Form 990EZ Fonddulaclions

What is the Form 990EZ Fonddulaclions

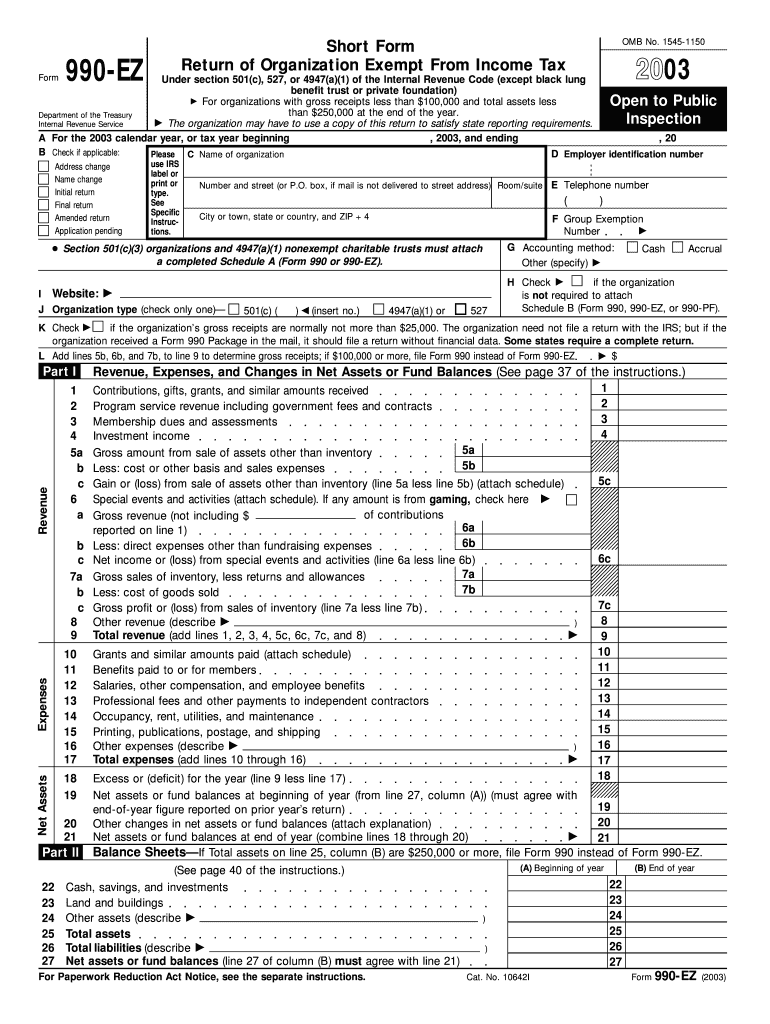

The Form 990EZ is a streamlined version of the standard Form 990, specifically designed for smaller tax-exempt organizations in the United States. This form is used to report financial information to the Internal Revenue Service (IRS) and is essential for maintaining tax-exempt status. Organizations that qualify to use Form 990EZ typically have gross receipts under two hundred fifty thousand dollars and total assets under five hundred thousand dollars. By providing a simplified reporting process, Form 990EZ allows smaller organizations to comply with IRS requirements without the complexity associated with the full Form 990.

Steps to complete the Form 990EZ Fonddulaclions

Completing the Form 990EZ involves several key steps that ensure accurate reporting of financial information. First, gather all necessary financial records, including income statements, balance sheets, and details of expenses. Next, fill out the form by providing information such as the organization’s name, address, and Employer Identification Number (EIN). Report total revenue, expenses, and net assets in the appropriate sections. Additionally, ensure that all required schedules are attached, such as Schedule A, which provides information about public charity status. Finally, review the completed form for accuracy before submission to avoid potential penalties.

Filing Deadlines / Important Dates

Organizations must adhere to specific deadlines when filing Form 990EZ to remain compliant with IRS regulations. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due by May fifteenth. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can apply for an automatic six-month extension by filing Form 8868, but it is crucial to ensure that the extension is submitted on time to avoid penalties.

Legal use of the Form 990EZ Fonddulaclions

The legal use of Form 990EZ is essential for maintaining the tax-exempt status of eligible organizations. By filing this form, organizations provide transparency regarding their financial activities, which is a requirement for all tax-exempt entities under Section 501(c)(3) of the Internal Revenue Code. Failure to file Form 990EZ can result in penalties, including the loss of tax-exempt status. It is important for organizations to understand their obligations under federal law and to ensure that they file the form accurately and on time to comply with legal requirements.

Key elements of the Form 990EZ Fonddulaclions

Key elements of Form 990EZ include various sections that capture essential financial information about the organization. These elements consist of the organization’s revenue, expenses, and net assets. Additionally, the form requires disclosure of compensation for the highest-paid employees and contractors, as well as any significant changes in the organization’s activities. The form also includes a section for providing detailed information about the organization’s mission and programs, which helps the IRS assess compliance with tax-exempt purposes. Understanding these key elements is crucial for accurate completion and reporting.

Examples of using the Form 990EZ Fonddulaclions

Examples of using Form 990EZ can vary widely among organizations. For instance, a small nonprofit that provides community services may use the form to report its annual income from donations and grants, along with expenses related to program activities. Another example could involve a local charity that organizes fundraising events, where the form would detail revenues generated from ticket sales and associated costs. Each organization’s use of Form 990EZ reflects its unique financial activities and compliance with IRS regulations, ensuring transparency and accountability in the nonprofit sector.

Quick guide on how to complete form 990ez fonddulaclions

Effortlessly Prepare [SKS] on Any Device

The management of online documents has surged in popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without any delays. Manage [SKS] seamlessly on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of the documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your updates.

- Select your preferred method for sharing the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990ez fonddulaclions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 990EZ Fonddulaclions, and why is it important?

Form 990EZ Fonddulaclions is a simplified version of the IRS Form 990 that smaller nonprofit organizations can use to report their financial activities. This form is crucial for maintaining tax-exempt status and ensuring compliance with federal regulations. By using airSlate SignNow, you can easily eSign and submit your Form 990EZ Fonddulaclions, streamlining the process for your organization.

-

How can airSlate SignNow help me with Form 990EZ Fonddulaclions?

airSlate SignNow offers an intuitive platform that allows you to prepare, eSign, and manage your Form 990EZ Fonddulaclions seamlessly. With features like customizable templates and automated workflows, you can save time and reduce errors in your filing process. This tool also ensures your documents are secure and accessible whenever you need them.

-

What features does airSlate SignNow provide for handling Form 990EZ Fonddulaclions?

Our platform includes advanced features such as document sharing, secure eSigning, and tracking capabilities specifically tailored for Form 990EZ Fonddulaclions. You can gain real-time updates on the status of your documents and send reminders for pending signatures. This functionality enhances collaboration and makes the filing process more efficient.

-

What is the pricing model for using airSlate SignNow in relation to Form 990EZ Fonddulaclions?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of organizations of all sizes, including those needing to file Form 990EZ Fonddulaclions. Our plans are cost-effective, starting from a basic package that includes essential features, to premium offerings with additional capabilities. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for Form 990EZ Fonddulaclions preparation?

Yes, airSlate SignNow integrates seamlessly with a wide range of applications, allowing you to automate your workflow for Form 990EZ Fonddulaclions. You can connect it with accounting software, CRMs, and document management systems for a more streamlined experience. This integration helps maintain organization and efficiency as you prepare and submit your forms.

-

Is airSlate SignNow secure for handling sensitive information related to Form 990EZ Fonddulaclions?

Absolutely. airSlate SignNow prioritizes the security of your sensitive information related to Form 990EZ Fonddulaclions. Our platform uses industry-standard encryption, secure access controls, and compliance with relevant regulations to protect your data throughout the eSigning process. You can trust that your organization's information is safe with us.

-

What are the benefits of using airSlate SignNow for Form 990EZ Fonddulaclions?

Using airSlate SignNow for Form 990EZ Fonddulaclions offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The user-friendly interface allows for quick navigation, making it easy for anyone in your organization to get involved in the filing process. Additionally, the ability to track status and gather electronic signatures simplifies compliance and reporting.

Get more for Form 990EZ Fonddulaclions

- Participant information form howard county maryland

- Mv1484 2014 form

- Navfacusace past performance questionnaire

- Mi 1040x 12 form

- Professional house cleaning checklist printable form

- Community service form print out

- Veterans preference form the city of boca raton

- 4 njeda aa form 2 monthly project workforce report 2014 jan

Find out other Form 990EZ Fonddulaclions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors