BAffidavitb of Loss of Original Tax BSaleb CertificateTax Deed Revenue Alabama 2016

What is the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

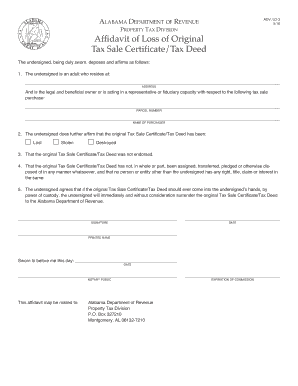

The BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama is a legal document used to declare that an original tax sale certificate or tax deed has been lost. This affidavit serves as a formal declaration, allowing individuals or entities to request a replacement for the lost document. It is crucial for property owners or buyers involved in tax sales to understand this form, as it helps protect their rights and interests in real estate transactions.

How to obtain the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

To obtain the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama, individuals should contact the local revenue office or the appropriate county clerk's office. The process typically involves filling out a request form and providing necessary identification and details about the lost document. Some counties may offer online access to forms, while others may require in-person visits. It is essential to check specific requirements for the county in which the property is located.

Steps to complete the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

Completing the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama involves several key steps:

- Gather necessary information about the lost tax sale certificate or tax deed, including property details and the date of the original transaction.

- Visit the local revenue or county clerk's office to obtain the affidavit form.

- Fill out the affidavit accurately, ensuring all required fields are completed.

- Sign the affidavit in the presence of a notary public, if required.

- Submit the completed affidavit to the appropriate office, along with any required fees.

Key elements of the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

Key elements of the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama include:

- The declarant's full name and contact information.

- A detailed description of the lost document, including its type and any identifying numbers.

- A statement affirming the loss and the circumstances surrounding it.

- The date of the original transaction related to the lost document.

- Signature and date, often requiring notarization for legal validity.

State-specific rules for the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

Each state may have specific rules governing the use of the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama. In Alabama, it is essential to adhere to local regulations, which may include specific formatting requirements, submission deadlines, and fees. Additionally, some counties may have unique processes for handling lost documents, so it is advisable to consult the local revenue office for guidance.

Legal use of the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

The legal use of the BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama allows property owners to assert their rights to the property despite the loss of the original document. This affidavit can be used in legal proceedings to establish ownership and facilitate the issuance of a replacement document. It is vital for individuals to ensure that the affidavit is completed correctly to avoid potential legal complications.

Quick guide on how to complete baffidavitb of loss of original tax bsaleb certificatetax deed revenue alabama

Complete BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools needed to generate, modify, and eSign your documents promptly without interruptions. Handle BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama with ease

- Obtain BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Accentuate important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Put aside the concerns of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from a device of your preference. Modify and eSign BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct baffidavitb of loss of original tax bsaleb certificatetax deed revenue alabama

Create this form in 5 minutes!

How to create an eSignature for the baffidavitb of loss of original tax bsaleb certificatetax deed revenue alabama

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama?

A BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama is a legal document that certifies the loss of a tax sale certificate or deed. This affidavit allows property owners to assert their ownership rights when the original document is lost. Using airSlate SignNow, you can easily create and eSign this affidavit for a streamlined process.

-

How can I obtain a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama?

To obtain a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama, you can use airSlate SignNow's templates to quickly generate the document. Once you fill in your details, you can eSign it and share it directly with relevant parties. This simplifies the process and saves time.

-

What are the key features of airSlate SignNow for handling BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document sharing that make it easy to manage BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama. Users benefit from real-time collaboration, audit trails, and mobile access, ensuring easy management of important documents at any time.

-

Is airSlate SignNow cost-effective for individuals needing a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama?

Yes, airSlate SignNow provides a cost-effective solution for individuals needing a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama. With flexible pricing plans, you can choose an option that fits your budget while enjoying all necessary features to create and eSign your affidavit efficiently.

-

Can multiple users collaborate on a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama document. This feature enables seamless teamwork, making it easier for all parties involved to add information, review, and eSign the affidavit together.

-

What integrations does airSlate SignNow offer for managing BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama?

airSlate SignNow integrates with various applications like Google Drive, Dropbox, and CRM systems to enhance your document management workflow. These integrations allow you to access and store your BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama directly within your existing tools, making the process more efficient.

-

How secure is the eSigning process for a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama in airSlate SignNow?

The eSigning process for a BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama in airSlate SignNow is highly secure. The platform uses advanced encryption and authentication measures to protect your documents and personal information, ensuring that your affidavit remains confidential and tamper-proof.

Get more for BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

- Equipment borrowing agreement template form

- Reading an imperial ruler form

- Vitas hospice form

- Variation of lease form

- Construction certificate form

- Sdlt1 form sample

- Pneumonia vaccine consent amp registration form revised 10

- Department of health and human services division of vocational rehabilitation services service animal form

Find out other BAffidavitb Of Loss Of Original Tax BSaleb CertificateTax Deed Revenue Alabama

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement