Cityofdetroitincometaxnonresidentform 2013

What is the Cityofdetroitincometaxnonresidentform

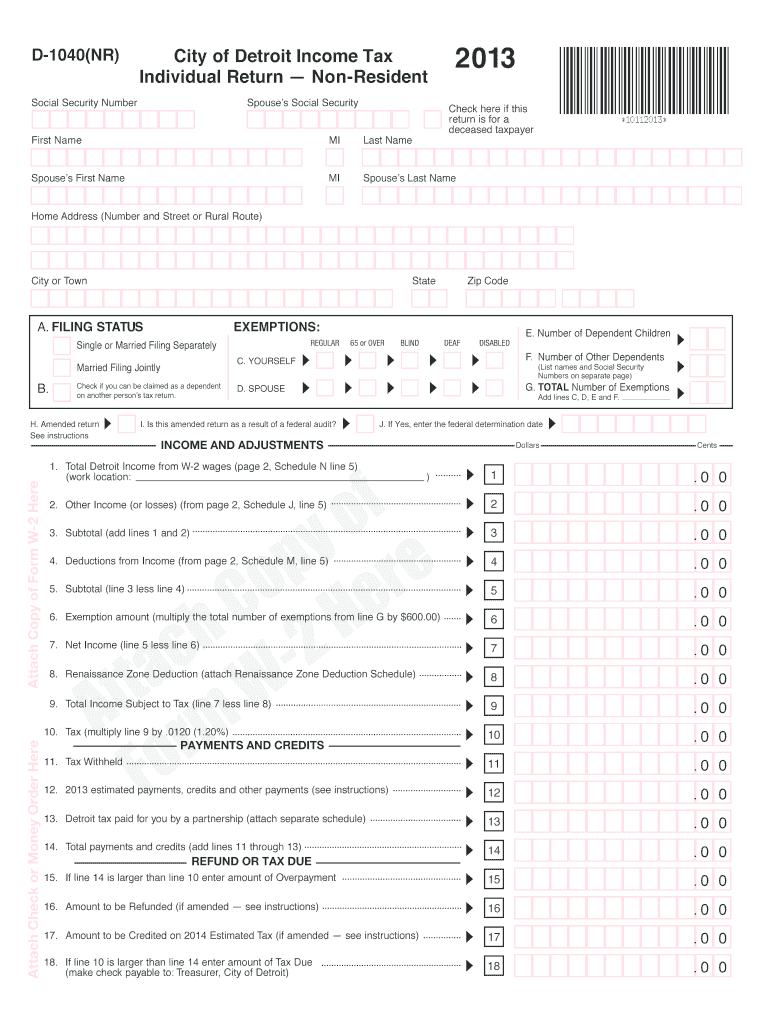

The Cityofdetroitincometaxnonresidentform is a specific tax document designed for individuals who earn income within the city of Detroit but are not residents. This form allows nonresidents to report their income and pay any applicable city income taxes. It is essential for compliance with local tax laws and ensures that nonresidents contribute fairly to the city's revenue based on their earnings within the jurisdiction.

How to use the Cityofdetroitincometaxnonresidentform

To effectively use the Cityofdetroitincometaxnonresidentform, individuals should first gather all necessary income documentation, such as W-2s or 1099s. Once the form is obtained, it should be filled out accurately, reflecting all income earned in Detroit. After completing the form, nonresidents can submit it electronically or via mail, depending on their preference and the submission methods available. Ensuring accuracy and timely submission is crucial to avoid penalties.

Steps to complete the Cityofdetroitincometaxnonresidentform

Completing the Cityofdetroitincometaxnonresidentform involves several key steps:

- Obtain the latest version of the form from the appropriate city tax authority.

- Fill in personal information, including name, address, and Social Security number.

- Report all income earned in Detroit, using supporting documents as needed.

- Calculate the tax owed based on the income reported.

- Review the form for accuracy and completeness.

- Sign and date the form, ensuring compliance with eSignature requirements if submitting electronically.

- Submit the completed form by the specified deadline.

Key elements of the Cityofdetroitincometaxnonresidentform

The Cityofdetroitincometaxnonresidentform includes several key elements that must be completed accurately:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Nonresidents must detail all income earned within Detroit.

- Tax Calculation: The form includes a section for calculating the total tax owed based on reported income.

- Signature: A signature is required to validate the form, which can be done electronically.

Filing Deadlines / Important Dates

Filing deadlines for the Cityofdetroitincometaxnonresidentform typically align with the federal tax filing deadlines. It is essential for nonresidents to be aware of these dates to avoid late fees and penalties. Generally, the deadline for filing is April 15 of each year, unless it falls on a weekend or holiday, in which case it may be extended to the next business day. Keeping track of these important dates ensures compliance with local tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Cityofdetroitincometaxnonresidentform can be submitted through various methods, providing flexibility for nonresidents. Options typically include:

- Online Submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: The form can be printed and sent via postal service to the designated tax authority.

- In-Person: Nonresidents may also choose to submit the form in person at local tax offices, if available.

Quick guide on how to complete cityofdetroitincometaxnonresidentform 2013

Your assistance manual on how to prepare your Cityofdetroitincometaxnonresidentform

If you’re curious about how to finalize and submit your Cityofdetroitincometaxnonresidentform, here are some concise guidelines to simplify tax submission.

To begin, you just need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally intuitive and efficient document solution that enables you to edit, draft, and finalize your tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to modify responses as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and hassle-free sharing.

Follow the instructions below to complete your Cityofdetroitincometaxnonresidentform in just a few minutes:

- Create your account and start processing PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to open your Cityofdetroitincometaxnonresidentform in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Signature Tool to add your legally-recognized electronic signature (if necessary).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing may increase errors and prolong refunds. Prior to electronically filing your taxes, please consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct cityofdetroitincometaxnonresidentform 2013

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

Can I fill out an income tax return for FY 2012-2013?

According to section 139 (1) of the Income Tax Act, 1961:Every person —

Create this form in 5 minutes!

How to create an eSignature for the cityofdetroitincometaxnonresidentform 2013

How to generate an eSignature for your Cityofdetroitincometaxnonresidentform 2013 in the online mode

How to generate an electronic signature for the Cityofdetroitincometaxnonresidentform 2013 in Google Chrome

How to create an electronic signature for signing the Cityofdetroitincometaxnonresidentform 2013 in Gmail

How to generate an electronic signature for the Cityofdetroitincometaxnonresidentform 2013 right from your mobile device

How to generate an eSignature for the Cityofdetroitincometaxnonresidentform 2013 on iOS

How to generate an eSignature for the Cityofdetroitincometaxnonresidentform 2013 on Android

People also ask

-

What is the Cityofdetroitincometaxnonresidentform?

The Cityofdetroitincometaxnonresidentform is a tax document required for non-residents working in Detroit. This form helps ensure compliance with local tax regulations and can greatly simplify the filing process for non-residents.

-

How can airSlate SignNow help with the Cityofdetroitincometaxnonresidentform?

With airSlate SignNow, you can easily create, send, and eSign the Cityofdetroitincometaxnonresidentform. Our platform provides a user-friendly interface that streamlines document management, allowing you to focus on your work while ensuring tax compliance.

-

Is there a cost associated with using airSlate SignNow for the Cityofdetroitincometaxnonresidentform?

airSlate SignNow offers competitive pricing plans, making it cost-effective for businesses needing to manage the Cityofdetroitincometaxnonresidentform. You can choose from various subscription options to suit your organization's needs while staying within budget.

-

Can I integrate airSlate SignNow with other software for the Cityofdetroitincometaxnonresidentform?

Yes, airSlate SignNow supports integrations with popular software applications, making it easier to handle the Cityofdetroitincometaxnonresidentform. You can automate workflows and sync data seamlessly to enhance productivity.

-

What features does airSlate SignNow offer for handling the Cityofdetroitincometaxnonresidentform?

Our platform offers features like customizable templates, secure eSigning, automated reminders, and real-time tracking. These capabilities make managing the Cityofdetroitincometaxnonresidentform efficient and hassle-free.

-

How secure is the airSlate SignNow platform for the Cityofdetroitincometaxnonresidentform?

The airSlate SignNow platform prioritizes security, employing advanced encryption protocols to protect your documents, including the Cityofdetroitincometaxnonresidentform. Your sensitive information remains secure throughout the signing process.

-

Is it easy to use airSlate SignNow for beginners managing the Cityofdetroitincometaxnonresidentform?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for beginners to navigate. You can quickly learn how to create and manage the Cityofdetroitincometaxnonresidentform without extensive training.

Get more for Cityofdetroitincometaxnonresidentform

- Permission for medical treatment form

- Da form 3433 100084195

- Ameritech college transcript request form

- Dj le 247 wisconsin department of justice doj state wi form

- Us financial life insurance form

- Cigna specialty pharmacy infertility form

- Hra documentation guide amazon web form

- Ldss 5145 referral for child support services ldss 5145 referral for child support services form

Find out other Cityofdetroitincometaxnonresidentform

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now