Cityofdetroitincometaxnonresidentform 2011

What is the Cityofdetroitincometaxnonresidentform

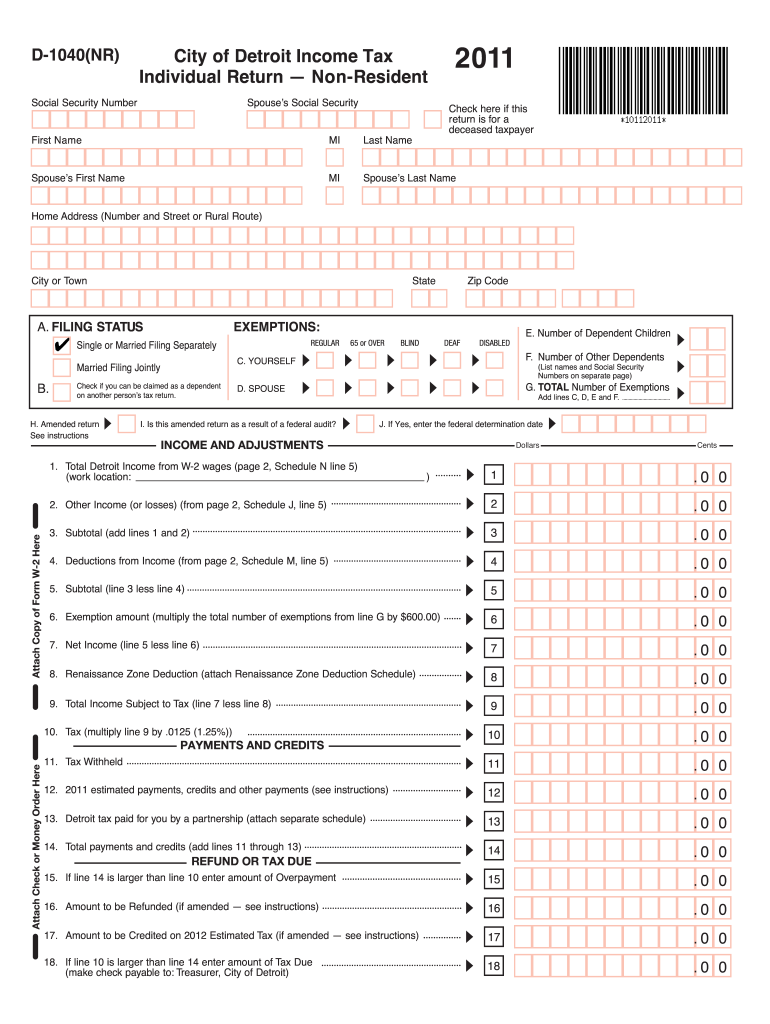

The Cityofdetroitincometaxnonresidentform is a specific tax document used by non-residents who earn income within the city of Detroit. This form enables individuals who do not reside in Detroit but have taxable income sourced from the city to report their earnings accurately. It is essential for ensuring compliance with local tax regulations and helps facilitate the proper assessment of tax liabilities for non-residents. Understanding this form is crucial for anyone earning income in Detroit while maintaining residency elsewhere.

How to use the Cityofdetroitincometaxnonresidentform

Using the Cityofdetroitincometaxnonresidentform involves several steps. First, gather all necessary documentation, such as income statements and identification. Next, fill out the form with accurate information regarding your income earned in Detroit. Ensure that all sections are completed thoroughly to avoid delays or issues with processing. Once completed, sign the form electronically or by hand, depending on your submission method. Finally, submit the form by your chosen method—online, by mail, or in person—to ensure timely processing.

Steps to complete the Cityofdetroitincometaxnonresidentform

Completing the Cityofdetroitincometaxnonresidentform involves a systematic approach:

- Collect your income documentation, including W-2s or 1099s.

- Access the form through the appropriate channels, ensuring you have the latest version.

- Fill in your personal details, including your name, address, and Social Security number.

- Report your income earned in Detroit accurately, ensuring all figures are correct.

- Review the form for any errors or omissions before signing it.

- Choose your submission method—e-filing, mailing, or delivering in person—and follow the necessary steps for that method.

Legal use of the Cityofdetroitincometaxnonresidentform

The legal use of the Cityofdetroitincometaxnonresidentform is governed by local tax laws and regulations. Non-residents must file this form to report income earned within the city limits to comply with Detroit's income tax requirements. Failure to submit the form may result in penalties or legal consequences. It is important to ensure that the form is filled out accurately and submitted on time to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Cityofdetroitincometaxnonresidentform typically align with federal tax deadlines. Non-residents should be aware of the following important dates:

- The standard filing deadline is usually April 15 for the previous tax year.

- If you are unable to meet this deadline, you may request an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

- Keep track of any changes in local tax laws that may affect deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Cityofdetroitincometaxnonresidentform can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online: E-filing is available through approved platforms, allowing for quick and secure submission.

- Mail: You can print the completed form and send it to the designated tax office address.

- In-Person: Submitting the form in person at local tax offices is also an option for those who prefer direct interaction.

Quick guide on how to complete cityofdetroitincometaxnonresidentform 2011

Your assistance manual on how to prepare your Cityofdetroitincometaxnonresidentform

If you’re curious about how to create and submit your Cityofdetroitincometaxnonresidentform, here are some concise guidelines on how to simplify tax filing.

To start, you simply need to register your airSlate SignNow account to transform your document management online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to modify, create, and complete your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to alter information as necessary. Streamline your tax handling with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Cityofdetroitincometaxnonresidentform in no time:

- Create your account and begin working on PDFs within minutes.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Cityofdetroitincometaxnonresidentform in our editor.

- Input the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it onto your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper may increase return errors and postpone refunds. Of course, before e-filing your taxes, review the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct cityofdetroitincometaxnonresidentform 2011

FAQs

-

What are the key UX trends to watch out for in 2011?

I agree with a lot of what is being outlined here. In addition, here's what I think lies on the horizon.Relevancy Based Content Delivery: Stuff that interests you delivered to you in the real world where most relevant (sort of like minority report delivered ads) - We already see smart ads being delivered across the web through facebook and shopping - soon it will appear in the real world.Media Listening Devices - I think we are going to see more devices that "listen" to the surrounding atmosphere and deliver content. It will start with TV and Movies and then start signNowing out into the real world through the use of a combination of GEO and Real World HarmonicsMore Touch - Touch screens will become the norm wherever button interactions happen now (ATMS, Gas Stations, etc)NoTouch Gesture UI - Just as touch devices are pushing mouse and keyboard input away, not even having to the screen will be the next thing. Stand in one spot, swipe the air.Screen-less displays - Soon anything will become a display even air. Holographic projections could start seeing there way into our lives.Ubiquitious Computing - I am waiting for the day when we carry one device that we use on the go, then access from our desktop then access through our TV Sets at home. Everywhere you go, your computer is with you.I think that is it for now....g

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

What are the best fashion startups to keep an eye out for in 2011?

Fashion inspiration: Pinterest - http://pinterest.com/ Polyvore - http://www.polyvore.comEmerging designer discovery: Fashionstake - http://Fashionstake.com Of A Kind - http://ofakind.com/ Boticca - http://boticca.com/ Fabricly - http://www.fabricly.com/Vintage luxury online marketplace: 1st Dibs - http://www.1stdibs.com/ Portero - http://www.portero.com/Cheap chic (subscription model, monthly stylist picks): Shoedazzle - http://www.shoedazzle.com/ Jewelmint - http://www.jewelmint.com/ BeautyMint - http://www.beautymint.com/ StyleMint - http://www.stylemint.com/ JustFabulous - http://www.justfab.com/Clothing line business model innovation (launching lines over the web, cutting out middlemen): Bonobos - http://www.bonobos.com/ Everlane - http://www.everlane.com

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How can I max out my mid-2011 iMac 27"?

Replace your hard drive with an SSD. You will be amazed at what a difference that will make for your iMac. Fair waring: this is not an easy task. I upgraded my 2011 15" Macbook Pro to an SSD, and that was pretty easy. I also upgraded my son's 2011 21" iMac to an SSD and that was easily the most difficult hardware upgrade I've ever done. If you're not comfortable and experienced, find someone to do it for you. Fortunately, the benefits far outweigh the costs and effort involved in the upgrade. Your computer will feel better than new. When you think about all the advances in CPU, memory, and GPU technology over the last 20 years, and then compare that to hard drive technology, it is easy to see the problem. Hard drive capacities have grown dramatically over the years, but very little has changed to improve speed. I'm pretty sure your iMac has a 5400 rpm platter drive, which is slow even by hard drive standard. Fortunately, your iMac supports SATA III drives, so the potential is there. If you're ready for 15 second start up times, nearly instantaneous program launches and blazing fast file load times, get that SSD! It will extend the life of what is otherwise an excellent computer with a very powerful CPU and plenty of DRAM. My final pitch: I've been in the computer hardware business for over 20 years. I've built by hand scores of PCs, and upgraded even more PCs and Macs. I've upgraded DRAM, CPU, and graphics cards. Nothing can compare to the impact of upgrading from a traditional hard drive to an SSD. The wow factor can't be overstated.

Create this form in 5 minutes!

How to create an eSignature for the cityofdetroitincometaxnonresidentform 2011

How to generate an electronic signature for the Cityofdetroitincometaxnonresidentform 2011 in the online mode

How to generate an eSignature for your Cityofdetroitincometaxnonresidentform 2011 in Chrome

How to make an electronic signature for putting it on the Cityofdetroitincometaxnonresidentform 2011 in Gmail

How to create an eSignature for the Cityofdetroitincometaxnonresidentform 2011 straight from your smartphone

How to make an eSignature for the Cityofdetroitincometaxnonresidentform 2011 on iOS

How to make an electronic signature for the Cityofdetroitincometaxnonresidentform 2011 on Android OS

People also ask

-

What is the Cityofdetroitincometaxnonresidentform, and who needs it?

The Cityofdetroitincometaxnonresidentform is a document required for non-residents who earn income in Detroit. This form helps ensure that non-residents comply with local tax regulations and pay the necessary taxes on their earnings. If you work in Detroit but reside elsewhere, this form is essential for your tax filings.

-

How can airSlate SignNow help with the Cityofdetroitincometaxnonresidentform?

airSlate SignNow simplifies the process of completing and submitting the Cityofdetroitincometaxnonresidentform. With its easy-to-use interface, you can fill out the form electronically, eSign it, and send it directly to the tax authorities. This streamlines the process, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the Cityofdetroitincometaxnonresidentform?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs. While the cost may vary based on the plan you choose, the service remains cost-effective compared to traditional paper filing methods. With the subscription, you'll gain access to additional features that enhance your eSigning experience.

-

What features does airSlate SignNow offer for the Cityofdetroitincometaxnonresidentform?

airSlate SignNow provides a range of features for the Cityofdetroitincometaxnonresidentform, including customizable templates, document sharing, and secure eSigning. These features ensure that your forms are filled out accurately and sent securely. Additionally, you can track the progress of your document submissions in real-time.

-

Can airSlate SignNow integrate with other software for processing the Cityofdetroitincometaxnonresidentform?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions such as Google Drive, Microsoft Office, and various CRM platforms. This functionality enhances your workflow and makes it easier to manage documents like the Cityofdetroitincometaxnonresidentform alongside your other business processes.

-

What are the benefits of using airSlate SignNow for tax forms like the Cityofdetroitincometaxnonresidentform?

Using airSlate SignNow for tax forms like the Cityofdetroitincometaxnonresidentform offers numerous benefits, including increased efficiency and reduced processing time. The electronic signature capabilities mean you can finalize your forms quickly without the hassle of printing and mailing. Additionally, the platform enhances compliance by ensuring your forms are properly filled and securely submitted.

-

How secure is the process of signing the Cityofdetroitincometaxnonresidentform with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform implements advanced encryption and complies with industry-standard security protocols to protect your data. When signing the Cityofdetroitincometaxnonresidentform, you can trust that your information is safe and securely handled throughout the entire process.

Get more for Cityofdetroitincometaxnonresidentform

- Leveattest form

- Iglr assessment pdf form

- South carolina department of revenue form 1606

- Lpc name change andor duplicate license form texas gov

- Softball player profile template pdf 17719075 form

- Honoring choices mn pdf form

- Hormone replacement therapy mammogram waiver form

- Neuromuscular re education intake form

Find out other Cityofdetroitincometaxnonresidentform

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT