Irs Gov Tax Forms

What is the IRS Gov Tax Forms

The IRS Gov tax forms are official documents used by taxpayers in the United States to report their income, claim deductions, and calculate their tax liabilities. These forms are essential for individuals and businesses to comply with federal tax laws. The IRS provides a variety of forms, each designed for specific purposes, such as the 1040 for individual income tax returns or the W-2 for reporting wages. Understanding the different types of forms available is crucial for accurate tax filing.

How to Use the IRS Gov Tax Forms

Using IRS Gov tax forms involves several steps to ensure compliance and accuracy. First, identify the correct form based on your tax situation. Next, gather all necessary documentation, including income statements, receipts for deductions, and any relevant identification numbers. Once you have the appropriate form, fill it out carefully, ensuring all required fields are completed. After completing the form, review it for accuracy before submitting it to the IRS, either electronically or by mail.

Steps to Complete the IRS Gov Tax Forms

Completing IRS Gov tax forms requires attention to detail. Follow these steps for successful completion:

- Determine the correct form based on your filing status and income type.

- Collect all necessary documents, such as W-2s, 1099s, and receipts.

- Fill out the form accurately, ensuring to include all required information.

- Double-check for any errors or omissions.

- Submit the form by the deadline, either electronically or via mail.

Legal Use of the IRS Gov Tax Forms

IRS Gov tax forms must be used in accordance with federal tax laws. It is important to only use the most current versions of the forms, as outdated forms may not be accepted. Additionally, taxpayers should ensure that all information provided is truthful and accurate to avoid penalties. Misuse of tax forms, such as falsifying information or submitting incorrect forms, can lead to legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for IRS Gov tax forms vary depending on the type of form and the taxpayer's situation. Generally, individual income tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to be aware of these deadlines to avoid late fees and penalties. Taxpayers should also note any extensions available for filing, which may provide additional time under specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit IRS Gov tax forms through various methods. The most efficient way is to file electronically using IRS-approved software or through the IRS website. This method allows for faster processing and confirmation of receipt. Alternatively, forms can be mailed to the appropriate IRS address, depending on the type of form and the taxpayer's location. In some cases, taxpayers may also have the option to file in person at designated IRS offices, although this is less common.

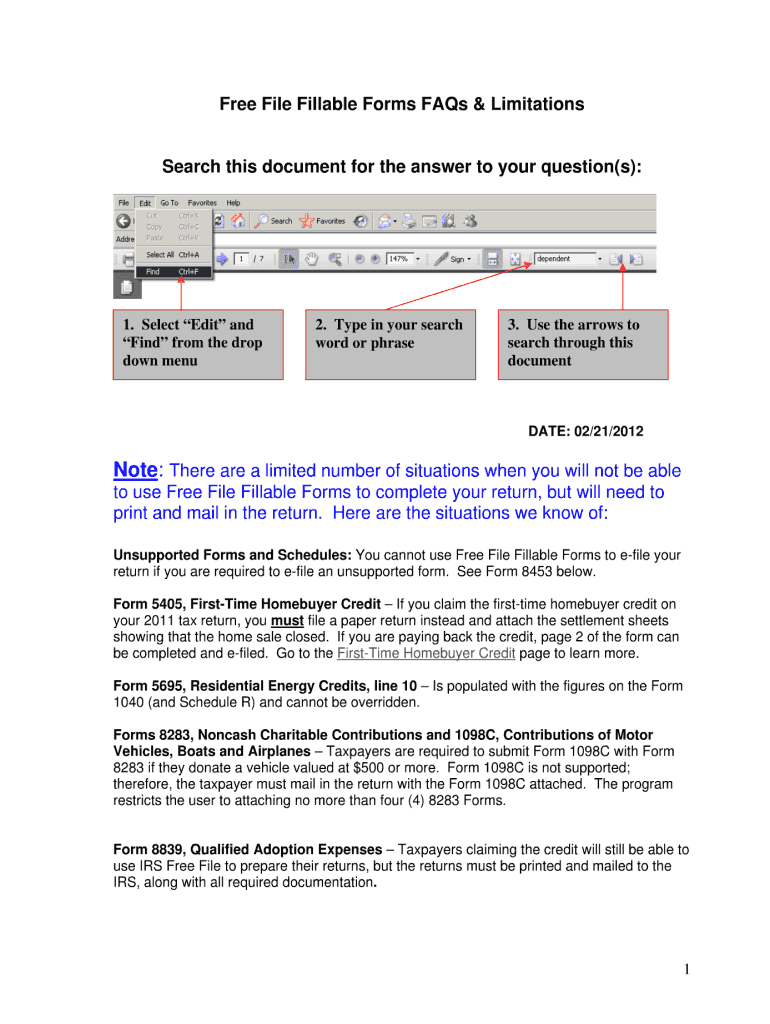

Quick guide on how to complete irs fillable form

Uncover the most efficient method to complete and sign your Irs Gov Tax Forms

Are you still spending time organizing your official documents on paper instead of doing it online? airSlate SignNow provides a superior way to finalize and endorse your Irs Gov Tax Forms and comparable forms for public services. Our intelligent eSignature solution equips you with everything necessary to handle paperwork swiftly while adhering to official standards - comprehensive PDF editing, management, security, signing, and sharing tools are all accessible within a user-friendly interface.

Only a few steps are needed to fill out and sign your Irs Gov Tax Forms:

- Incorporate the fillable template into the editor using the Get Form button.

- Review the information you need to input in your Irs Gov Tax Forms.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Conceal areas that are no longer relevant.

- Click on Sign to create a legally binding eSignature using any method you prefer.

- Add the Date beside your signature and complete your task with the Done button.

Store your completed Irs Gov Tax Forms in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our solution also enables convenient file sharing. There’s no need to print out your forms when submitting them to the relevant public office - manage it via email, fax, or by requesting a USPS “snail mail” dispatch from your account. Experience it now!

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

How do I get the taxes done in a social security that was used by someone else, but was under my name?

There are a number of steps to take, and I will give you a link below.Certainly for tax purposes, you need to contact the IRS. There is a form to fill out if someone else is using your SSN. Complete IRS Form 14039, Identity Theft Affidavit. Use a fillable form at An official website of the United States government, print, then mail or fax according to instructions.You also should call your local social security office.Here are other steps to follow:Identity Theft Information for Taxpayers and Victims

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

Create this form in 5 minutes!

How to create an eSignature for the irs fillable form

How to make an electronic signature for your Irs Fillable Form in the online mode

How to make an eSignature for your Irs Fillable Form in Google Chrome

How to make an eSignature for signing the Irs Fillable Form in Gmail

How to generate an eSignature for the Irs Fillable Form from your smartphone

How to make an eSignature for the Irs Fillable Form on iOS devices

How to generate an eSignature for the Irs Fillable Form on Android devices

People also ask

-

What are IRS Gov Tax Forms and how can airSlate SignNow help?

IRS Gov Tax Forms are official documents required for tax reporting and filing in the United States. airSlate SignNow provides a seamless way to eSign and send these forms securely, ensuring compliance and accuracy while simplifying the overall tax preparation process.

-

Are there any costs associated with using airSlate SignNow for IRS Gov Tax Forms?

Yes, airSlate SignNow offers a range of pricing plans designed to fit various business needs. Whether you are a solo entrepreneur or a larger organization, you can choose a plan that allows for efficient handling of IRS Gov Tax Forms without breaking the bank.

-

Can I integrate airSlate SignNow with other software for handling IRS Gov Tax Forms?

Absolutely! airSlate SignNow offers integrations with various popular software applications, making it easy to manage your IRS Gov Tax Forms alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow provide for managing IRS Gov Tax Forms?

airSlate SignNow includes features such as document templates, bulk sending, and secure eSigning, specifically designed to facilitate the management of IRS Gov Tax Forms. These features ensure that you can handle your tax documents efficiently and securely.

-

Is airSlate SignNow compliant with IRS regulations for tax forms?

Yes, airSlate SignNow is compliant with IRS regulations for eSigning and submitting IRS Gov Tax Forms. This compliance ensures that your electronic signatures are legally valid, helping you avoid any potential issues during tax filing.

-

How can I track the status of my IRS Gov Tax Forms with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your IRS Gov Tax Forms through the dashboard. This feature allows you to see who has signed the documents and any pending actions, providing you with peace of mind throughout the tax filing process.

-

What benefits does airSlate SignNow offer for businesses dealing with IRS Gov Tax Forms?

Using airSlate SignNow for IRS Gov Tax Forms offers numerous benefits, including time savings, improved accuracy, and enhanced security. By digitizing your tax documents, you can streamline your filing process and reduce the risk of errors associated with traditional paper forms.

Get more for Irs Gov Tax Forms

- Notice of confidential information within court filing duval county

- Antrag auf erteilung eines schengen visum form

- Refresher certification form

- Online essay graphic organizer form

- Quit claim deed joint tenancy will county recorder form

- Kane quit claim deed form

- Internal mobility applicant interview form

- 92458 rent schedule low rent housing sc state housing form

Find out other Irs Gov Tax Forms

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure