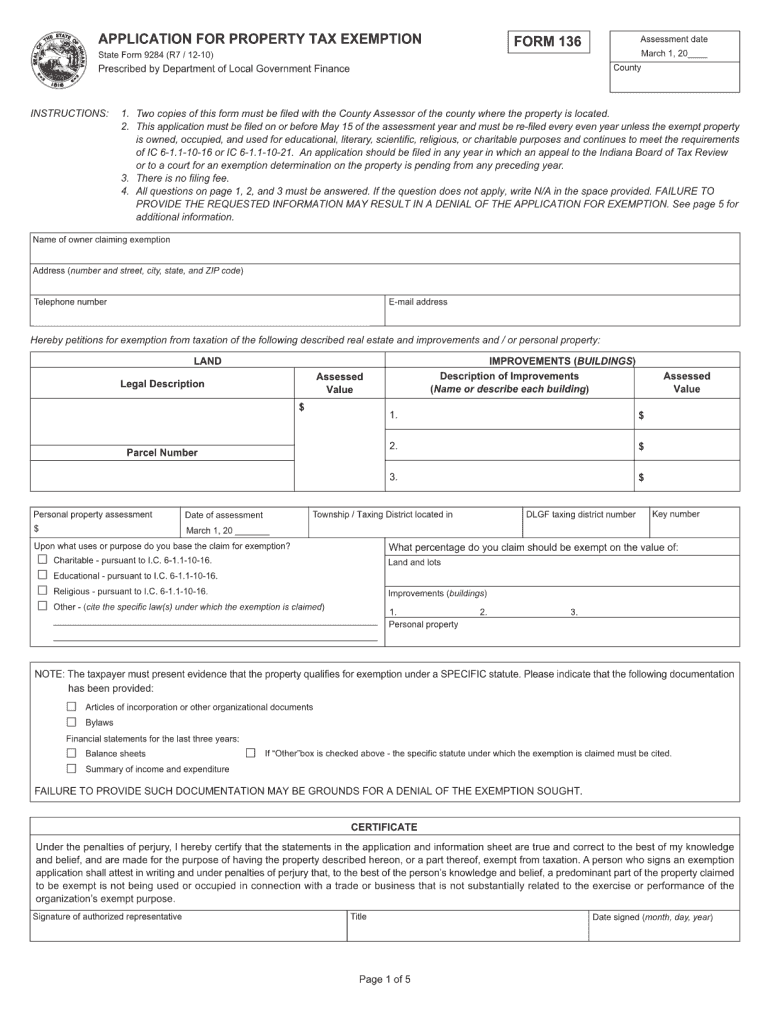

The Application For Property Tax Exemption Form 136 is a crucial document used by property owners in the United States to apply for tax exemptions on their properties. This form allows eligible individuals to claim exemptions that can significantly reduce their property tax liabilities. Typically, the form is utilized by homeowners who meet specific criteria set by state and local governments, such as age, disability status, or income level. Understanding the purpose and function of this form is essential for anyone looking to benefit from property tax reductions.

Steps to Complete the Application For Property Tax Exemption Form 136

Completing the Application For Property Tax Exemption Form 136 involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary personal information, including your name, address, and property details. Next, review the eligibility criteria to confirm that you qualify for the exemption. Carefully fill out the form, paying close attention to each section to avoid errors. Once completed, you will need to sign the form, either digitally or by hand, depending on your submission method. Finally, submit the form according to your local guidelines, ensuring it is sent to the correct office and within any specified deadlines.

How to Obtain the Application For Property Tax Exemption Form 136

The Application For Property Tax Exemption Form 136 can be obtained through various channels. Most commonly, it is available on the official website of your local or state tax authority. You may also find printed copies at government offices or local libraries. If you prefer a digital format, many tax authorities provide downloadable versions of the form that can be filled out online. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Eligibility Criteria for the Application For Property Tax Exemption Form 136

To qualify for the Application For Property Tax Exemption Form 136, applicants must meet specific eligibility criteria that vary by state. Generally, these criteria may include factors such as age, disability status, and income level. For instance, many states offer exemptions for senior citizens or individuals with disabilities. Additionally, applicants may need to demonstrate ownership of the property and use it as their primary residence. It is essential to review the specific requirements set forth by your local tax authority to determine your eligibility for the exemption.

Form Submission Methods

The submission of the Application For Property Tax Exemption Form 136 can typically be done through several methods, including online, by mail, or in person. Many local tax authorities offer online submission options, allowing applicants to fill out and submit the form digitally for convenience. If you prefer to submit by mail, ensure that you send the completed form to the correct address and allow sufficient time for processing. In-person submissions may also be available at local tax offices, where you can receive immediate assistance if needed. Each method has its own advantages, so choose the one that best suits your needs.

Required Documents for the Application For Property Tax Exemption Form 136

When submitting the Application For Property Tax Exemption Form 136, applicants may need to provide supporting documents to verify their eligibility. Commonly required documents include proof of income, age verification (such as a birth certificate or driver's license), and any relevant medical documentation for disability claims. It is advisable to check with your local tax authority for a comprehensive list of required documents, as these can vary by state and may affect the approval process. Ensuring that you have all necessary documentation ready can help streamline your application.

Quick guide on how to complete application for property tax exemption form 136 2010

Your assistance manual on how to prepare your Application For Property Tax Exemption Form 136

If you’re interested in learning how to create and send your Application For Property Tax Exemption Form 136, here are a few simple guidelines to make tax filing more manageable.

First, you only need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to edit, draft, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, while being able to adjust information as necessary. Simplify your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to finalize your Application For Property Tax Exemption Form 136 in no time:

- Set up your account and begin working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax form; sift through versions and schedules.

- Click Get form to access your Application For Property Tax Exemption Form 136 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding electronic signature (if needed).

- Inspect your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper may increase return errors and delay refunds. Naturally, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct application for property tax exemption form 136 2010

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What tax form do I have to fill out for the money I made on Quora?

For 2018, there is only form 1040. Your income is too low to file. Quora will issue you a 1099 Misc only if you made over $600

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the application for property tax exemption form 136 2010

How to make an eSignature for the Application For Property Tax Exemption Form 136 2010 online

How to generate an electronic signature for your Application For Property Tax Exemption Form 136 2010 in Google Chrome

How to create an eSignature for signing the Application For Property Tax Exemption Form 136 2010 in Gmail

How to make an electronic signature for the Application For Property Tax Exemption Form 136 2010 right from your mobile device

How to create an electronic signature for the Application For Property Tax Exemption Form 136 2010 on iOS

How to make an eSignature for the Application For Property Tax Exemption Form 136 2010 on Android OS

People also ask

-

What is the Application For Property Tax Exemption Form 136?

The Application For Property Tax Exemption Form 136 is a specific document used by property owners to apply for property tax exemptions. This form enables applicants to demonstrate their eligibility for potential tax reductions based on various criteria. Proper completion and submission of this form can signNowly decrease your property tax liability.

-

How do I access the Application For Property Tax Exemption Form 136 using airSlate SignNow?

You can easily access the Application For Property Tax Exemption Form 136 through airSlate SignNow’s user-friendly platform. Simply navigate to the document templates section and search for the specific form. Once located, you can customize and fill it out as needed before eSigning.

-

Is there a cost associated with using airSlate SignNow for the Application For Property Tax Exemption Form 136?

airSlate SignNow offers various pricing plans to fit different business needs. The cost is determined based on the features and number of users. However, using our platform to manage the Application For Property Tax Exemption Form 136 can be a cost-effective solution compared to traditional methods.

-

What features does airSlate SignNow provide for the Application For Property Tax Exemption Form 136?

airSlate SignNow offers robust features for the Application For Property Tax Exemption Form 136, including customizable templates, secure eSigning, and cloud storage. You can track the status of your document in real time, ensuring easy management and compliance throughout the process. These features streamline your application submission.

-

Can I integrate airSlate SignNow with other tools for my property tax exemption process?

Yes, airSlate SignNow supports various integrations, allowing you to connect with tools you already use. Whether it's CRM systems, payment platforms, or document management software, airSlate SignNow can enhance the efficiency of handling the Application For Property Tax Exemption Form 136. Integration simplifies managing your documents without switching between different apps.

-

What are the benefits of using airSlate SignNow for the Application For Property Tax Exemption Form 136?

Using airSlate SignNow for the Application For Property Tax Exemption Form 136 provides multiple benefits such as speeding up the signing process and improving document management. The platform ensures that all signatures are legally binding and securely stored. Additionally, you reduce paper waste and gain a streamlined approach to managing your property tax exemptions.

-

How can I ensure that my Application For Property Tax Exemption Form 136 is completed correctly?

To ensure your Application For Property Tax Exemption Form 136 is completed correctly, carefully review the form instructions provided within airSlate SignNow. Utilize the templates and guides available on the platform to help you fill in the necessary information accurately. If needed, you can save your progress and return to the form to make adjustments before finalizing it.

Get more for Application For Property Tax Exemption Form 136

- Aig ltcsm xsi agents form

- Privacy notice form no opt out with affiliate marketing first bank

- Registering for a geolinc account government of prince edward gov pe form

- Registration form to fax hong kong institute of economics and business strategy the university of hong kong pokfulam road hong

- Post 2 251 2018 2019 form

- Print and complete both parts of the authorization form below and return it with

- Special constable application form dyfed powys police

- Request for permit to harvest endangered or formsfreshfromfl

Find out other Application For Property Tax Exemption Form 136

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple