Mi Nr 2014-2026

Understanding the Mi Nr

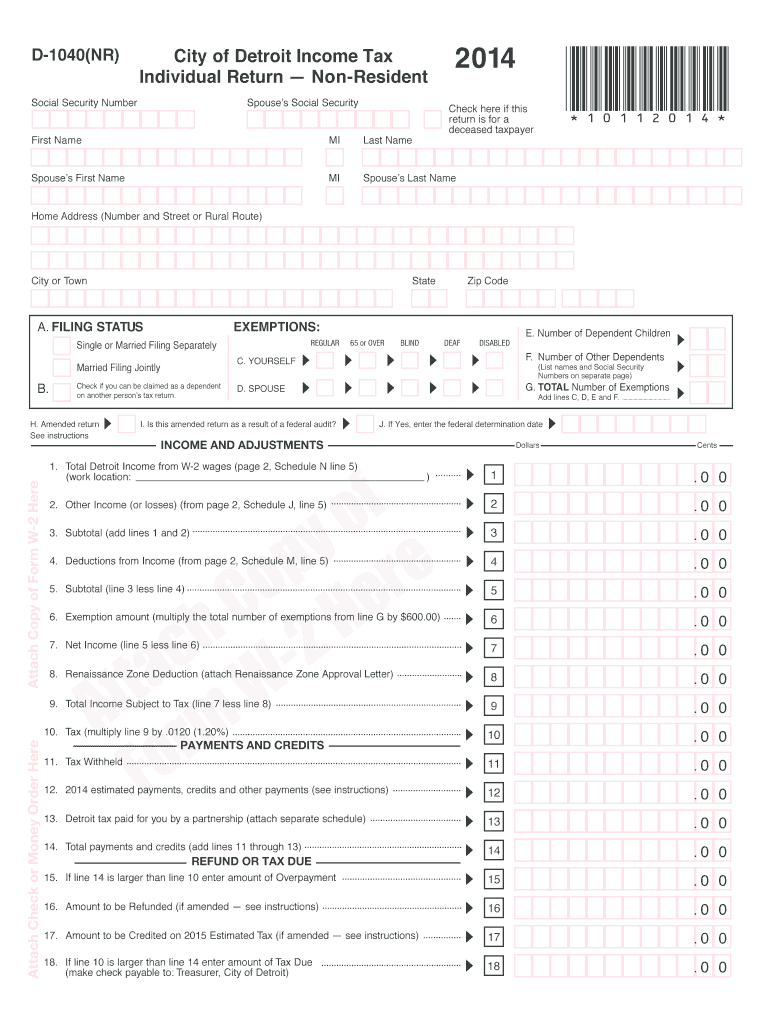

The Mi Nr, or Michigan Non-Resident Income Tax Return, is a crucial document for individuals who earn income in Michigan but reside in another state. This form is specifically designed for non-residents who need to report their income derived from Michigan sources. Understanding the Mi Nr is essential for ensuring compliance with state tax laws and avoiding potential penalties.

Non-residents must file this return if they have income from Michigan sources, such as wages, rental income, or business profits. The Mi Nr helps determine the amount of tax owed to the state based on the income generated within its borders.

Steps to Complete the Mi Nr

Completing the Mi Nr involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including W-2 forms, 1099s, and any other income statements related to your Michigan earnings. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from Michigan sources, ensuring you include all relevant earnings.

- Calculate your tax liability using the appropriate Michigan tax rates.

- Claim any applicable credits or deductions to lower your tax bill.

- Review your completed form for accuracy before submitting it.

Once completed, the Mi Nr can be submitted electronically or via mail, depending on your preference.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for avoiding penalties. For the Mi Nr, the standard deadline for submission aligns with the federal tax deadline, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year.

Additionally, if you owe taxes, payments should be made by the same deadline to avoid interest and penalties. Early filing is encouraged to ensure timely processing and to address any potential issues that may arise.

Required Documents

To successfully file the Mi Nr, certain documents are required. These include:

- W-2 forms from employers for income earned in Michigan.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any rental income or business profits sourced from Michigan.

- Proof of any tax credits or deductions you plan to claim.

Having these documents organized and readily available will streamline the filing process and help ensure accuracy in reporting your income and tax liability.

IRS Guidelines

When filing the Mi Nr, it is essential to adhere to IRS guidelines regarding income reporting and tax obligations. The IRS requires that all income be reported accurately, regardless of the taxpayer's residency status. Non-residents must ensure they are following both Michigan state regulations and federal tax laws.

For specific guidance, the IRS provides resources and publications that outline the requirements for non-resident taxpayers. Staying informed about these guidelines can help prevent errors and ensure compliance with tax laws.

Penalties for Non-Compliance

Failing to file the Mi Nr or inaccurately reporting income can result in significant penalties. Michigan imposes fines for late filings and underpayment of taxes. These penalties can accumulate quickly, leading to increased financial burden.

To avoid penalties, it is crucial to file the Mi Nr on time and ensure that all income is reported accurately. If you are unsure about your tax obligations, seeking assistance from a tax professional can be beneficial.

Quick guide on how to complete form d 1040 nrpdffillercom 2014 2018

Your assistance manual on how to prepare your Mi Nr

If you’re interested in understanding how to finalize and submit your Mi Nr, here are some brief recommendations on how to streamline the tax submission process.

To start, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and complete your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit any answers that need adjustment. Simplify your tax administration with enhanced PDF editing, eSigning, and straightforward sharing options.

Follow the instructions below to finish your Mi Nr in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Mi Nr in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Kindly be aware that submitting by paper can lead to return errors and delay refunds. Before e-filing your taxes, remember to consult the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct form d 1040 nrpdffillercom 2014 2018

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the form d 1040 nrpdffillercom 2014 2018

How to make an electronic signature for your Form D 1040 Nrpdffillercom 2014 2018 online

How to create an eSignature for your Form D 1040 Nrpdffillercom 2014 2018 in Google Chrome

How to create an eSignature for putting it on the Form D 1040 Nrpdffillercom 2014 2018 in Gmail

How to create an eSignature for the Form D 1040 Nrpdffillercom 2014 2018 from your smartphone

How to make an electronic signature for the Form D 1040 Nrpdffillercom 2014 2018 on iOS devices

How to make an eSignature for the Form D 1040 Nrpdffillercom 2014 2018 on Android devices

People also ask

-

What is Mi Nr. in the context of airSlate SignNow?

Mi Nr. is a unique identifier used within airSlate SignNow to track and manage documents efficiently. By incorporating your Mi Nr. into the platform, you can easily access and organize your signed documents, ensuring that your workflow remains streamlined and efficient.

-

How does airSlate SignNow pricing work with Mi Nr.?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Each plan allows you to utilize your Mi Nr. for tracking and organizing your documents, making it a cost-effective solution for businesses of all sizes.

-

Can I customize the Mi Nr. settings in airSlate SignNow?

Yes, you can customize your Mi Nr. settings within airSlate SignNow to enhance your document management process. This feature allows you to tailor how you track and identify your documents, providing a more personalized experience.

-

What are the key features of airSlate SignNow related to Mi Nr.?

Key features of airSlate SignNow related to Mi Nr. include document tracking, automated workflows, and customizable templates. These features help you streamline your eSigning process and maintain organization, making it easier to manage your documents effectively.

-

How does airSlate SignNow enhance document security with Mi Nr.?

airSlate SignNow enhances document security by using Mi Nr. for tracking all signed documents securely. This unique identifier helps ensure that your documents are easily traceable and protected, providing peace of mind for businesses handling sensitive information.

-

What integrations does airSlate SignNow offer that utilize Mi Nr.?

airSlate SignNow offers various integrations with popular applications that utilize Mi Nr. for document tracking and management. These integrations enable seamless workflows across different platforms, enhancing productivity and efficiency for your business.

-

What benefits does using Mi Nr. provide in airSlate SignNow?

Using Mi Nr. in airSlate SignNow offers several benefits, including improved document organization, enhanced tracking capabilities, and streamlined workflows. These advantages help businesses save time and reduce errors in their document management processes.

Get more for Mi Nr

- H ez form

- Earning statement 100064697 form

- Dog license application gloucester county virginia gloucesterva form

- Mn short form power of attorney fillable

- Applebees flapjack fundraiser waiver form

- Lic50 form

- Cost letter request form for tiers iii iv and vi members code sb64 form

- F80 verification letter form

Find out other Mi Nr

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT