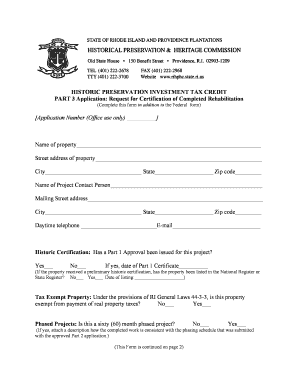

HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri Form

Understanding the Historic Preservation Investment Tax Credit Part 3

The Historic Preservation Investment Tax Credit Part 3 is a crucial component of the federal tax incentive program designed to encourage the rehabilitation of historic buildings. This tax credit allows property owners to recover a percentage of the costs associated with the rehabilitation of certified historic structures. The program aims to promote the preservation of America's architectural heritage while stimulating local economies. To qualify, properties must meet specific criteria, including being listed on the National Register of Historic Places or contributing to a registered historic district.

Steps to Complete the Historic Preservation Investment Tax Credit Part 3

Completing the Historic Preservation Investment Tax Credit Part 3 involves several key steps. First, ensure that your property is eligible by confirming its status on the National Register of Historic Places. Next, gather all necessary documentation that demonstrates the rehabilitation work completed. This includes detailed descriptions, photographs, and invoices for the work performed. Once you have compiled the required materials, fill out the appropriate forms accurately, ensuring all information is complete and clear. Finally, submit your application to the relevant state historic preservation office for review.

Eligibility Criteria for the Historic Preservation Investment Tax Credit Part 3

To qualify for the Historic Preservation Investment Tax Credit Part 3, certain eligibility criteria must be met. The property must be a certified historic structure, which means it is either individually listed on the National Register of Historic Places or contributes to a registered historic district. Additionally, the rehabilitation work must meet the Secretary of the Interior's Standards for Rehabilitation, ensuring that the historical integrity of the property is maintained. The property must also be used for income-producing purposes, such as rental or commercial use, to be eligible for the tax credit.

Required Documents for the Historic Preservation Investment Tax Credit Part 3

When applying for the Historic Preservation Investment Tax Credit Part 3, specific documents are required to support your application. These documents typically include:

- A completed application form detailing the rehabilitation work.

- Photographs of the property before, during, and after rehabilitation.

- Invoices and receipts for all work completed.

- Documentation proving the property's historic status.

- Any additional materials that demonstrate compliance with the Secretary of the Interior's Standards.

Filing Deadlines for the Historic Preservation Investment Tax Credit Part 3

Filing deadlines for the Historic Preservation Investment Tax Credit Part 3 are critical to ensure timely processing of your application. Generally, the application should be submitted within a specific timeframe following the completion of the rehabilitation work. It is advisable to consult the guidelines provided by the state historic preservation office for exact dates and any potential extensions. Staying aware of these deadlines can help avoid delays in receiving your tax credit.

IRS Guidelines for the Historic Preservation Investment Tax Credit Part 3

The IRS provides comprehensive guidelines for the Historic Preservation Investment Tax Credit Part 3, outlining the requirements and procedures for claiming the credit. These guidelines include information on eligible expenditures, necessary documentation, and the calculation of the tax credit amount. It is essential to review these guidelines thoroughly to ensure compliance and maximize your potential benefits from the program.

Quick guide on how to complete historic preservation investment tax credit part 3 preservation ri

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] seamlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and then click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri

Create this form in 5 minutes!

How to create an eSignature for the historic preservation investment tax credit part 3 preservation ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri?

The HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri is a financial incentive aimed at encouraging the restoration and preservation of historic properties. This tax credit can signNowly reduce the cost of renovation projects, making it an attractive option for property owners and investors in Rhode Island.

-

How can the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri benefit my project?

Utilizing the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri can result in substantial financial savings, enabling property owners to invest more in preserving historical characteristics. This tax credit not only enhances the value of your property but also contributes to the preservation of Rhode Island's cultural heritage.

-

What are the eligibility requirements for the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri?

To qualify for the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri, your property must meet certain historical significance criteria and comply with state and federal preservation standards. Additionally, projects must be completed within a specified timeframe to ensure compliance with the credit requirements.

-

How does the application process for the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri work?

The application process for the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri involves submitting detailed project plans, photographs, and documentation of historical significance to the appropriate state authority. It’s vital to follow all guidelines to ensure a smooth application and approval process.

-

Can I combine the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri with other tax incentives?

Yes, in many cases, the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri can be combined with other state and federal tax incentives. However, it’s important to consult with a tax professional to understand how these credits can work together for your specific situation.

-

What types of projects qualify for the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri?

Various projects qualify for the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri, including restorations, rehabilitations, and renovations of historic buildings. Work must focus on maintaining the historical integrity while making improvements that comply with preservation standards.

-

What are the financial implications of using the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri?

The financial implications of using the HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri can be signNow, potentially covering up to 20% of qualified rehabilitation expenses. This allows property owners to maximize their investment in restoring historic properties, leading to improved property values and financial returns.

Get more for HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri

Find out other HISTORIC PRESERVATION INVESTMENT TAX CREDIT PART 3 Preservation Ri

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application