Blank Department of Revenue Dor Wa Form

What is the Blank Department Of Revenue Dor Wa

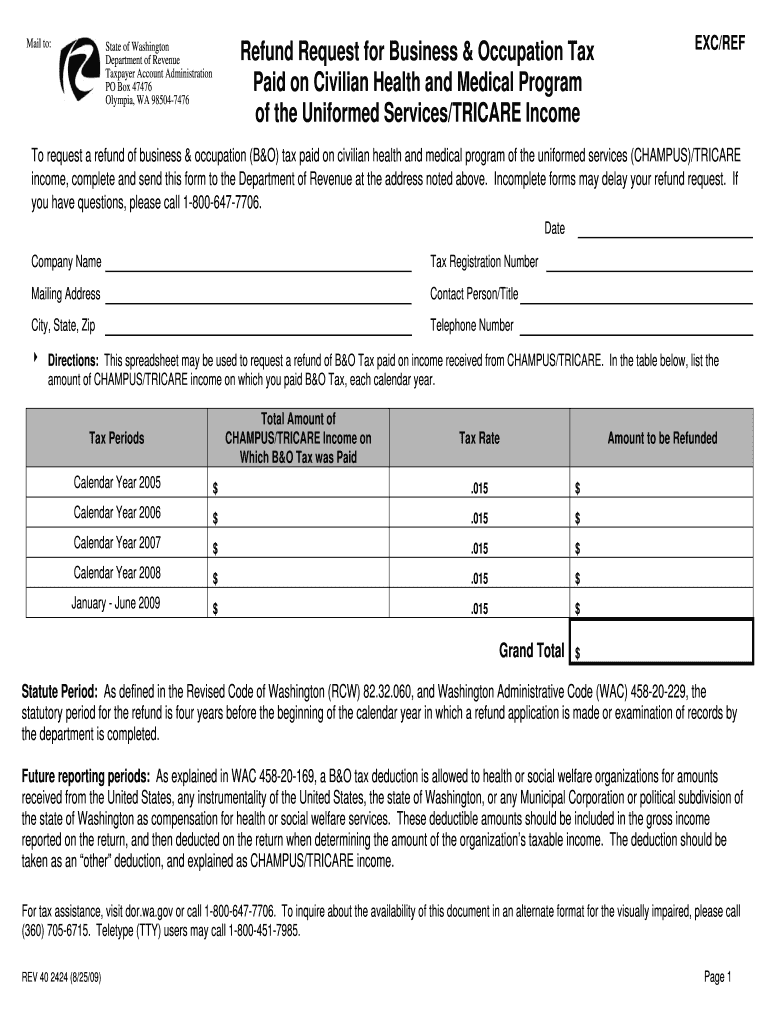

The Blank Department Of Revenue Dor Wa is a form used primarily for tax purposes within the state of Washington. This document serves various functions, including reporting income, claiming deductions, and ensuring compliance with state tax regulations. It is essential for individuals and businesses to accurately complete this form to avoid potential penalties and ensure proper tax reporting.

How to use the Blank Department Of Revenue Dor Wa

Using the Blank Department Of Revenue Dor Wa involves several steps. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. This form can be submitted electronically or via traditional mail, depending on your preference and the specific requirements of the Washington Department of Revenue.

Steps to complete the Blank Department Of Revenue Dor Wa

Completing the Blank Department Of Revenue Dor Wa requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the Washington Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, self-employment earnings, and any other sources of income.

- Claim any eligible deductions or credits that apply to your situation.

- Double-check all entries for accuracy before signing and dating the form.

- Submit the completed form according to the submission guidelines provided by the Department of Revenue.

Legal use of the Blank Department Of Revenue Dor Wa

The Blank Department Of Revenue Dor Wa is legally required for individuals and businesses to report their income and pay taxes owed to the state of Washington. Failure to use this form correctly can result in penalties, interest on unpaid taxes, and potential legal action. It is crucial to understand the legal implications of submitting this form, ensuring all information is truthful and complete to comply with state tax laws.

Key elements of the Blank Department Of Revenue Dor Wa

Several key elements are essential when filling out the Blank Department Of Revenue Dor Wa. These include:

- Personal Information: Accurate identification details are necessary for processing.

- Income Reporting: All sources of income must be reported to ensure compliance.

- Deductions and Credits: Understanding which deductions and credits apply can significantly affect tax liability.

- Signature and Date: The form must be signed and dated to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Blank Department Of Revenue Dor Wa are crucial to avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is April 15. However, it is advisable to check for any state-specific extensions or changes that may affect the filing date. Keeping track of these deadlines ensures timely compliance with tax obligations.

Quick guide on how to complete blank department of revenue dor wa

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary template and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Construct your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all information thoroughly and click the Done button to save your modifications.

- Select your preferred method for sharing your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Blank Department Of Revenue Dor Wa

Create this form in 5 minutes!

How to create an eSignature for the blank department of revenue dor wa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Blank Department Of Revenue Dor Wa?

The Blank Department Of Revenue Dor Wa is an official form used for submitting various tax-related documents to the Washington Department of Revenue. Utilizing airSlate SignNow, you can easily fill out, sign, and submit this form electronically, streamlining your tax submission process.

-

How much does it cost to use airSlate SignNow for Blank Department Of Revenue Dor Wa?

airSlate SignNow offers a range of pricing plans, making it accessible for all users. Depending on the features you need for managing the Blank Department Of Revenue Dor Wa, you can choose a plan that fits your budget and requirements, ensuring a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing the Blank Department Of Revenue Dor Wa?

With airSlate SignNow, you can seamlessly create, send, and eSign the Blank Department Of Revenue Dor Wa. Key features include customizable templates, an intuitive user interface, and robust security measures, ensuring that your documents are handled safely and efficiently.

-

Can I integrate airSlate SignNow with other applications for handling Blank Department Of Revenue Dor Wa?

Yes, airSlate SignNow supports integration with various third-party applications, enhancing your workflow when handling the Blank Department Of Revenue Dor Wa. This enables you to synchronize your documents and data effortlessly across platforms, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the Blank Department Of Revenue Dor Wa?

Using airSlate SignNow for the Blank Department Of Revenue Dor Wa allows for a more efficient and organized tax process. Benefits include faster turnaround times, reduced paper usage, and enhanced tracking capabilities, all of which contribute to a more streamlined experience.

-

Is airSlate SignNow secure for signing the Blank Department Of Revenue Dor Wa?

Absolutely! airSlate SignNow prioritizes user security by implementing advanced encryption and authentication measures. When signing the Blank Department Of Revenue Dor Wa, you can be confident that your information and documents are protected against unauthorized access.

-

How can I get started with airSlate SignNow for the Blank Department Of Revenue Dor Wa?

Getting started with airSlate SignNow is easy! You can sign up for an account directly on the website, choose the relevant plan, and start creating and managing your Blank Department Of Revenue Dor Wa documents in no time.

Get more for Blank Department Of Revenue Dor Wa

- Arkansas unclaimed property form

- College trip notice format

- Affidavit of marriage kenya sample form

- Number words form

- Fill out the release form rushmore tramway adventures

- Collection instruction form baycorp baycorp co

- Ttb f 500024 excise tax return ttb f 500024 excise tax return ttb form

- Bid bond request form your name contractor obligee

Find out other Blank Department Of Revenue Dor Wa

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors