DistributionNotice of Withholding Form 5 New Direction IRA Inc

What is the Distribution Notice of Withholding Form 5 New Direction IRA Inc

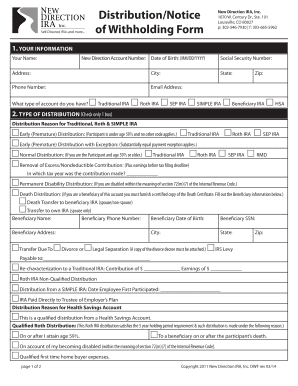

The Distribution Notice of Withholding Form 5 is a document used by New Direction IRA Inc to inform account holders about the tax withholding on distributions from their Individual Retirement Accounts (IRAs). This form is essential for ensuring compliance with Internal Revenue Service (IRS) regulations regarding tax obligations on early distributions or distributions that are not rolled over into another retirement account. The form outlines the amount that will be withheld for federal taxes, helping account holders understand their potential tax liabilities when accessing their retirement funds.

How to use the Distribution Notice of Withholding Form 5 New Direction IRA Inc

Using the Distribution Notice of Withholding Form 5 involves several steps. First, account holders should review the form to understand the withholding rates and the implications for their tax situation. It is important to fill out the form accurately, providing necessary details such as the type of distribution and the account holder's identification information. Once completed, the form must be submitted to New Direction IRA Inc as part of the distribution request process. This ensures that the correct amount is withheld before the funds are disbursed, aligning with IRS requirements.

Steps to complete the Distribution Notice of Withholding Form 5 New Direction IRA Inc

Completing the Distribution Notice of Withholding Form 5 requires careful attention to detail. Here are the steps to follow:

- Begin by downloading the form from the New Direction IRA Inc website or requesting a copy from their customer service.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the type of distribution you are requesting, whether it is a full withdrawal, partial withdrawal, or rollover.

- Specify the withholding amount you wish to apply, keeping in mind the IRS guidelines on minimum withholding rates.

- Review the completed form for accuracy and sign where indicated.

- Submit the form to New Direction IRA Inc along with any additional required documentation.

Key elements of the Distribution Notice of Withholding Form 5 New Direction IRA Inc

The Distribution Notice of Withholding Form 5 contains several key elements that are crucial for both the account holder and New Direction IRA Inc. These elements include:

- Account Holder Information: Personal details of the account holder, including identification numbers.

- Distribution Type: The nature of the distribution, whether it is a direct payment or rollover.

- Withholding Amount: The percentage or flat amount to be withheld for federal taxes.

- Signature: The account holder’s signature, confirming the accuracy of the information provided.

- Date: The date on which the form is completed and submitted.

IRS Guidelines

The IRS provides specific guidelines regarding the withholding on distributions from retirement accounts. According to IRS regulations, a minimum of ten percent must be withheld for federal income tax unless the account holder opts out or specifies a different amount. It is essential for account holders to be aware of these guidelines to avoid under-withholding, which could result in penalties or unexpected tax liabilities. Additionally, understanding the implications of early distributions is critical, as they may incur additional taxes if taken before the age of fifty-nine and a half.

Form Submission Methods

Submitting the Distribution Notice of Withholding Form 5 can be done through various methods, ensuring convenience for the account holder. The primary methods include:

- Online Submission: Many account holders prefer to submit their forms electronically through the New Direction IRA Inc online portal.

- Mail: The form can also be printed and mailed to the designated address provided by New Direction IRA Inc.

- In-Person: For those who prefer a personal touch, visiting a local office to submit the form in person is an option.

Quick guide on how to complete distributionnotice of withholding form 5 new direction ira inc

Complete [SKS] effortlessly on any device

Online document administration has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without complications. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DistributionNotice Of Withholding Form 5 New Direction IRA Inc

Create this form in 5 minutes!

How to create an eSignature for the distributionnotice of withholding form 5 new direction ira inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DistributionNotice Of Withholding Form 5 New Direction IRA Inc.?

The DistributionNotice Of Withholding Form 5 New Direction IRA Inc. is a crucial document for individuals withdrawing from their retirement accounts. It details the withholding tax that may apply to your distribution. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can I complete the DistributionNotice Of Withholding Form 5 New Direction IRA Inc. using airSlate SignNow?

Completing the DistributionNotice Of Withholding Form 5 New Direction IRA Inc. with airSlate SignNow is straightforward. Simply upload your form, fill in the required fields, and eSign it using our intuitive interface. This saves time and ensures accuracy in your submissions.

-

What are the pricing options for using airSlate SignNow for the DistributionNotice Of Withholding Form 5 New Direction IRA Inc.?

airSlate SignNow offers flexible pricing plans, starting from a basic tier for individuals to advanced plans for businesses. Each plan allows you to send and eSign documents, including the DistributionNotice Of Withholding Form 5 New Direction IRA Inc., efficiently and affordably. Check our website for detailed pricing information.

-

What are the benefits of using airSlate SignNow for the DistributionNotice Of Withholding Form 5 New Direction IRA Inc.?

Using airSlate SignNow for the DistributionNotice Of Withholding Form 5 New Direction IRA Inc. provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your sensitive information is protected while also allowing for easy tracking of document status.

-

Can I access the DistributionNotice Of Withholding Form 5 New Direction IRA Inc. on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices. You can easily access, complete, and eSign the DistributionNotice Of Withholding Form 5 New Direction IRA Inc. from your smartphone or tablet, giving you the flexibility to manage your documents on the go.

-

Does airSlate SignNow integrate with other tools to manage the DistributionNotice Of Withholding Form 5 New Direction IRA Inc.?

Absolutely! airSlate SignNow offers integrations with various productivity and business tools, making it easy to manage the DistributionNotice Of Withholding Form 5 New Direction IRA Inc. alongside your existing workflows. Check our integrations page for a comprehensive list of compatible platforms.

-

What security measures are in place when using airSlate SignNow for the DistributionNotice Of Withholding Form 5 New Direction IRA Inc.?

Security is a top priority for airSlate SignNow. When handling the DistributionNotice Of Withholding Form 5 New Direction IRA Inc., we employ industry-leading encryption and compliance standards to protect your documents. Your data remains confidential and secure throughout the signing process.

Get more for DistributionNotice Of Withholding Form 5 New Direction IRA Inc

- Does omb no 3206 0134 need to be completed before scd changed form

- Attorney lawyer form

- Otc 905 form

- Privacy act consent form 100375428

- Bapplicationb for non immigrant visa the philippine embassy in port bb form

- Application to join a library 93833239 form

- Student directions build an atom activity answer key form

- Drug use evaluation template form

Find out other DistributionNotice Of Withholding Form 5 New Direction IRA Inc

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form