EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE Form

What is the Employees Withholding Allowance Certificate?

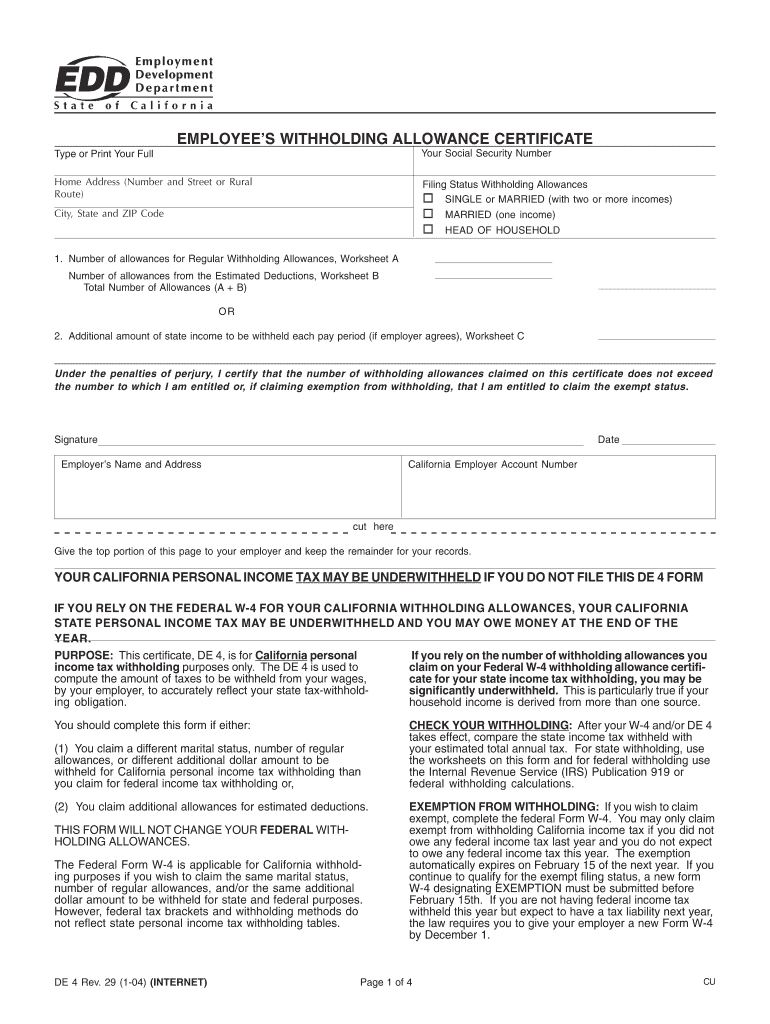

The Employees Withholding Allowance Certificate, commonly referred to as Form W-4, is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form helps determine the amount of federal income tax that should be withheld from an employee's paycheck. By providing information about personal circumstances, such as marital status and number of dependents, employees can ensure that the correct amount of tax is withheld throughout the year, helping to avoid underpayment or overpayment of taxes.

How to Use the Employees Withholding Allowance Certificate

Using the Employees Withholding Allowance Certificate involves several straightforward steps. First, obtain the form from your employer or download it from the IRS website. Next, fill out the required sections, including your personal information, filing status, and any additional allowances you wish to claim. Once completed, submit the form to your employer, who will then adjust your tax withholding accordingly. It is advisable to review and update your W-4 whenever there are significant life changes, such as marriage, divorce, or the birth of a child, to ensure accurate withholding.

Steps to Complete the Employees Withholding Allowance Certificate

Completing the Employees Withholding Allowance Certificate involves a few essential steps:

- Obtain the Form: Access the W-4 form from your employer or the IRS website.

- Fill in Personal Information: Provide your name, address, Social Security number, and filing status.

- Claim Allowances: Indicate the number of allowances you are claiming based on your personal situation.

- Additional Withholding: If desired, specify any additional amount you want withheld from each paycheck.

- Sign and Date: Ensure you sign and date the form before submitting it to your employer.

Legal Use of the Employees Withholding Allowance Certificate

The Employees Withholding Allowance Certificate is legally binding and must be completed accurately to comply with federal tax laws. Employers are required to withhold the correct amount of federal income tax based on the information provided on the W-4 form. Failure to submit a properly completed form can lead to incorrect tax withholding, resulting in potential penalties or tax liabilities for both the employee and employer. It is essential to keep the information on the form updated to reflect any changes in personal circumstances.

Key Elements of the Employees Withholding Allowance Certificate

Several key elements are essential when filling out the Employees Withholding Allowance Certificate:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married filing jointly, married filing separately, or head of household.

- Allowances: The number of allowances claimed influences the amount of tax withheld.

- Additional Withholding: An option to request an extra amount to be withheld from each paycheck.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Employees Withholding Allowance Certificate is crucial for maintaining compliance. While there is no specific deadline for submitting the W-4 form, it is recommended to complete and submit it as soon as you start a new job or experience a significant life change. Employers should process the form promptly to ensure correct withholding begins with the next paycheck. It is also advisable to review your W-4 annually or whenever there are changes in your financial situation.

Quick guide on how to complete employees withholding allowance certificate employees withholding allowance certificate

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can find the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, exhaustive form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE

Create this form in 5 minutes!

How to create an eSignature for the employees withholding allowance certificate employees withholding allowance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE?

The EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE is a document used by employees to inform their employer about the amount of tax to withhold from their paychecks. This certificate allows employees to manage their withholding allowances based on their personal financial situations. It plays a vital role in ensuring accurate tax deductions throughout the year.

-

How can airSlate SignNow help with the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE?

airSlate SignNow provides a straightforward solution for creating, sending, and eSigning your EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE. With our user-friendly platform, you can easily manage your tax documents while ensuring compliance and efficiency. Our electronic signature feature streamlines the process and saves valuable time for both employers and employees.

-

What are the benefits of using airSlate SignNow for tax documents like the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE?

Using airSlate SignNow for your EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE offers several benefits, including ease of use, security, and accessibility. Our service ensures that sensitive information is protected while allowing you to quickly access and manage your documents from anywhere. Plus, our platform provides automatic updates, keeping your documents current and compliant.

-

Is airSlate SignNow cost-effective for managing EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATES?

Yes, airSlate SignNow is a cost-effective solution for managing EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATES. Our pricing plans are designed to fit businesses of all sizes, allowing you to save money on traditional paper-based processes. By utilizing our platform, you can reduce costs associated with printing, mailing, and storing documents.

-

Can I integrate airSlate SignNow with other software for managing the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enabling you to import and export your EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE easily. You can connect with popular tools such as CRM systems, accounting software, and more to enhance your workflow and streamline the document management process.

-

What features does airSlate SignNow offer for the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE?

airSlate SignNow includes a range of features specifically designed for documents like the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE. Key features include customizable templates, eSigning capabilities, secure storage, and audit trails for compliance tracking. These functionalities empower users to manage their tax documents effectively.

-

How does eSigning work for the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE using airSlate SignNow?

The eSigning process for the EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE using airSlate SignNow is intuitive and straightforward. Users can send the document securely to individuals for signatures, track the status in real-time, and receive notifications when the signing is complete. This ensures that the document is signed promptly and securely, without the need for physical paperwork.

Get more for EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE

- Cricket lesson plans pdf in hindi form

- Written consent to release confidential customer dominion form

- Instrument selection worksheet gladesbandmiami com form

- Wisconsin contract for sale and purchase of real estate with no broker for residential home sale agreement form

- Physicianamp39s certification of claimantamp39s health connecticut ctdol state ct form

- Petition to establish custody pinal county arizona fillable form

- Nail salon sign in sheet form

- Printable bbq score sheet form

Find out other EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE EMPLOYEES WITHHOLDING ALLOWANCE CERTIFICATE

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form