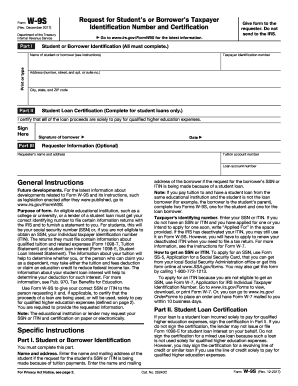

GovFormW9S for the Latest Information 2017

Understanding the ELAC Tax Form

The ELAC tax form, often referred to as the 1098-T form, is a crucial document for students attending East Los Angeles College. This form is issued by educational institutions to provide information about qualified tuition and related expenses. It is particularly important for students who wish to claim education-related tax benefits, such as the American Opportunity Credit or the Lifetime Learning Credit.

The 1098-T form includes essential details such as the amount billed for qualified tuition and fees, scholarships or grants received, and the student's personal information. Understanding this form is vital for ensuring accurate tax reporting and maximizing potential tax credits.

Steps to Complete the ELAC Tax Form

Completing the ELAC tax form involves several straightforward steps:

- Gather necessary documents, including your 1098-T form, receipts for tuition payments, and any financial aid documentation.

- Review the information on the 1098-T form to ensure accuracy, including your name, Social Security number, and the amounts reported.

- Determine your eligibility for education tax credits by consulting IRS guidelines or a tax professional.

- Complete your tax return using the information from the 1098-T form, ensuring you include any applicable credits.

By following these steps, students can effectively utilize the ELAC tax form to optimize their tax filings.

Who Issues the ELAC Tax Form

The 1098-T form is issued by East Los Angeles College to all eligible students who have paid qualified tuition and related expenses during the tax year. The college is responsible for accurately reporting the amounts billed and any scholarships or grants awarded to students. Students can typically access their 1098-T forms through the college's online portal or by contacting the financial aid office for assistance.

IRS Guidelines for the ELAC Tax Form

The IRS provides specific guidelines regarding the use of the 1098-T form. Students must ensure that the information reported on the form aligns with their tax return. The IRS requires educational institutions to report amounts that reflect what students were billed for qualified tuition and related expenses, as well as any scholarships or grants received.

It is essential for students to retain a copy of their 1098-T form for their records and to consult IRS publications or a tax advisor for detailed instructions on how to claim education-related tax benefits.

Filing Deadlines for the ELAC Tax Form

Filing deadlines for tax returns that include the 1098-T form typically align with the standard tax filing deadlines in the United States. Generally, individual tax returns are due on April fifteenth of each year. However, students should be aware that if they are claiming education credits, they may need to file early to ensure they have all necessary documentation.

It is advisable to check the IRS website for any updates or changes to filing deadlines, especially in light of potential extensions or special provisions that may arise.

Common Scenarios for Using the ELAC Tax Form

Students may encounter various scenarios when using the 1098-T form:

- Students who are eligible for the American Opportunity Credit can use the 1098-T to claim up to $2,500 of qualified expenses.

- Graduate students may utilize the form to claim the Lifetime Learning Credit, which can provide up to $2,000 per tax return.

- Students who have received scholarships or grants must report these amounts accurately, as they can affect the total qualified expenses.

Understanding these scenarios can help students navigate their tax obligations effectively.

Quick guide on how to complete govformw9s for the latest information

Effortlessly Prepare GovFormW9S For The Latest Information on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to find the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without delays. Manage GovFormW9S For The Latest Information on any platform using airSlate SignNow applications for Android or iOS and enhance any document-focused operation today.

The easiest way to edit and electronically sign GovFormW9S For The Latest Information effortlessly

- Obtain GovFormW9S For The Latest Information and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive data using tools provided specifically for this purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details, then click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign GovFormW9S For The Latest Information while ensuring effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct govformw9s for the latest information

Create this form in 5 minutes!

How to create an eSignature for the govformw9s for the latest information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the elac tax form and why do I need it?

The elac tax form is a specific document required for reporting eligible educational expenses for certain tax benefits. Businesses and individuals can use this form to ensure they receive all available tax deductions or credits. By understanding the elac tax form, you can maximize your tax savings efficiently.

-

How can airSlate SignNow help me with completing the elac tax form?

airSlate SignNow offers a seamless solution for filling out and eSigning the elac tax form. With our intuitive platform, you can easily upload documents and collaborate with others, ensuring accurate and timely submissions. This helps streamline your tax filing process and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the elac tax form?

Yes, airSlate SignNow operates on a subscription model, but it remains a cost-effective choice for managing documents, including the elac tax form. We offer various plans based on user needs, ensuring you can find an option that fits your budget. Many users find that the efficiency gained exceeds the subscription costs.

-

What features does airSlate SignNow offer for handling the elac tax form?

airSlate SignNow includes features like document templates, secure eSigning, and real-time collaboration, which are essential for managing the elac tax form. Additionally, our platform offers cloud storage options and advanced tracking capabilities, ensuring you stay organized and compliant during tax season.

-

Can I integrate airSlate SignNow with other applications to manage the elac tax form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM platforms. This allows you to easily access your elac tax form from anywhere, streamlining your workflow and enhancing collaboration with your team or accountant.

-

Is airSlate SignNow secure when dealing with sensitive documents like the elac tax form?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and compliance measures to protect your documents, including the elac tax form. You can confidently eSign and share sensitive information knowing it is secure throughout the process.

-

How do I start using airSlate SignNow for my elac tax form needs?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and explore our user-friendly interface. Once registered, you can upload your elac tax form and start utilizing our features immediately to simplify your document management.

Get more for GovFormW9S For The Latest Information

- Affidavit waiver form

- Agreement arbitrate 497331846 form

- Letter to request to attend a conference form

- Motion amended complaint form

- Modified american academy of pediatrics refusal of vaccination form aap

- Motion release property 497331850 form

- Agreement to manage production on cruise form

- Defects goods form

Find out other GovFormW9S For The Latest Information

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document