Retroactive Distribution of Funding is the Process of Changing the Funding Account Charged for Payroll Expenses After the Fact F Form

Understanding the Retroactive Distribution of Funding

The retroactive distribution of funding refers to the process of adjusting the funding account charged for payroll expenses after they have been incurred. This adjustment is essential for accurate financial reporting and ensures that expenses are allocated to the correct budget sources. Organizations may find it necessary to make these changes due to various reasons, such as errors in initial accounting or changes in project funding sources.

Steps to Complete the Retroactive Distribution of Funding

To successfully complete the retroactive distribution of funding, follow these steps:

- Identify the payroll expenses that require adjustment.

- Gather necessary documentation, including original payroll records and any relevant funding agreements.

- Determine the correct funding account that should be charged.

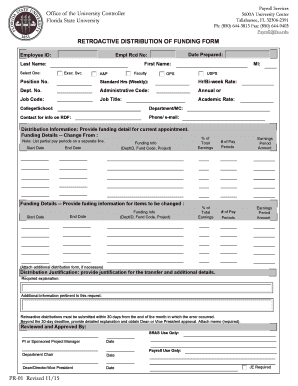

- Prepare the necessary forms, such as the PR 01 form, to initiate the adjustment.

- Submit the completed forms to the appropriate financial department for processing.

- Monitor the adjustments to ensure they are reflected in the financial records.

Legal Considerations for Retroactive Distribution of Funding

When adjusting funding accounts for payroll expenses, it is crucial to comply with legal guidelines. Organizations must ensure that the adjustments do not violate any contractual obligations or funding regulations. Additionally, maintaining accurate records is essential for audit purposes and to avoid potential penalties for misreporting expenses.

Required Documents for the Retroactive Distribution of Funding

To facilitate the retroactive distribution of funding, specific documents are typically required. These may include:

- Original payroll records

- Funding agreements or contracts

- Completed PR 01 form

- Internal memos or communications regarding the funding adjustments

Examples of Retroactive Distribution of Funding in Practice

Organizations often encounter scenarios where retroactive distribution of funding is necessary. For example, a university may need to reallocate funds from a grant that was initially charged to one department but should have been attributed to another. Similarly, a non-profit organization may adjust payroll expenses related to a specific project after receiving additional funding from a donor.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines when submitting the PR 01 form for retroactive distribution of funding. Organizations should establish a timeline for completing necessary adjustments, ensuring that all forms are submitted in a timely manner to avoid disruptions in funding or financial reporting.

Quick guide on how to complete retroactive distribution of funding is the process of changing the funding account charged for payroll expenses after the fact

Complete Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Handle Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F effortlessly

- Obtain Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information carefully and click on the Done button to preserve your adjustments.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document administration with just a few clicks from any device of your preference. Modify and eSign Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retroactive distribution of funding is the process of changing the funding account charged for payroll expenses after the fact

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PR 01 form and how is it used with airSlate SignNow?

The PR 01 form is a document that can be easily eSigned using airSlate SignNow's platform. It allows businesses to streamline the signing process, making it efficient and legally binding. By utilizing airSlate SignNow, you ensure that your PR 01 forms are completed in a secure and compliant manner.

-

How does airSlate SignNow make sending PR 01 forms easier?

airSlate SignNow simplifies the process of sending PR 01 forms by allowing users to upload documents, add signers, and send requests in just a few clicks. The platform also provides notifications and reminders, ensuring that your PR 01 forms are completed promptly. This ease of use saves time and enhances productivity.

-

What are the pricing plans for using airSlate SignNow with PR 01 forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including functionality for managing PR 01 forms. You can choose from individual plans to enterprise solutions that provide additional features such as team collaboration and advanced integrations. This flexibility ensures you find the right fit for your budget and requirements.

-

Are there any special features for managing PR 01 forms in airSlate SignNow?

Yes, airSlate SignNow includes several features tailored for managing PR 01 forms, such as customizable templates, in-app editing, and detailed tracking of document status. These features enhance the user experience and help ensure that all necessary information is captured and signatures are properly recorded on your PR 01 forms.

-

Can I integrate airSlate SignNow with other applications for managing PR 01 forms?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, making it easy to manage PR 01 forms alongside your existing workflows. You can connect to CRMs, document management systems, and other tools to streamline the entire process of document management and signing.

-

How does airSlate SignNow ensure the security of PR 01 forms?

Security is a priority for airSlate SignNow when handling PR 01 forms. The platform employs industry-leading encryption methods and complies with strict data protection regulations. This commitment ensures that your documents are secure and your sensitive information remains confidential throughout the signing process.

-

What benefits does airSlate SignNow provide for businesses using PR 01 forms?

Using airSlate SignNow for PR 01 forms provides several benefits, including faster turnaround times, reduced paper usage, and improved accuracy in document handling. Businesses also experience enhanced compliance and accountability, as every action on the PR 01 form is recorded and accessible for future reference.

Get more for Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F

- Vt cover form

- Supplemental residential lease forms package vermont

- Residential landlord tenant rental lease forms and agreements package vermont

- Name change instructions and forms package for an adult vermont

- Vermont name change instructions and forms package for a minor vermont

- Name change instructions and forms package for a family vermont

- Vermont change name 497429018 form

- Vt family form

Find out other Retroactive Distribution Of Funding Is The Process Of Changing The Funding Account Charged For Payroll Expenses After The Fact F

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free