Maryland Form MW 507, Employee's Maryland Withholding 2023-2026

What is the Maryland Form MW 507, Employee's Maryland Withholding

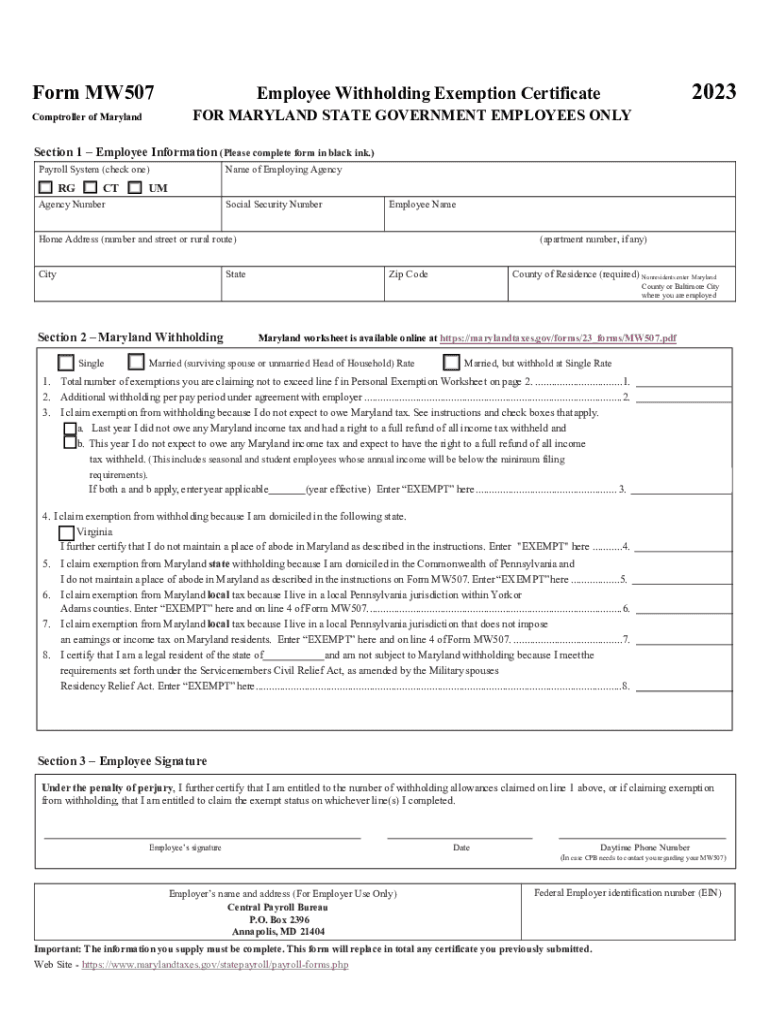

The Maryland Form MW 507 is a crucial document for employees working in Maryland. This form is used to determine the amount of state income tax that should be withheld from an employee's wages. It is essential for ensuring compliance with Maryland state tax laws. By accurately completing the MW 507, employees can adjust their withholding based on personal circumstances, such as marital status and the number of exemptions claimed.

Steps to complete the Maryland Form MW 507, Employee's Maryland Withholding

Filling out the Maryland MW 507 involves several straightforward steps:

- Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Exemptions: Specify the number of exemptions you are claiming. This affects the amount withheld.

- Additional Withholding: If you wish to have an additional amount withheld, you can specify that in the designated section.

- Signature: Sign and date the form to certify that the information provided is accurate.

Once completed, the form should be submitted to your employer for processing.

How to obtain the Maryland Form MW 507, Employee's Maryland Withholding

The Maryland Form MW 507 can be easily obtained through several methods. It is available for download from the official Maryland state government website. Additionally, employers may provide copies of the form to their employees as part of the onboarding process. If you prefer a physical copy, you can request one from your local tax office or other designated state offices.

Legal use of the Maryland Form MW 507, Employee's Maryland Withholding

The MW 507 form is legally required for employees in Maryland to ensure proper tax withholding. Employers are obligated to collect this form from their employees to comply with state tax regulations. Failure to submit a completed MW 507 can result in incorrect withholding amounts, potentially leading to tax liabilities for both the employee and employer. Therefore, it is essential to complete and submit this form accurately and on time.

Key elements of the Maryland Form MW 507, Employee's Maryland Withholding

Several key elements are essential to understand when completing the MW 507:

- Employee Information: Accurate personal details are crucial for identification and tax purposes.

- Filing Status: This determines the withholding rate and is based on your marital status.

- Exemption Claims: The number of exemptions impacts the amount withheld from your paycheck.

- Additional Withholding: Employees can request extra withholding if they anticipate owing more taxes.

Examples of using the Maryland Form MW 507, Employee's Maryland Withholding

Understanding how to use the MW 507 can be clarified through examples:

For instance, a single employee with no dependents may claim one exemption, resulting in a higher withholding amount compared to someone married with two children who may claim three exemptions. Additionally, an employee anticipating a significant tax bill might choose to have extra amounts withheld to avoid underpayment penalties. Each scenario illustrates the importance of accurately completing the MW 507 to align withholding with individual tax situations.

Quick guide on how to complete maryland form mw 507 employees maryland withholding

Complete Maryland Form MW 507, Employee's Maryland Withholding effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Maryland Form MW 507, Employee's Maryland Withholding on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The most efficient way to modify and electronically sign Maryland Form MW 507, Employee's Maryland Withholding with ease

- Locate Maryland Form MW 507, Employee's Maryland Withholding and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Edit and electronically sign Maryland Form MW 507, Employee's Maryland Withholding while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland form mw 507 employees maryland withholding

Create this form in 5 minutes!

How to create an eSignature for the maryland form mw 507 employees maryland withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MD withholding form 2023 and why is it important?

The MD withholding form 2023 is a crucial document that allows employers to report and withhold state income taxes from employee wages. Completing this form accurately ensures compliance with Maryland tax regulations and helps avoid potential penalties. Using airSlate SignNow can streamline the eSigning process, making it easier to manage.

-

How can airSlate SignNow help me with the MD withholding form 2023?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending the MD withholding form 2023. Our solution allows you to streamline document workflows, reduce paperwork, and ensure timely submissions. With features like templates and automated reminders, completing this essential form becomes hassle-free.

-

Is there a cost associated with using airSlate SignNow for the MD withholding form 2023?

Yes, airSlate SignNow provides a cost-effective solution for managing documents, including the MD withholding form 2023. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you can take advantage of our features without breaking the bank. Check our website to find the right plan for your needs.

-

Are there any integrations available for airSlate SignNow when handling the MD withholding form 2023?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications that can enhance your workflow when dealing with the MD withholding form 2023. Whether you need to connect with CRM systems, cloud storage, or accounting software, our platform supports integrations to improve efficiency.

-

Can I track the status of my MD withholding form 2023 using airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your MD withholding form 2023. You’ll receive notifications when the document is viewed and signed, ensuring you stay updated on its progress. This functionality helps you manage workflows and deadlines more effectively.

-

Is airSlate SignNow secure for managing the MD withholding form 2023?

Security is a top priority at airSlate SignNow. Our platform employs robust encryption and compliance standards to protect sensitive information within the MD withholding form 2023. You can trust that your documents are safe, giving you peace of mind when sending and storing important files.

-

How does airSlate SignNow enhance collaboration for the MD withholding form 2023?

airSlate SignNow enhances collaboration by allowing multiple users to access, edit, and sign the MD withholding form 2023 in real-time. This capability ensures that all stakeholders can contribute to the document, reducing bottlenecks and expediting the completion process. Experience effortless teamwork with our platform.

Get more for Maryland Form MW 507, Employee's Maryland Withholding

- Punitive damages be assessed against you if you do not relent in this malicious retaliatory form

- Serving notices during tenancy province of british columbia form

- Motion and order to recognize foreign judgments form

- Have passed until 20 form

- Notice to owner of obligation arising from conractcorporation form

- Installment agreement conservationtools form

- La rev stat94832 rs 94832cancellation of notice of form

- Know all men by these presents that as principal whose form

Find out other Maryland Form MW 507, Employee's Maryland Withholding

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application