Enter on Line 1 Below, the Number of Personal Exemptions 2017

What is the Enter On Line 1 Below, The Number Of Personal Exemptions

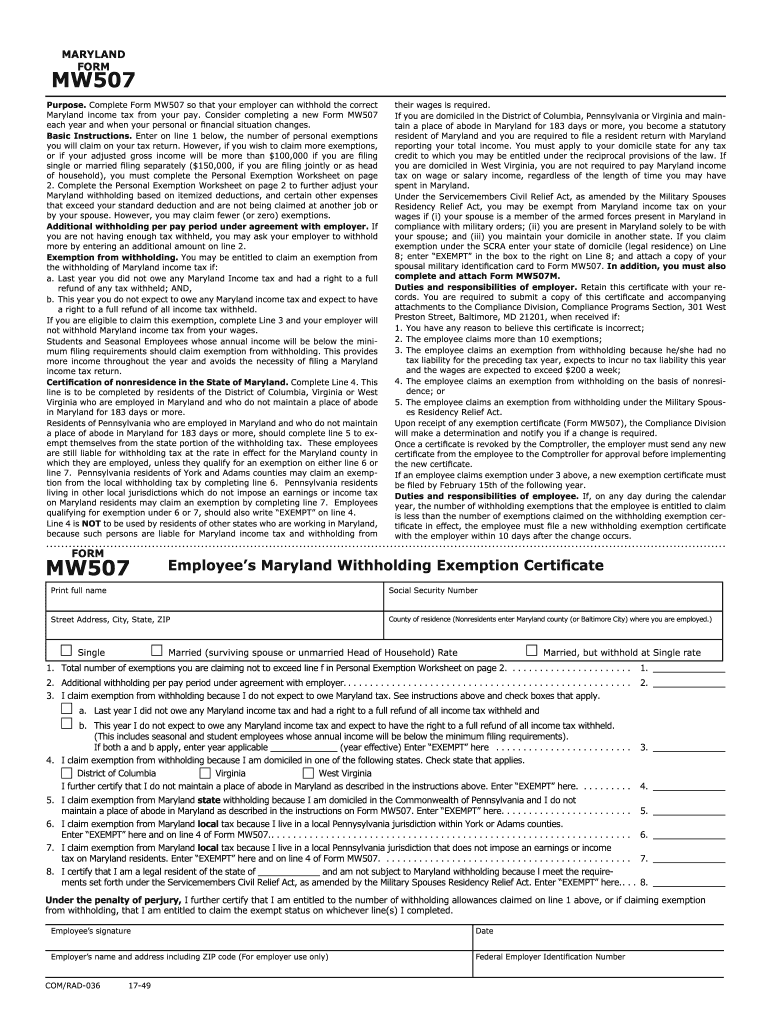

The "Enter On Line 1 Below, The Number Of Personal Exemptions" refers to a specific section on tax forms where taxpayers indicate the number of personal exemptions they are claiming for the tax year. This number directly impacts the taxpayer's overall tax liability, as each exemption reduces the taxable income. Understanding how to accurately report personal exemptions is crucial for ensuring compliance with IRS regulations and optimizing tax benefits.

Steps to complete the Enter On Line 1 Below, The Number Of Personal Exemptions

Completing the section for personal exemptions requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your filing status and the number of dependents.

- Locate the section on the tax form that specifies "Enter On Line 1 Below, The Number Of Personal Exemptions."

- Count the number of exemptions you are eligible to claim, including yourself, your spouse, and any dependents.

- Enter the total number of personal exemptions in the designated field, ensuring accuracy to avoid potential issues with the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding personal exemptions, which can change from year to year. For the current tax year, taxpayers should refer to IRS publications or the official IRS website for updates on exemption limits and eligibility criteria. It's essential to stay informed about any changes that may affect your tax return and personal exemptions.

Legal use of the Enter On Line 1 Below, The Number Of Personal Exemptions

Legally, the "Enter On Line 1 Below, The Number Of Personal Exemptions" section must be filled out accurately to ensure compliance with federal tax laws. Misreporting exemptions can lead to penalties, interest, or audits. Taxpayers are encouraged to consult tax professionals or refer to IRS resources to understand the legal implications of their reported exemptions.

Required Documents

To accurately complete the personal exemptions section, you may need the following documents:

- Previous year's tax return for reference.

- Social Security numbers for yourself and any dependents.

- Documentation proving eligibility for any claimed exemptions, such as birth certificates or adoption papers.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their completed forms, including:

- Online submission through e-filing platforms, which often provide guidance for filling out forms.

- Mailing a paper return to the appropriate IRS address based on your location.

- In-person submission at designated IRS offices, which may offer assistance for complex tax situations.

Quick guide on how to complete enter on line 1 below the number of personal exemptions

Your assistance manual on how to prepare your Enter On Line 1 Below, The Number Of Personal Exemptions

If you’re curious about how to finalize and dispatch your Enter On Line 1 Below, The Number Of Personal Exemptions, here are a few straightforward instructions on how to simplify tax processing.

Initially, you just need to create your airSlate SignNow account to alter the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures while being able to revert and update information as necessary. Optimize your tax management with enhanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to finalize your Enter On Line 1 Below, The Number Of Personal Exemptions within a few minutes:

- Create your account and begin working on PDFs in just a few minutes.

- Utilize our catalog to obtain any IRS tax form; navigate through versions and schedules.

- Click Obtain form to access your Enter On Line 1 Below, The Number Of Personal Exemptions in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your version, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can lead to increased return inaccuracies and delayed refunds. It goes without saying, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct enter on line 1 below the number of personal exemptions

FAQs

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

I have gained exemption in accounts in group 1 and when I recently filled my exam form, I forgot to fill the detail of the exemption. So, how can I correct the same?

Talk to ICAI examination deptt imediately. May be this would not be a problem at all. But dont take risk. And contact them, if possible personally face to face and not by phone.

Create this form in 5 minutes!

How to create an eSignature for the enter on line 1 below the number of personal exemptions

How to create an electronic signature for the Enter On Line 1 Below The Number Of Personal Exemptions online

How to generate an eSignature for the Enter On Line 1 Below The Number Of Personal Exemptions in Chrome

How to make an electronic signature for putting it on the Enter On Line 1 Below The Number Of Personal Exemptions in Gmail

How to create an electronic signature for the Enter On Line 1 Below The Number Of Personal Exemptions right from your smart phone

How to make an electronic signature for the Enter On Line 1 Below The Number Of Personal Exemptions on iOS devices

How to make an electronic signature for the Enter On Line 1 Below The Number Of Personal Exemptions on Android devices

People also ask

-

What does it mean to 'Enter On Line 1 Below, The Number Of Personal Exemptions'?

Entering 'On Line 1 Below, The Number Of Personal Exemptions' refers to the section in tax forms where individuals declare the exemptions they qualify for. This helps in calculating tax liabilities accurately. It's essential for our users to be aware of this when preparing documents that require electronic signatures.

-

How does airSlate SignNow streamline the process of handling personal exemptions?

With airSlate SignNow, businesses can quickly prepare and send tax documents that require individuals to 'Enter On Line 1 Below, The Number Of Personal Exemptions.' Our platform allows for seamless document edits and quick eSignatures, ensuring compliance and efficiency in handling sensitive tax information.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that fit various business needs. We believe in providing value, which is why our solutions are priced competitively, allowing you to manage documents and 'Enter On Line 1 Below, The Number Of Personal Exemptions' without breaking the bank. Contact us for a customized quote based on your requirements.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports various integrations with popular software applications, enhancing your workflow and productivity. You can easily integrate systems where you might need to 'Enter On Line 1 Below, The Number Of Personal Exemptions,' thus streamlining processes and keeping everything in sync.

-

What features does airSlate SignNow provide for document management?

Our platform includes features like templates, advanced signing options, and customization that allow users to prepare documents that require users to 'Enter On Line 1 Below, The Number Of Personal Exemptions.' These tools help speed up the document workflow and improve turnaround times for important signatures.

-

How does airSlate SignNow ensure document security?

Security is a top priority at airSlate SignNow. Our platform uses end-to-end encryption, secure cloud storage, and compliant practices to protect your documents, especially those requiring 'Enter On Line 1 Below, The Number Of Personal Exemptions.' You can trust that your data is safe as you manage sensitive information digitally.

-

Is there a mobile app for airSlate SignNow?

Yes, there is a mobile app available for airSlate SignNow, allowing you to manage documents on the go. This feature is crucial for users needing to quickly access documents and 'Enter On Line 1 Below, The Number Of Personal Exemptions' anytime and anywhere, making your workflow more flexible.

Get more for Enter On Line 1 Below, The Number Of Personal Exemptions

- Pima community college transcripts form

- Driver abstract statement of intent driver abstract statement of intent form

- Hospital art consultants form

- Cintas order form marine corps league auxiliary nationalmcla

- Notice nonpayment of rent eviction notice form

- G2112 form

- Mini mets cheer camp registration form estem pcs inc

- Sample the terry fox foundation form

Find out other Enter On Line 1 Below, The Number Of Personal Exemptions

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format