How to Fill Out MW507 Form Single and Married Examples 2020

How to fill out the MW507 form for single and married taxpayers

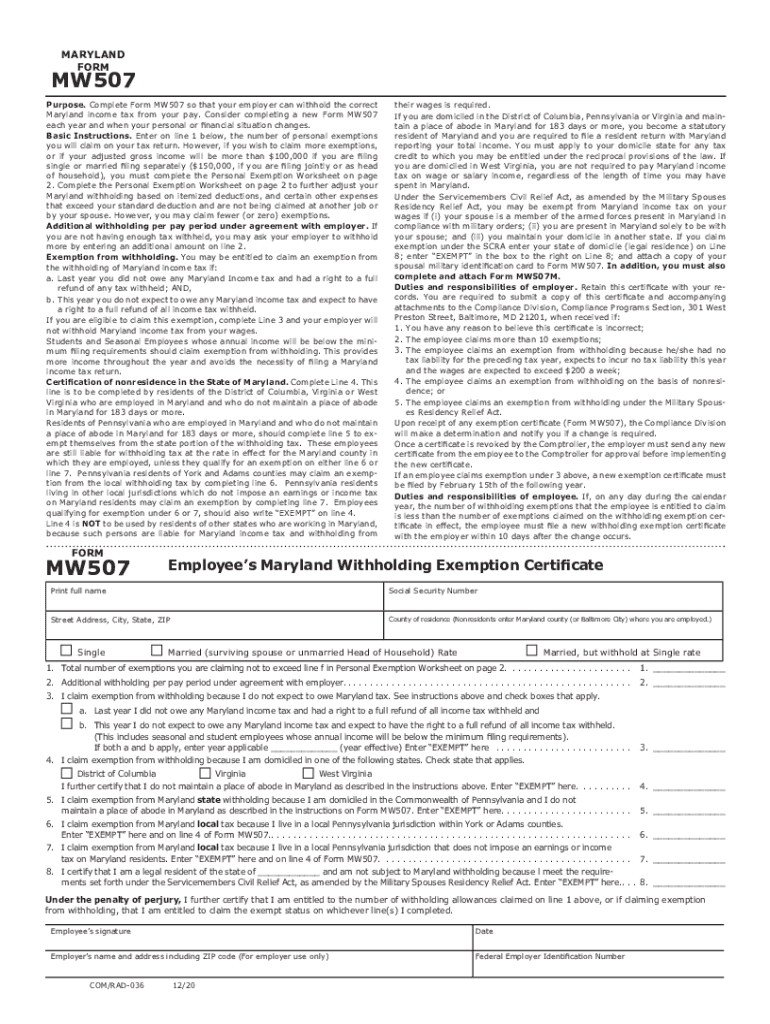

The MW507 form is essential for Maryland taxpayers to determine the correct amount of state income tax withholding. Filling out this form accurately is crucial for both single and married individuals. For single taxpayers, the process involves providing personal information, including your name, address, and Social Security number. You will also need to indicate your filing status and any additional allowances you wish to claim.

For married taxpayers, the form allows you to choose between filing jointly or separately. If filing jointly, both spouses' information must be included, and you may claim allowances based on combined income. If filing separately, each spouse must complete their own MW507 form, reflecting their individual income and allowances. Understanding these distinctions is vital to ensure proper withholding and avoid underpayment penalties.

Key elements of the MW507 form

The MW507 form includes several key elements that are essential for accurate completion. First, personal identification details such as your name, address, and Social Security number are required. Next, you must select your filing status, which can be single, married filing jointly, or married filing separately. Additionally, the form allows you to claim allowances, which directly affect the amount of tax withheld from your paycheck.

Another important section is the additional withholding option, where you can specify an extra amount to be withheld if you anticipate owing more taxes. Be sure to review the instructions provided with the form, as they outline how to calculate your allowances based on your specific tax situation.

Steps to complete the MW507 form

Completing the MW507 form involves several straightforward steps. Start by gathering your personal information, including your Social Security number and details about your spouse if applicable. Next, select your filing status and determine the number of allowances you can claim based on your financial situation.

Once you have filled in the necessary information, review the form for accuracy. It's important to double-check your entries to avoid errors that could lead to incorrect tax withholding. After ensuring everything is correct, submit the form to your employer, who will use it to adjust your state tax withholding accordingly.

Legal use of the MW507 form

The MW507 form serves a legal purpose in the context of Maryland state tax law. It is used by employers to determine the correct amount of state income tax to withhold from employees' paychecks. Proper completion of this form is essential to comply with state tax regulations and to ensure that employees do not face unexpected tax liabilities at the end of the year.

Employers are required to keep the completed MW507 forms on file for their records. This documentation helps demonstrate compliance with withholding requirements and provides a reference in case of audits or inquiries from tax authorities.

Filing deadlines and important dates for the MW507 form

Understanding the filing deadlines for the MW507 form is crucial for Maryland taxpayers. Generally, the MW507 form should be submitted to your employer as soon as you start a new job or if you experience a change in your tax situation, such as marriage or the birth of a child.

Additionally, it's important to keep in mind that while the MW507 itself does not have a specific submission deadline, the information it provides affects your state tax withholding throughout the year. Therefore, timely submission can help ensure that the correct amount is withheld from your paychecks, reducing the risk of underpayment at tax time.

Examples of using the MW507 form

Using the MW507 form can vary based on individual circumstances. For instance, a single taxpayer with no dependents would complete the form differently than a married couple with children. A single taxpayer might claim one allowance, while a married couple may choose to claim multiple allowances based on their combined income and dependents.

Consider a scenario where a married couple both work and have two children. They may decide to file jointly and claim allowances for themselves and their children, which would reduce the amount of state tax withheld from their paychecks. Conversely, if one spouse is a stay-at-home parent, the working spouse may choose to claim more allowances to reflect their lower overall tax liability.

Quick guide on how to complete how to fill out mw507 form single and married examples

Effortlessly Complete How To Fill Out MW507 Form Single And Married Examples on Any Gadget

Web-based document management has gained traction among entities and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed records, as you can acquire the appropriate format and securely archive it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your papers rapidly without delays. Manage How To Fill Out MW507 Form Single And Married Examples on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Edit and eSign How To Fill Out MW507 Form Single And Married Examples with Ease

- Obtain How To Fill Out MW507 Form Single And Married Examples and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which lasts mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then press the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device you prefer. Edit and eSign How To Fill Out MW507 Form Single And Married Examples to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill out mw507 form single and married examples

Create this form in 5 minutes!

How to create an eSignature for the how to fill out mw507 form single and married examples

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the md 507 form 2024 used for?

The md 507 form 2024 is a specific form used for official documentation and legal requests in 2024. It allows users to efficiently complete necessary paperwork, ensuring compliance with regulations. Using airSlate SignNow, you can quickly eSign and send the md 507 form 2024 to streamline your document management process.

-

How can airSlate SignNow help with the md 507 form 2024?

airSlate SignNow provides an intuitive platform for managing the md 507 form 2024, allowing users to eSign and send the form electronically. This not only saves time but also reduces errors that can occur with manual processing. With our solution, businesses can efficiently handle their document workflows involving the md 507 form 2024.

-

Is there a cost to use airSlate SignNow for the md 507 form 2024?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Pricing for using airSlate SignNow with the md 507 form 2024 starts at a competitive rate, allowing businesses to choose a plan that fits their budget. The investment in our platform ultimately leads to increased productivity and reduced operational costs.

-

Can I integrate airSlate SignNow with other software for the md 507 form 2024?

Absolutely! airSlate SignNow offers integrations with popular software applications, making it easy to manage the md 507 form 2024 alongside your existing tools. Whether you need to sync data with your CRM or project management tool, our platform facilitates seamless integration to enhance your workflow.

-

What features does airSlate SignNow offer for the md 507 form 2024?

airSlate SignNow includes a range of features specifically designed to streamline the management of the md 507 form 2024. These features include secure eSigning, document templates, and real-time tracking, all of which ensure a smooth and efficient signing process. Users benefit from automation tools that simplify document handling.

-

How secure is the airSlate SignNow platform for signing the md 507 form 2024?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols to protect your documents, including the md 507 form 2024. Our compliance with industry standards ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Are there templates available for the md 507 form 2024 in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for the md 507 form 2024, allowing users to easily create and modify documents. Using templates speeds up the process of filling out and sending forms, ensuring that all necessary information is accurately captured. This feature greatly enhances efficiency in document management.

Get more for How To Fill Out MW507 Form Single And Married Examples

- Locker combination cheat sheet form

- Alabama a 4 form pdf

- Ertragsvorschau form

- Pu101 form 21

- The wheel of life form

- Iha requesting release of information

- If you confirm that the file is coming from a trusted source you can send the following sha 256 hash value to your admin for form

- For a limited certificate of admission to practice law in south carolina pursuant to rule 405 scacr form

Find out other How To Fill Out MW507 Form Single And Married Examples

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple