Form 7004 Rev November Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other R

What is the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns

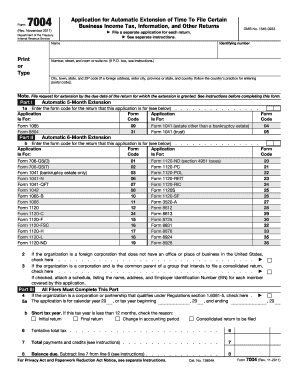

The Form 7004 Rev November is an official document used by businesses to request an automatic extension of time to file specific business income tax, information, and other returns. This form is essential for ensuring that businesses can meet their tax obligations without incurring penalties for late filing. It applies to various business entities, including corporations, partnerships, and certain trusts, allowing them to extend their filing deadlines by six months. Understanding the purpose of this form is crucial for maintaining compliance with IRS regulations.

How to use the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns

Using the Form 7004 Rev November involves a straightforward process. First, businesses must accurately complete the form, providing necessary information such as the entity's name, address, and Employer Identification Number (EIN). Once the form is filled out, it must be submitted to the IRS by the original due date of the return for which the extension is requested. This submission can be done electronically or via mail. It is important to remember that while this form grants an extension for filing, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Steps to complete the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns

Completing the Form 7004 Rev November requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of Form 7004 from the IRS website or authorized sources.

- Fill in the entity's name, address, and EIN accurately.

- Indicate the type of return for which the extension is being requested.

- Sign and date the form, ensuring that the information is complete and correct.

- Submit the form by the original due date of the return, either electronically or by mail.

IRS Guidelines

The IRS provides specific guidelines for using the Form 7004 Rev November. According to these guidelines, businesses must ensure that the form is submitted on time to qualify for the automatic extension. The IRS also outlines the types of returns eligible for extension under this form, which include various business income tax returns. It is advisable to review the IRS instructions carefully to ensure compliance and to understand any additional requirements that may apply to specific business entities.

Filing Deadlines / Important Dates

Filing deadlines are critical when using the Form 7004 Rev November. The form must be filed by the original due date of the tax return for which the extension is requested. For most corporations, this is typically the fifteenth day of the fourth month following the end of the tax year. For partnerships and other entities, the deadlines may vary. It is important for businesses to keep track of these dates to avoid penalties associated with late filing.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 7004 Rev November can result in significant penalties. If the form is not filed by the due date, businesses may face late filing penalties, which can accumulate over time. Additionally, if taxes owed are not paid by the original due date, interest and further penalties may apply. Understanding these consequences emphasizes the importance of timely and accurate filing of the form to maintain compliance with IRS regulations.

Quick guide on how to complete form 7004 rev november application for automatic extension of time to file certain business income tax information and other

Easily Prepare [SKS] on Any Device

Digital document administration has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the features you need to create, edit, and electronically sign your documents swiftly without any delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

Effortlessly Modify and Electronically Sign [SKS]

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other R

Create this form in 5 minutes!

How to create an eSignature for the form 7004 rev november application for automatic extension of time to file certain business income tax information and other

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 7004 Rev November and how does it relate to business tax extensions?

The Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns is a form used by businesses to request an automatic extension for filing certain business tax returns. This form is crucial for ensuring compliance with IRS regulations and can help businesses avoid penalties due to late filing.

-

How does airSlate SignNow simplify the process of signing the Form 7004 Rev November?

airSlate SignNow streamlines the signing process for the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns by allowing users to eSign documents seamlessly. This eliminates the need for printing, scanning, or faxing, making the entire process more efficient and straightforward.

-

What are the key features of airSlate SignNow that benefit users filing Form 7004 Rev November?

Key features of airSlate SignNow include customizable templates, secure eSigning, and integrated document management. These features specifically enhance the experience of users filing the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns by ensuring accuracy and security.

-

Is airSlate SignNow a cost-effective solution for filing Form 7004 Rev November?

Absolutely! airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it a cost-effective solution for those needing to file Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns. The savings on time and compliance-related costs add even more value.

-

What integrations does airSlate SignNow offer for filing Form 7004 Rev November?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations enhance users' ability to manage documents, including the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns, directly from their preferred platforms.

-

How can airSlate SignNow help ensure compliance when filing Form 7004 Rev November?

airSlate SignNow helps ensure compliance by providing users with audit trails, secure storage, and reminders for deadlines related to the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns. These features support businesses in adhering to IRS requirements and avoiding unnecessary penalties.

-

Can Form 7004 Rev November be filed electronically using airSlate SignNow?

Yes, you can file the Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns electronically with airSlate SignNow. The platform allows users to complete, sign, and send documents digitally, ensuring a fast and reliable submission process.

Get more for Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other R

- Recruit training command guest security access form 491066930

- Otp banka potvrda o zaposlenju i visini primanja 88469177 form

- Gross anatomy of the brain and cranial nerves form

- Tesla letter to shareholders form

- Motion for bond reduction forms fairfaxcounty

- 8th grade math fsa review packet form

- Medical flashcards pdf form

- Il form

Find out other Form 7004 Rev November Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other R

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure