Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323 2023-2026

What is the Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

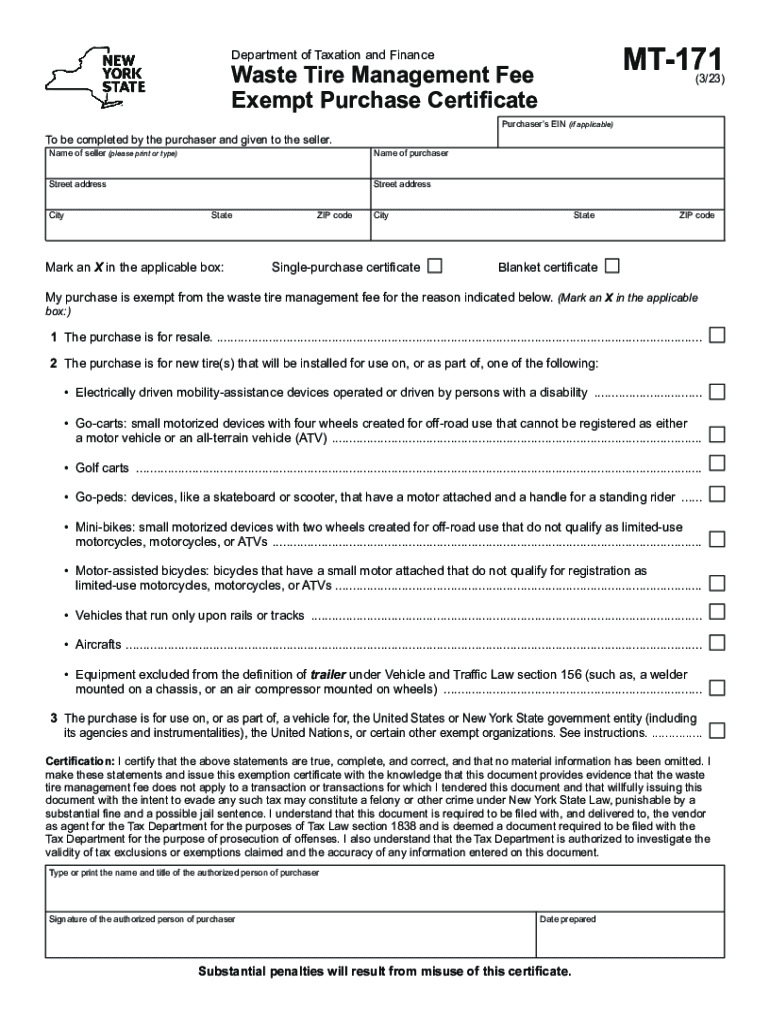

The Form MT 171 is a Waste Tire Management Fee Exempt Purchase Certificate used in New York State. This form allows eligible purchasers to claim an exemption from the waste tire management fee when buying certain tires. The exemption is typically applicable to specific types of purchases, such as those made by government entities or non-profit organizations. Understanding the purpose of this form is crucial for businesses and organizations that frequently purchase tires and wish to avoid unnecessary fees.

How to use the Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

To use the Form MT 171, eligible purchasers must complete the certificate accurately before making a tire purchase. This involves providing essential information such as the purchaser's name, address, and the reason for the exemption. Once filled out, the form should be presented to the tire seller at the time of purchase. It's important to ensure that all details are correct to avoid any issues with the exemption claim.

Steps to complete the Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

Completing the Form MT 171 involves several straightforward steps:

- Obtain the form from a reliable source, ensuring it is the most recent version.

- Fill in the purchaser's name and address accurately.

- Indicate the specific reason for the exemption, such as being a government agency or a non-profit organization.

- Sign and date the form to validate it.

- Present the completed form to the tire seller during the transaction.

Key elements of the Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

The key elements of the Form MT 171 include the purchaser's identification details, the exemption reason, and a declaration statement. These components ensure that the form serves its purpose effectively. It is essential for users to provide accurate information, as any discrepancies may lead to complications in claiming the exemption.

Legal use of the Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

The legal use of the Form MT 171 is governed by New York State regulations regarding waste tire management fees. Only eligible entities, such as government bodies and certain non-profits, can utilize this form to claim an exemption. Misuse of the form or providing false information can result in penalties or the denial of the exemption, making it vital for users to adhere to the legal requirements associated with this certificate.

State-specific rules for the Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

In New York State, specific rules apply to the use of the Form MT 171. These rules dictate who qualifies for the exemption and the types of purchases that are eligible. Understanding these regulations is crucial for purchasers to ensure compliance and avoid any potential legal issues. It is advisable for users to familiarize themselves with the state guidelines to ensure proper use of the form.

Quick guide on how to complete form mt 171 waste tire management fee exempt purchase certificate revised 323

Effortlessly prepare Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323 on any device

Managing documents online has gained widespread popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Handle Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323 across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323 without any hassle

- Locate Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow caters to your needs in document management in just a few clicks from your device of choice. Modify and eSign Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323 to ensure outstanding communication at any phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mt 171 waste tire management fee exempt purchase certificate revised 323

Create this form in 5 minutes!

How to create an eSignature for the form mt 171 waste tire management fee exempt purchase certificate revised 323

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mt 171 in the context of airSlate SignNow?

The mt 171 refers to a specific document format related to international trade that can be managed effectively using airSlate SignNow's features. By implementing airSlate SignNow, businesses can easily eSign, send, and track the mt 171 documents, ensuring compliance and efficiency in transactions.

-

How does airSlate SignNow ensure the security of mt 171 documents?

airSlate SignNow provides military-grade encryption and robust security protocols designed to protect mt 171 documents during eSigning and storage. This ensures that all sensitive information contained in these documents remains confidential and secure from unauthorized access.

-

Is there a free trial available for airSlate SignNow to manage mt 171?

Yes, airSlate SignNow offers a free trial that allows users to experience its features, including the management of mt 171 documents. This trial provides potential customers the opportunity to explore the platform's capabilities before committing to a subscription.

-

What pricing plans does airSlate SignNow offer for handling mt 171 documents?

airSlate SignNow offers several pricing plans tailored to fit various business needs, including those specifically for managing mt 171 documents. Plans are competitively priced and designed to provide signNow value in terms of features and functionalities.

-

Can I integrate airSlate SignNow with my existing tools when handling mt 171?

Yes, airSlate SignNow supports various integrations with popular business tools and software, making it easier to process mt 171 documents within your existing workflow. This seamless integration enhances productivity and streamlines your document management process.

-

What are the benefits of using airSlate SignNow for mt 171 document processes?

Using airSlate SignNow for processing mt 171 documents comes with numerous benefits, including improved efficiency, reduced turnaround times, and enhanced document tracking. The user-friendly interface allows teams to collaborate effectively and manage documents with ease.

-

How does airSlate SignNow facilitate compliance for mt 171 signatures?

airSlate SignNow helps ensure compliance for mt 171 signatures through its legally binding eSignature capabilities in accordance with international standards. This is crucial for maintaining the legality of signed documents across various jurisdictions.

Get more for Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

Find out other Form MT 171 Waste Tire Management Fee Exempt Purchase Certificate Revised 323

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT