W 9s 2024-2026

What is the W-9?

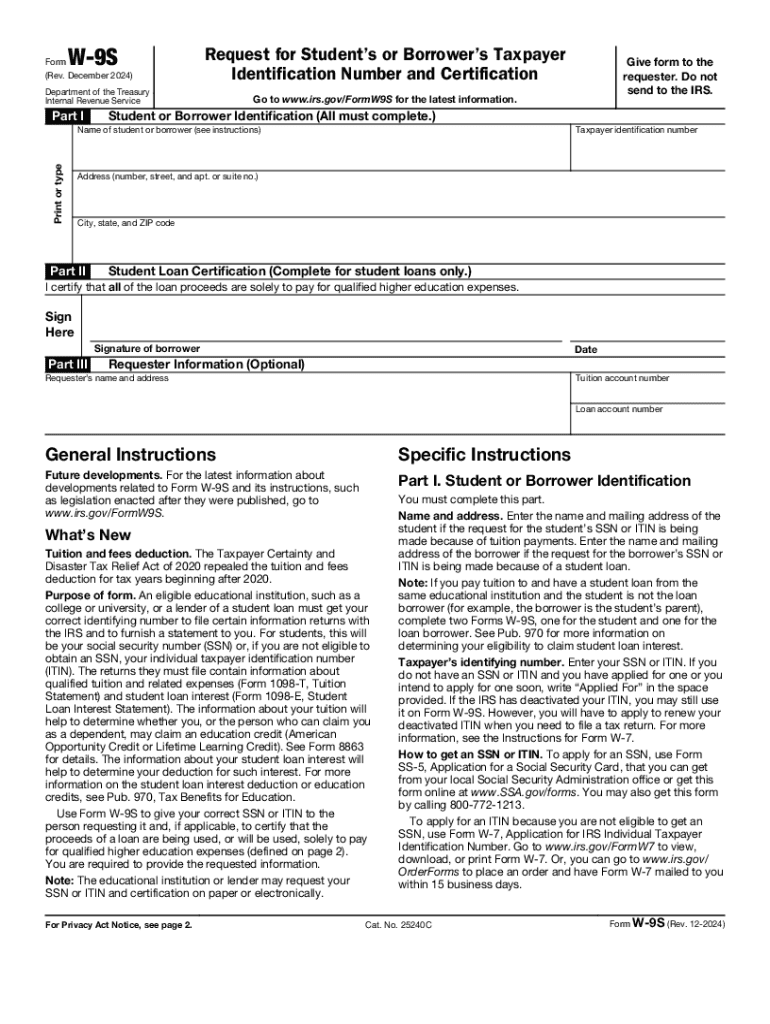

The W-9 form is an official document used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized to collect taxpayer information, including the name, address, and taxpayer identification number (TIN) of individuals and businesses. This form is essential for independent contractors, freelancers, and other self-employed individuals who need to report income to the IRS. By providing accurate information on the W-9, recipients enable payers to properly report payments made to them, ensuring compliance with tax regulations.

How to Obtain the W-9

Obtaining the W-9 form is straightforward. The form can be downloaded directly from the IRS website, where it is available as a PDF. Additionally, many businesses and organizations may provide the W-9 form upon request. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. The W-9 is not typically submitted to the IRS; instead, it is kept on file by the requester for their records.

Steps to Complete the W-9

Completing the W-9 form involves several key steps:

- Provide your name: Enter your full legal name as it appears on your tax return.

- Business name (if applicable): If you operate under a different name, include it in this section.

- Check the appropriate box: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Enter your address: Include your street address, city, state, and ZIP code.

- Taxpayer identification number: Provide your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date: Ensure you sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9

The W-9 form is legally required for certain financial transactions and is used to report income paid to non-employees. Businesses must collect a completed W-9 from independent contractors before making payments. This form helps ensure that the IRS receives accurate information regarding income reporting. Failure to provide a W-9 when requested can result in backup withholding, where the payer is required to withhold a percentage of payments for tax purposes.

IRS Guidelines for the W-9

The IRS provides specific guidelines for the use of the W-9 form. It is essential to complete the form accurately and submit it promptly when requested. The IRS does not require the W-9 to be submitted with a tax return; however, it must be retained by the requester for their records. The form should be updated if there are changes to your taxpayer information, such as a name change or change in business structure.

Examples of Using the W-9

The W-9 form is commonly used in various scenarios, such as:

- Independent contractors: Freelancers providing services to businesses need to submit a W-9 to report their earnings.

- Real estate transactions: Landlords may request a W-9 from tenants for tax reporting purposes.

- Financial institutions: Banks may require a W-9 when opening an account or for interest reporting.

Handy tips for filling out W 9s online

Quick steps to complete and e-sign W 9s online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a GDPR and HIPAA compliant solution for optimum simplicity. Use signNow to e-sign and send out W 9s for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct w 9s

Create this form in 5 minutes!

How to create an eSignature for the w 9s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are W 9s and why are they important?

W 9s are tax forms used in the United States to provide taxpayer identification information to businesses. They are essential for independent contractors and freelancers to ensure proper tax reporting. Understanding W 9s helps businesses comply with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with W 9s?

airSlate SignNow simplifies the process of sending and signing W 9s electronically. With our platform, you can easily create, send, and receive completed W 9 forms, ensuring a smooth workflow. This not only saves time but also enhances accuracy and security in document handling.

-

What features does airSlate SignNow offer for managing W 9s?

Our platform offers features such as customizable templates for W 9s, secure eSignature capabilities, and real-time tracking of document status. These features streamline the management of W 9s, making it easier for businesses to collect and store important tax information. Additionally, our user-friendly interface ensures that anyone can navigate the process effortlessly.

-

Is there a cost associated with using airSlate SignNow for W 9s?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, especially for businesses that frequently handle W 9s and other documents. You can choose a plan that fits your budget while still accessing all the essential features for managing W 9s efficiently.

-

Can I integrate airSlate SignNow with other software for W 9s?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM and accounting tools. This integration allows you to automate the process of collecting and managing W 9s, enhancing your overall productivity. By connecting your existing systems, you can ensure that your W 9s are always up-to-date and easily accessible.

-

What are the benefits of using airSlate SignNow for W 9s?

Using airSlate SignNow for W 9s offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our electronic signature solution ensures that your W 9s are signed quickly and securely, minimizing delays in processing. Additionally, the ability to store and manage documents digitally helps you stay organized and compliant.

-

How secure is airSlate SignNow when handling W 9s?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your W 9s and other sensitive documents. Our platform complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

Get more for W 9s

Find out other W 9s

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later